The balance sheet is a type of financial statement that gives a report of the financial activities of a company at a particular point in time during an accounting period; a balance sheet shows a summary of the assets, liabilities, equity, and other financial activities of a company at any accounting period, hence the balance sheet is also known as a statement of financial condition. Other types of financial statements include the income statement and the cash flow statement. The balance sheet is also known as a statement of financial position because it gives a summary of the financial standing of a firm at a particular point in time.

Accounting period

An accounting period is a timeframe during which the financial transactions of a company are all recorded; in essence, the period in a business year that can be accounted for in the financial statements can be referred to as the accounting period. This accounting period could be a calendar year, natural business year, or fiscal year (financial year or budget year).

A calendar year is a period starting from January 1st to December 31st; whereas a fiscal year is any 12-month period or 52 to 53-week period used for accounting that does not end on December 31st. Some businesses may decide to use a fiscal year for accounting purposes in order to align with their natural business year. The natural business year is any 12 consecutive month period that ends at a time when the sales activity of a business is low. Any financial statement that is issued between the beginning and end of the year is regarded as an interim financial statement.

The balance sheet or any other financial statements are often created to include any of these accounting periods. Financial statements may be created every calendar year or every quarter of the calendar year and are made available to investors, financial analysts, government agencies, suppliers, lenders, credit rating organizations, and even customers. Such financial statements created for external use are known as external financial statements.

Some companies may create their financial statements monthly, but this is often used only by the company’s management in order to closely monitor the financial activities of the company, that way, any adjustment can be made quickly regarding what is working and what does not work.

The date on the balance sheet usually represents the final day of the accounting period. For firms that issue monthly financial statements, this will be the last day of every month. This date is important because it indicates that all transactions that appeared on the balance sheet have been accounted for up to the last moment of the date.

Balance sheet explained

There are two columns on a statement of financial position, one column is assets while the other column is liabilities and equity.

One of the uses of a statement of financial position is that it helps investors, owners, auditors, accountants, etc to track earnings and spending.

Order of items listed on a balance sheet

The types of accounts on a balance sheet are listed from the most liquid account to the illiquid account. For example, cash and inventory are liquid, hence they are listed first before plant, property, and equipment, which is not liquid.

Balance sheet equation (Accounting equation)

Assets = Liabilities + Equity

The above expression is known as the balance sheet equation or accounting equation because on the statement of financial position, the total amount in all assets accounts must be equal to the total amount in all liabilities and equity accounts; if this happens, then there is a balance; if not, then it is not balanced.

The balance sheet equation makes sense because for you to acquire assets for your sole proprietorship business, you must use either your own money (owner’s equity) or you borrow money such as loans (this increases your liabilities or debts). The same applies to a corporation, it can acquire assets by getting money from investors (shareholders equity) or borrowings such as loans (increasing the liabilities).

Bookkeeping

Understanding the accounting equation is key to understanding how to record transactions in a statement of financial position, and this can be done easily by learning the accounting debit and credit rules. As we look at each type of account on the balance sheet, we will see how transactions can be recorded and how it affects each type of account on the balance sheet.

The process of recording financial transactions in financial statements is known as Bookkeeping. There are two methods of recording financial transactions: the single-entry (or the one-column method) and the double entry (or the two-column method).

Double-entry bookkeeping is common and involves recording a single transaction in two accounts simultaneously. In double-entry bookkeeping, a financial transaction MUST be either a credit or a debit, and when one account is credited, then the other must be debited with the same amount. This means the credited amount on one account must be equal to the debited amount on another account (DEBITS must be equal to CREDITS).

We will see how debit and credit transactions are recorded on the balance sheet in the following sections.

How is double-entry bookkeeping important?

Double-entry bookkeeping is important because it helps to prevent errors in recording financial transactions. Because the amount debited must be equal to the amount credited, it means the total amount on each column must balance the total amount on the other column. If the amounts on the two columns are not equal, you will know there is an error immediately. This way, double-entry bookkeeping helps to check for errors when recording transactions in a general ledger or in financial statements such as income statements and balance sheets.

Traditional debits and credits

Before we look at the accounting debit and credit rules, it is good to remind you to get rid of your traditional knowledge of how you receive bank alerts. In your everyday life, when a bank sends you a credit alert, it means your checking account has increased but when you receive a debit alert, you know your account has reduced. This applies to your personal life. In accounting, this is completely different. Have you ever imagined what happens to the account of a bank when you get credited? When you are credited, your bank account balance increases but the account of the bank that sent the credit to you reduces as yours increases.

Therefore, in accounting, a credit to an account decreases the balance of a company’s account on a financial statement while a debit to an account increases the balance on the account; it is very important to take note of this.

Below are the accounting debit and credit rules; these rules are very important and once you fully understand them, you will find journal entries to be very easy.

Accounting Debit and Credit Rules

- Whenever there is an INCREASE in the ASSETS of a company, then DEBITS will be recorded on the LEFT side of the balance sheet in the corresponding Account under the Asset Section.

- Whenever there is a DECREASE in the ASSETS of a company, then CREDITS will be recorded on the LEFT side of the balance sheet in the corresponding Account under the Asset Section.

- Whenever there is an INCREASE in the LIABILITIES or EQUITY of a company, then CREDITS will be recorded on the RIGHT side of the balance sheet in the corresponding Account under the LIABILITIES or EQUITY Section.

- Whenever there is a DECREASE in the LIABILITIES or EQUITY of a company, then DEBITS will be recorded on the RIGHT side of the balance sheet in the corresponding Account under the LIABILITIES or EQUITY Section.

What are balance sheet accounts?

Balance sheet accounts are names given to the different types of assets, liabilities, and equity that a company has. These names hold the value for each type of asset, liability, or equity and are useful in monitoring financial transactions. The balance sheet accounts are developed according to the guidelines of the international accounting standard board and some country-specific accounting boards.

The accounts on a balance sheet are useful for sorting and storing financial transactions, and there are many of them. We will look at the common balance sheet accounts and their uses.

Accounts on the Balance Sheet

- Cash and cash equivalents

- Accounts receivables

- Other receivables

- Prepaid expenses

- Property, Plant, and Equipment (PPE)

- Intangible assets

- Accounts payable

- Taxes payable

- Accrued expenses

- Deferred revenue

- Long term loans

- Common stock

- Retained earnings

- Dividends

- Revenue

- Interest expense

- Tax expense

The above are the types of accounts found on a balance sheet; we will go over each type of account as we discuss them under each of the components of a balance sheet. Each account would be defined and we will give an example of how a debit or credit transaction can affect the account.

Components of a balance sheet

The balance sheet has 3 components: assets, liabilities, and equity. Each of these components has different types of accounts under it. We will go over each component one by one.

Assets

The assets are what a company owns or what belongs to the company. Assets are the things (both physical and non-physical) that a business owns that can be converted to cash. The physical assets are also known as tangible assets while the non-physical that cannot be seen nor touched are called intangible assets. As far as what the business has can be converted to cash, such a thing is regarded as an asset. Examples of assets could be a company’s car, desk, table, chairs, computers, building, land, machines, etc.

Any amount to be recorded in an account under the assets section of a statement of financial position must fulfill the following criteria:

- the asset must be purchased or it was donated

- the asset should have a future economic value that can be measured or at least it should be possible to express the value of the asset in monetary terms.

- for prepaid expenses (that is, expenses in which the service paid for in advance has not been used up or hasn’t expired) should also be recorded.

The assets accounts are made up of Cash, Accounts receivables, Other receivables, Prepaid expenses, Property, Plant, and Equipment, and Intangible assets.

Of all the assets accounts, the Cash, Accounts receivables, Other receivables, and Prepaid expenses make up the current assets whereas the Property, Plant, and Equipment, and Intangible assets make up the non-current assets.

Types of assets accounts on the balance sheet

There are two types of assets on a statement of financial position: current and non-current assets.

Current assets

The current assets are the short-term assets that can easily be converted into cash within 1 year. The current assets accounts found on the balance sheet are discussed below.

Cash and cash equivalents

Cash includes the balances of the checking account, petty cash, and all checks received but yet to be deposited in the bank account.

Why is cash listed first on a balance sheet?

Cash is listed first on the balance sheet because it is the most liquid asset; in fact, cash is the most liquid of all current assets (short-term assets). Since the order in which accounts are listed on the balance sheet starts with the most liquid to the illiquid, Cash would be the first. The amount of cash on the statement of financial position reflects the degree of liquidity of a company.

Cash equivalents are short-term investments that should mature within 3 months from the date of purchase; their market values are unlikely to fluctuate in the short term. The cash equivalents may include money market funds, 90-day US treasury bills, short-term certificates of deposit, and short-term government bonds. Cash equivalents may also include short-term investments in the common stocks or preferred stocks of a different company, as long as the stocks can be sold immediately on a stock exchange when needed.

In general, the company would state the cash equivalents in the footnotes of the statement of financial position together with other information such as the type of accounting system used in preparing the balance sheet.

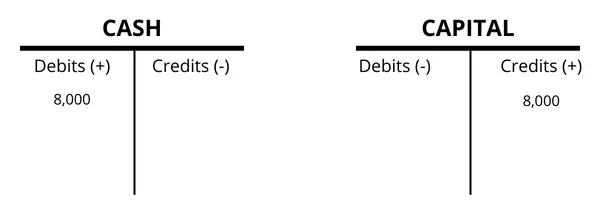

For example, assuming The Financial Falconet Inc. invested $8,000 cash when starting the business. This can be recorded on the statement of financial position with a debit to the CASH account and a credit to the CAPITAL account. It can be represented on the statement of financial position in the picture below.

What increases cash on a balance sheet?

Cash increases on the balance sheet when money is donated or invested into a company. There is also an increase in the cash account on the balance sheet from sales of assets.

Can you have a negative cash balance on the balance sheet?

A company can have a negative cash balance on the balance sheet when it writes a check that is more than the amount in its checking account (checks written in excess of cash balance). This will be reported on the balance sheet as a credit to the Cash Overdraft in the current liabilities section.

Accounts receivable

The account receivables contain any money that customers are still owing a company and may include an allowance for doubtful accounts because not all customers will pay.

What is an allowance for doubtful accounts on a balance sheet?

An allowance for doubtful accounts is the estimated amount of unpaid invoices that may appear on the statement of financial position. This amount is an estimate of bad debt that a company thinks the customer may not pay. The doubtful account is regarded as a contra asset account because when the doubtful invoices increase, the amount (allowance for doubtful accounts) has to be deducted from the account receivables.

The allowance for doubtful accounts can be regarded as a bad debt reserve. A doubtful account is an asset because it increases the assets if the customer pays, but it becomes a contra asset (reduces the asset) when the customer fails to pay (which means the amount has to be deducted from the account receivables.

Where is the allowance for doubtful accounts on the balance sheet?

The allowance for doubtful accounts appears directly under the Account receivables in the current assets of the balance sheet.

Inventory

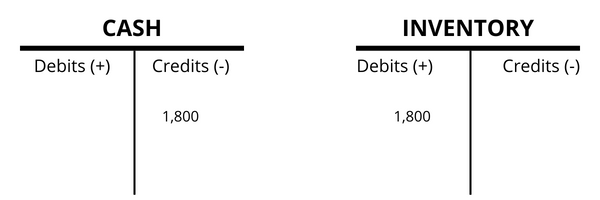

This includes any raw materials, unfinished products, and finished products. For example, if Financial Falconet Inc. paid $3,000 in cash for computer accessories. The accounting for this will affect the cash account and inventory account. This will cause a decrease in the cash account and an increase in the inventory account. We will represent this on a statement of financial position as shown below:

Prepaid expenses on balance sheet

Prepaid expenses appear in the current assets section of the balance sheet. Prepaid expenses is a balance sheet account that shows the expenses that a company has paid for in advance but have not been used up or the services have not expired; if the service has been partly used, then the current amount remaining or the unused amount is what is reported as the current prepaid expense on the balance sheet. Prepaid expenses include insurance, rent, advertising contracts, etc.

Example: if a firm paid for its property insurance in March for a 1-year subscription at $3,000 and assuming the insurance company charges $250 per month, then by June, the firm must have used up $1,000 out of the total $3,000 that was paid in advance. If by June (mid-year), the firm decides to issue a financial statement, then the remaining unused amount paid in advance will be added as a current prepaid expense on the balance sheet of the firm; and this will be 3000 – 1000 = $2,000.

Non-current assets

The non-current assets are the long-term assets that you don’t intend to convert into cash within a year or things you cannot easily convert into cash within a year.

Long-term assets include Long-term investments, Machinery and equipment, Buildings and land, and Intangible assets like goodwill, patents, franchise contract, copyrights, and trademarks.

Investments

These include long-term investments in securities, real estate, investments in other businesses, property put up for sale, and restricted assets (such as bond sinking funds). Bond sinking funds are restricted assets set aside for the purpose of retiring bonds.

Property, Plant, and Equipment (PPE)

PPE on the balance sheet includes buildings and ongoing construction, land, furniture, machinery, and equipment.

Land on a balance sheet refers to the cost of acquiring the land used for constructing office buildings, production facilities, warehouses, etc. The cost of the land on the balance sheet should be recorded separately from the cost of buildings because the cost of the land is not depreciated.

There are also land improvements such as parking lots, driveways, etc, that are depreciated with time (based on the useful lives). The useful life of an asset is the time during which the asset is still useful economically.

Intangible assets

Intangible assets refer to the types of assets that cannot be seen or touched. Examples of intangible assets are trademarks, goodwill, patents, and copyrights. When entering intangible assets into the balance sheet, it is good to list the fair market value of each intangible asset, that is, the fair price at which each intangible asset can be bought. It is important to note that the intangible assets on the balance sheet are the ones that are only acquired and not developed by the company.

What does ‘financed by’ mean on a balance sheet?

There are only two ways through which a business can acquire assets: one way is to borrow money from lending organizations such as banks or get money from investors, shareholders, or from the pocket of the owner of the company. “Financed by” on a balance sheet, therefore, represents the means through which a business acquired its assets. When a company acquired assets through borrowing or debt, the assets are said to be financed by liabilities. When a company acquired assets through the owner’s money, investors, or shareholders’ capital, then the assets are said to be financed by owner’s equity or shareholders’ equity.

Liabilities

Liabilities are what a company owes (that leads to expense or cost), and involve the debt and financial obligations of the company, including recurring expenses like rent, subscriptions to services, wages and salaries, utility bills, taxes, and interest payments.

Just as assets, there are two types of liabilities: current and non-current liabilities. The current liabilities are listed in the order of the date that they are due; with those having early due dates coming first.

The liabilities accounts consist of Accounts payable, Taxes payable, Accrued expenses, Deferred revenue, and Long term loans.

The current accounts of liabilities include Accounts payable, Taxes payable, Accrued expenses, and Deferred revenue; whereas the non-current account includes the Long term loans.

Types of liabilities

- Current liabilities (short-term liabilities)

- Non-current liabilities (long-term liabilities)

Current liabilities (short-term liabilities)

Short-term liabilities include taxes owed, salaries and wages, accounts payable, short-term loans that you have to repay within 1 year, and any credit card debt. Talking about short-term loans, they may include the current portion of long-term debt; which is part of a long-term debt that has to be paid within 12 months. For example, assuming a firm needs to make 2 installments every year for 10 years for a loan it secured for building a factory, then the 2 installments are recorded as short-term liabilities while the remaining 9 years’ installments would be recorded as long-term liabilities.

Accounts payable

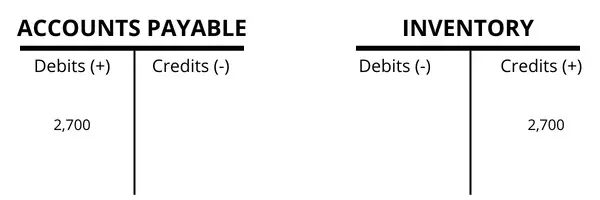

The account payable records the amount of money that must be paid to suppliers; it records what was bought on credit that must be paid, mostly within 30 days.

If a company, Duzzlag, purchases construction tools on credit for $2,700; then this can be accounted for on the statement of financial position with an increase in the inventory and a corresponding increase in the accounts payable. We can show this on a statement of financial position as follows:

Taxes payable

Taxes payable account records the amount of taxes that a company is currently owing the government and is yet to be paid as of the date when the balance sheet was prepared. The taxes include all unpaid taxes, including sales taxes, income taxes, etc.

Accrued expenses

Accrued expense is an account that records expenses that are incurred but have not yet been paid such as salaries, rent, or interest on loans. The accrued expense account shows only the expenses that have not been documented; it is an account that includes goods and services which the company is obligated to pay but the invoices have not yet been generated.

Deferred revenue

Deferred revenue is also called unearned revenue or deferred income, and it is a liability account that records the amount of money paid to a company for goods or services that the company is yet to deliver. It is a liability to the company because it is yet to render the service or yet to deliver the goods. The balance of the deferred income is converted to revenue when the goods are delivered or when the service is rendered.

Interest expense

Interest payable or interest expense is the accumulated interest a company is owing such as a past-due obligation.

Customer prepayments

Customer prepayments refer to the money received from a customer prior to the product or service being delivered. That means if the company fails to deliver the service or product, the customer’s money would be refunded. An example is booking a plane ticket, this is a customer prepayment and the money may be refunded if the airline fails to fulfill its service.

Non-current liabilities (long-term liabilities)

Non-current liabilities include bonds, pension funds, deferred tax, and long-term loans that you don’t have to pay after a year.

Pension fund liability

The pension fund liability is the money that is paid into the retirement accounts of the employees of a company.

Deferred tax

The deferred taxes are the accumulated taxes that are postponed for payment for another year.

How are deferred taxes recorded on the balance sheet?

Deferred taxes are recorded on the balance sheet as a liability representing the tax expense that will not be paid until a future date. When the law requires a company to pay taxes in a particular year, the company must record this expense as an adjustment to retained earnings.

Dividends payable

The dividends payable are the unissued dividends that are authorized but are not issued yet. For a company that pays dividends, you can check the amount to be paid as dividends under the dividend payable account in the liability section.

Do dividends show up on the balance sheet?

The dividends to be paid are shown on the balance sheet in the dividends payable account. When the dividends are paid, the dividends payable account is no more recorded on the balance sheet but rather reflected in the cash flow statement as a use of cash. The dividends payable account only appears on the balance sheet of companies that pay dividends,

Equity

Equity is the amount of money that the owner of a business put into it (for sole proprietorship) or the amount of money invested into a business by the shareholders or partners (for corporations or partnerships respectively); it is also the amount of money that a business generates, including any donation to the business. Equity is one of the two components of what a company owes, the other being liabilities.

Equity represents the contributions of investors and owners of the business; for a sole proprietorship, it is known as owner’s equity while for corporations, it is known as stockholders’ equity. The formula for equity can be expressed as Owner’s Equity or Stockholders’ Equity = Total Assets – Total Liabilities

From the balance sheet equation, we can derive the equity of shareholders by subtracting the liabilities from the total assets; the equity or net worth equation would be: Shareholders’ Equity = Total assets – Liabilities; the liabilities being the debt the company is owning the non-stockholders. Equity is also called net worth, net assets, or net capital; and it represents the difference between the assets and the liabilities of the company or organization.

The equity accounts are Common stock, Retained earnings, Treasury stock, and Additional paid-in capital or (capital surplus). The equity accounts are not subdivided into current and non-current accounts as found in assets and liabilities but consist of capital contributions and retained earnings.

Employee stock options and other contracts such as restricted shares (RSA and RSU) must be clearly stated under the equity section; the purpose and nature of each contract must be outlined.

Types of Equity Accounts on the Balance Sheet

- Common stock

- Additional paid-in capital

- Retained earnings

- Treasury stock

Common stock

The common stock account on the balance sheet records the total par value of the common stocks when the issued shares have a stated value or a par value; when the issued shares have no stated value or par value, then the total amount of issued shares will be recorded in the common stock account.

For example, if 10,000 shares were issued at $15 per share and a par value of $2; then the common stock account would be credited with $130,000. That is, 10,000 x (15-2 =13) = $130,000.

Related: How to Account for Common Stock on the Balance Sheet

Additional paid-in capital or capital surplus

The additional paid-in capital (also called capital surplus or paid-in capital in excess of par value) is the total amount that the shareholders paid in excess of the par value. This account is used when the issued shares have a stated value or a par value; it is the total amount paid for the issued shares above the par value. When there is no par value for the issued shares, then the total amount will be recorded in the common stock account. For example, if 10,000 shares were issued at $15 per share and a par value of $2; then the additional paid-in capital would be 10,000 x 2 = $20,000.

Retained earnings on the balance sheet

The retained earnings on the balance sheet are the money that remains when all liabilities and dividends have been paid. The retained earnings are often reinvested into the business for growth.

Treasury stock

Treasury stocks are repurchased shares that a company buys back from the shareholders after issuing shares. Companies often buy back their shares for many reasons, the most important is to prevent a hostile takeover. Other reasons may be because the owners think their stocks are undervalued. Buying back shares can improve the stock prices because there would be fewer stocks available, thereby increasing scarcity which could drive the price up. You can read more on Treasury stock accounting on the balance sheet. Treasure stocks held by subsidiary companies must also be disclosed.

Related: Negative treasury stocks on the balance sheet

Preferred stocks

For companies that issue preferred stock, the stocks are listed individually under the equity section of the balance sheet, different from the common stocks. The preferred stocks also have a random par value just like the par value of common stocks. The amount in the common stocks or the preferred stock account can be calculated by simply multiplying their par value by the number of shares issued.

Types of Balance Sheet

There are basically two types of balance sheets: the personal balance sheet and the business balance sheet. The business balance sheet can either be a small business balance sheet or a public business balance sheet. We will look at what each type is all about and also give examples of each type.

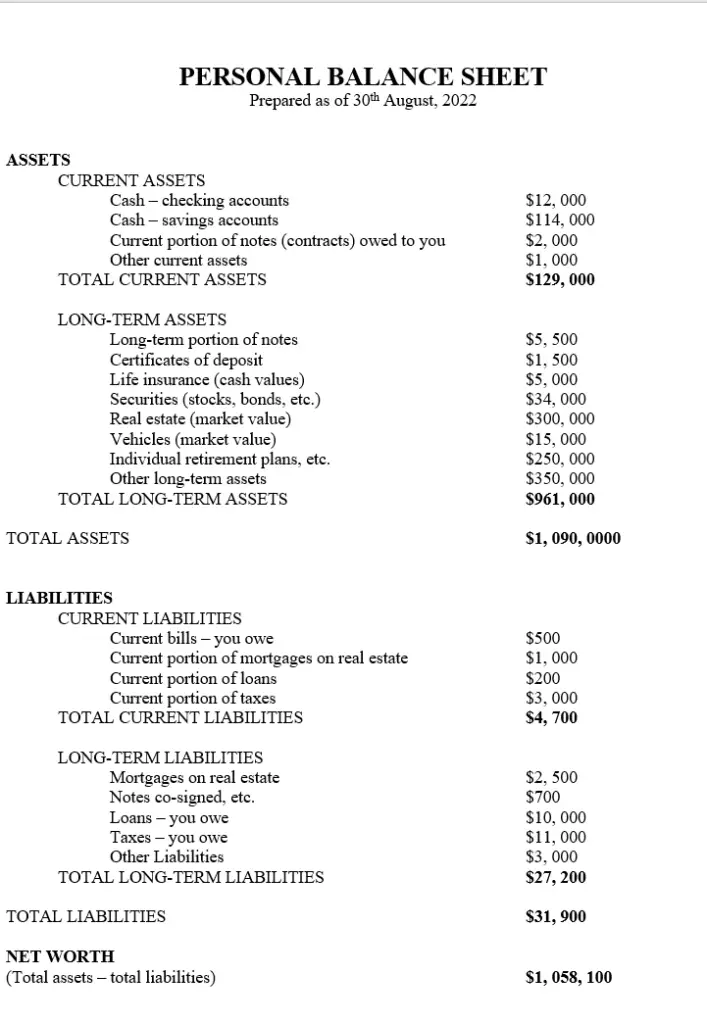

What is a personal balance sheet?

A personal balance sheet is a simple balance sheet that presents the assets, liabilities, and equity of an individual. It can be used to calculate the net worth of an individual. A personal balance sheet reports the current assets of an individual such as the amount of cash in chequing accounts and savings accounts, any available long-term assets like long-term stocks and real estate, and any due or overdue short-term loans or mortgages. The stocks and the real estate are listed with their current market value and not at any historical cost.

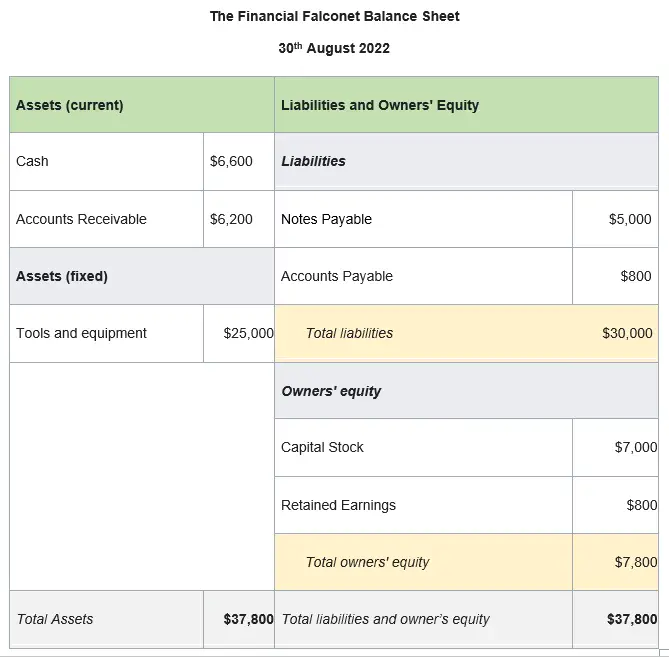

What is a small business balance sheet?

A small business balance sheet is a financial statement that shows the assets, liabilities, and equity of the small business at a given point in time. It is the regular statement of financial position but contains fewer accounts than the public business balance sheets. A small business balance sheet has more accounts than a personal balance sheet. It lists the current assets like cash, accounts receivable, and inventory; it also presents the tangible assets like buildings, land, and equipment. A small business balance sheet also lists intangible assets like patents and copyrights. Liabilities like accounts payable, long-term loans, and accrued expenses are also listed; any conditional liabilities like warranties are often noted in the footnotes of the balance.

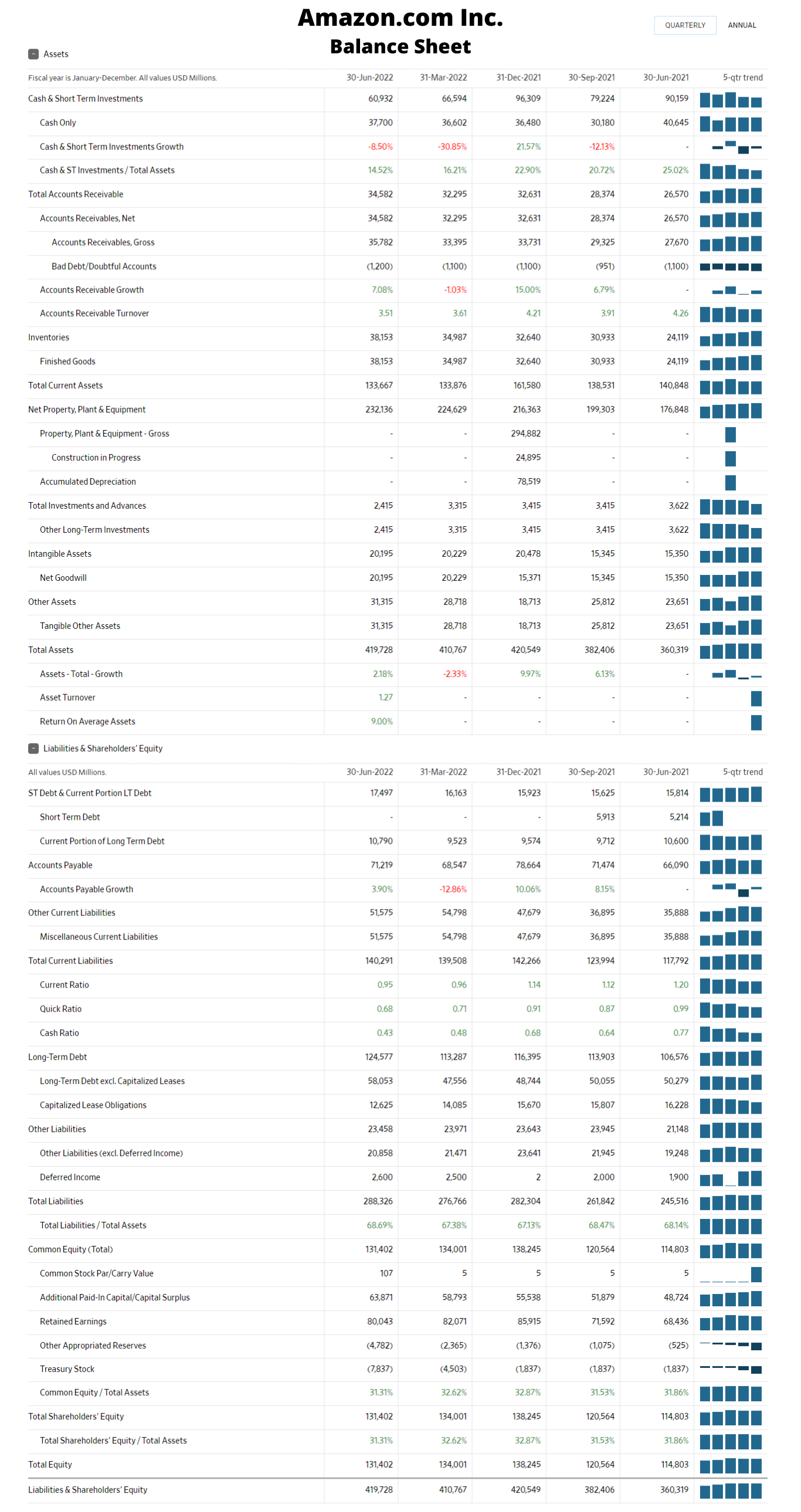

What is a public business balance sheet?

A public business balance sheet is a more complex form of a balance sheet in which the guidelines for reporting are given by the International Accounting Standards Board and other organizations that are specific to different countries. In the United States of America, the accounting standards are outlined by the Generally Accepted Accounting Principles (GAAP) which are usually developed by the Federal Accounting Standards Advisory Board (FASAB) for use by federal financial reporting entities.

The names of the different balance sheet accounts and how they are used would depend on the country of the company and the nature of the company. For example, the dividends payable account only appears on the balance sheet of companies that pay dividends.

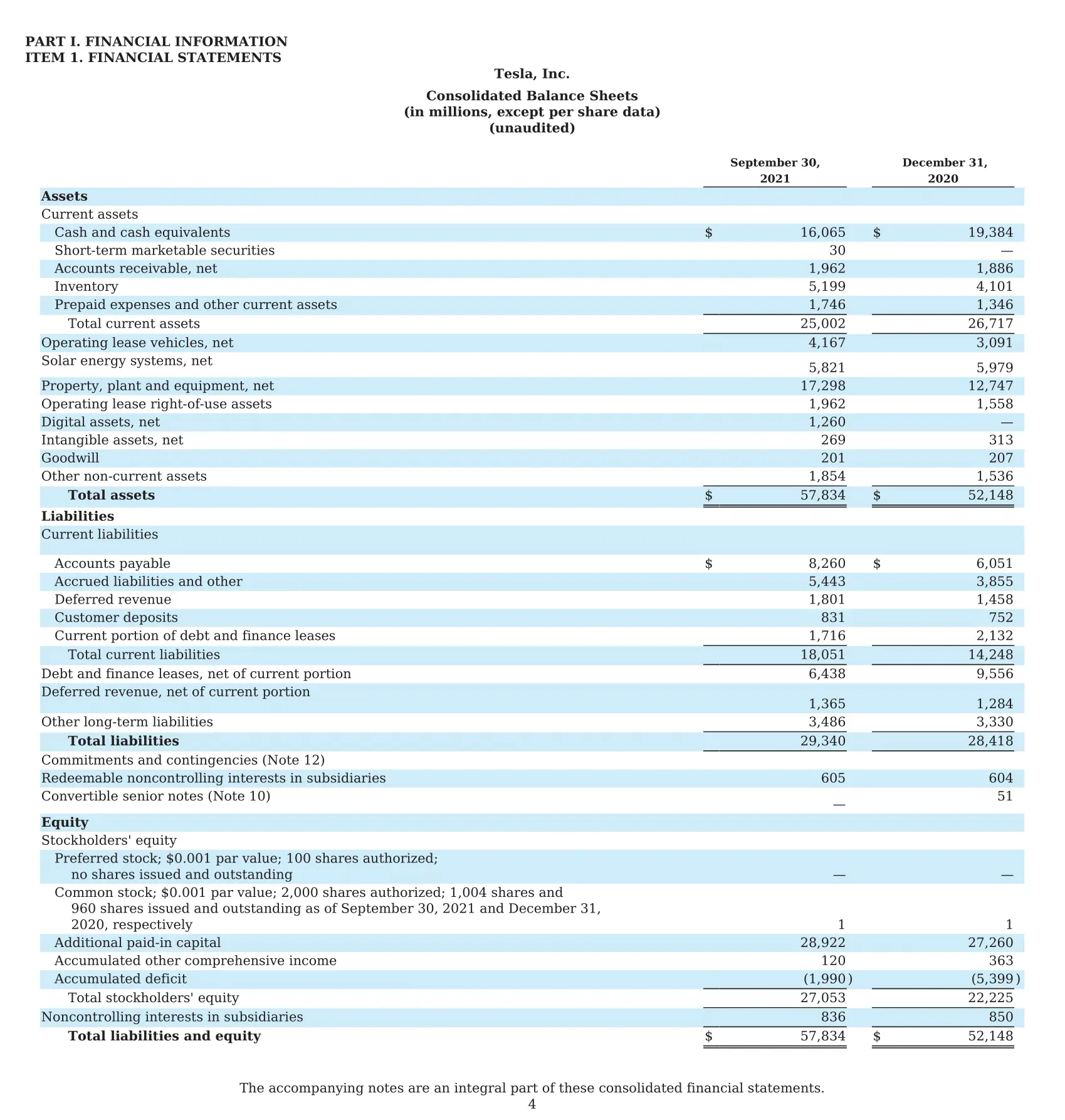

Tesla Balance Sheet Example

Source: Tesla

How to Make a Balance Sheet

- Name of Company

- Type of Financial statement

- Add the reporting period

- Create two columns – left and right

- Enter the balance sheet accounts

- Add any extra or vital information in the footnotes

Accountants or bookkeepers make use of the T-accounting method to record debit and credit transactions on financial statements. In this method, a “T” is drawn on the paper; at the top of the “T”, the account being affected is written (that is, the name of the account being debited or credited is written at the top of the “T”). A debit would be recorded on the left side of the “T” while a credit would be recorded on the right side of the “T”. This means every account must have a debit column and a credit column. We will use this method of recording transactions as you will see from the examples of double-entry bookkeeping that will be shown.

Name of company

The first information you need to add at the top of the page when creating a balance sheet is the name of the company. This identifies the company that created or prepared the statement of financial position. For a large corporation with subsidiaries, when each subsidiary is preparing its balance sheet, the name of the company will be the name of the subsidiary and not the parent or holding company.

If a parent company is preparing its own balance sheet without including the balance sheets from the subsidiaries, then the company’s name would be the name of the parent company. For the consolidated balance sheet, the company’s name would be that of the parent company but the statement of financial position would be named as a consolidated balance sheet, to indicate it is formed by merging other balance sheets from the subsidiaries.

Type of financial statement

There are different types of financial statements that can be created such as cash flow statements, income statements, statements of financial position, statements of retained earnings, etc. It is therefore important that when preparing a balance sheet or any financial statement, you should indicate the type of financial statement that is being reported. In this case, we are reporting the financial position of the company, hence it would be indicated at the top as a Balance sheet.

If the balance sheet is formed by combining the balance sheets of the subsidiaries, then it has to be indicated as a Consolidated Balance Sheet.

The type of financial statement should be written just below the name of the company.

Add the reporting period

After indicating the type of financial statement being reported, the next row is for the reporting date. The reporting date is the final date of the period covered by the financial statement. The reporting period covered by a financial statement could be monthly, quarterly, or yearly as earlier stated.

Create two columns – left and right

Draw two columns on a paper or any sheet you are using to make the balance sheet. The left column is for ASSETS and under the assets section, all the current and non-current balance sheet accounts that are assets are listed here.

The Right column would have two sections: one for the liabilities and the other for the stockholder’s equity. The liabilities section has current and non-current accounts under it.

Enter the balance sheet accounts

You can refer to the balance sheet accounts listed above to know what section each account falls under as well as their definitions.

Are balance sheet accounts permanent?

Whatever balance remains in any of the balance sheet accounts would be carried over to the next accounting year; this means that the balance sheet accounts are permanent accounts (or real accounts).

Add any extra or vital information in the footnotes

Any extra information such as accounting method used, references, adjusted figures, description of any inconsistencies on the balance sheet, and any vital information that may be needed to clarify what is on the balance sheet.

Types of Balance Sheet Templates

We will outline various templates of the balance sheet based on the types we mentioned earlier. Below are the balance sheet templates.

Personal Balance Sheet Template

You can download the document below: A Sample of a Personal Balance Sheet

Small Business Balance Sheet Template

Public Business Balance Sheet Sample

Below is an example of a public business balance sheet from Amazon.com Inc. The source of the information can be seen below the picture.

Values are in Millions of dollars. Source: From WSJ.com

Who is required to file a balance sheet?

The accountant is required to file the balance sheet at the Internal Revenue Service (IRS) for a public company or a partnership in some cases. For a corporation, it is mandatory to file a balance sheet.

When does a partnership have to file a balance sheet?

A partnership can only file a balance sheet when it has total receipts (gross receipts of at least $250,000) or more; or total assets of $1,000,000 (a million dollars) or more.

Who uses a balance sheet?

A balance sheet is useful to an investor, lending organizations, regulatory organizations such as some government agencies in charge of monitoring companies, the management of a company, and employees. Any type of company can use the balance sheet, be it a sole proprietorship, partnership, corporation, private limited company, or not-for-profit organization.

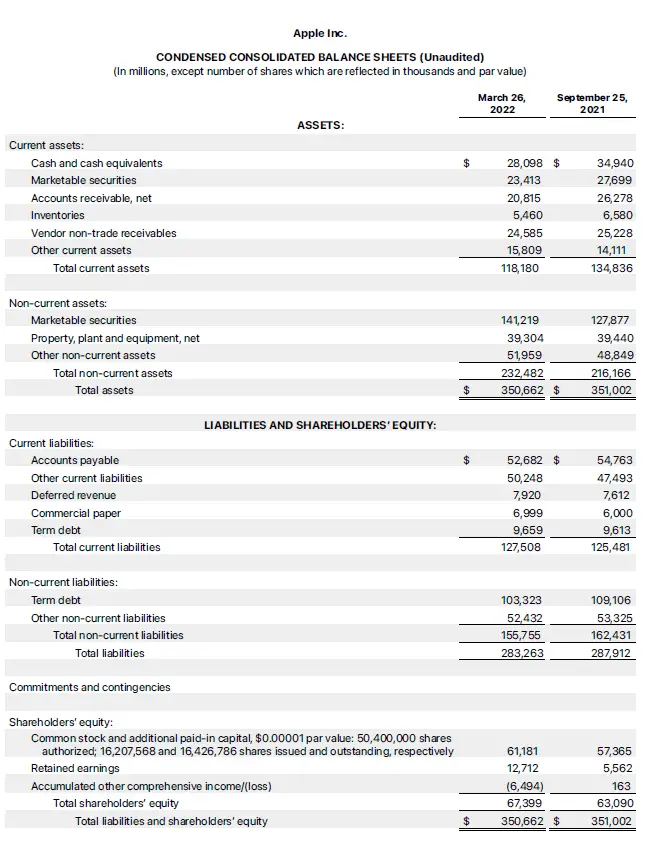

Consolidated Balance Sheets

Consolidated balance sheets are multiple balance sheets issued by a corporation that has many other subsidiaries. A consolidated balance sheet is usually issued by conglomerates or groups of companies. What happens is that multiple statements of financial position are merged into a single balance sheet, but the assets, liabilities, and equity that appear on the consolidated balance sheet are from multiple companies.

Consolidated Balance Sheet Sample

This is a consolidated balance sheet, which means that the assets, liabilities, and shareholders’ equity listed here are from different subsidiaries of Apple Inc. and have been merged into a single balance sheet. The source of the main PDF file can be seen below the picture.

Apple Balance Sheet Example

Every value here is in millions except the number of shares which are reflected in thousands and par value.

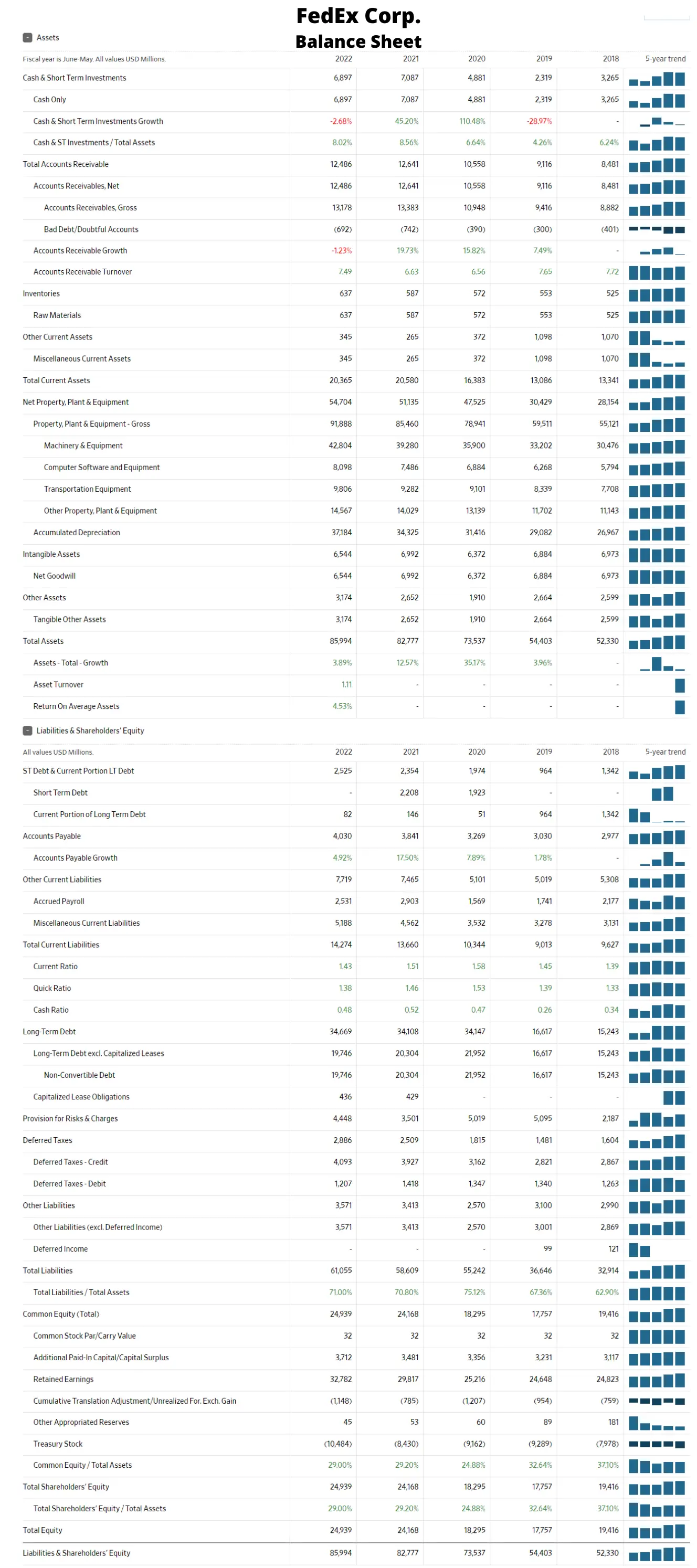

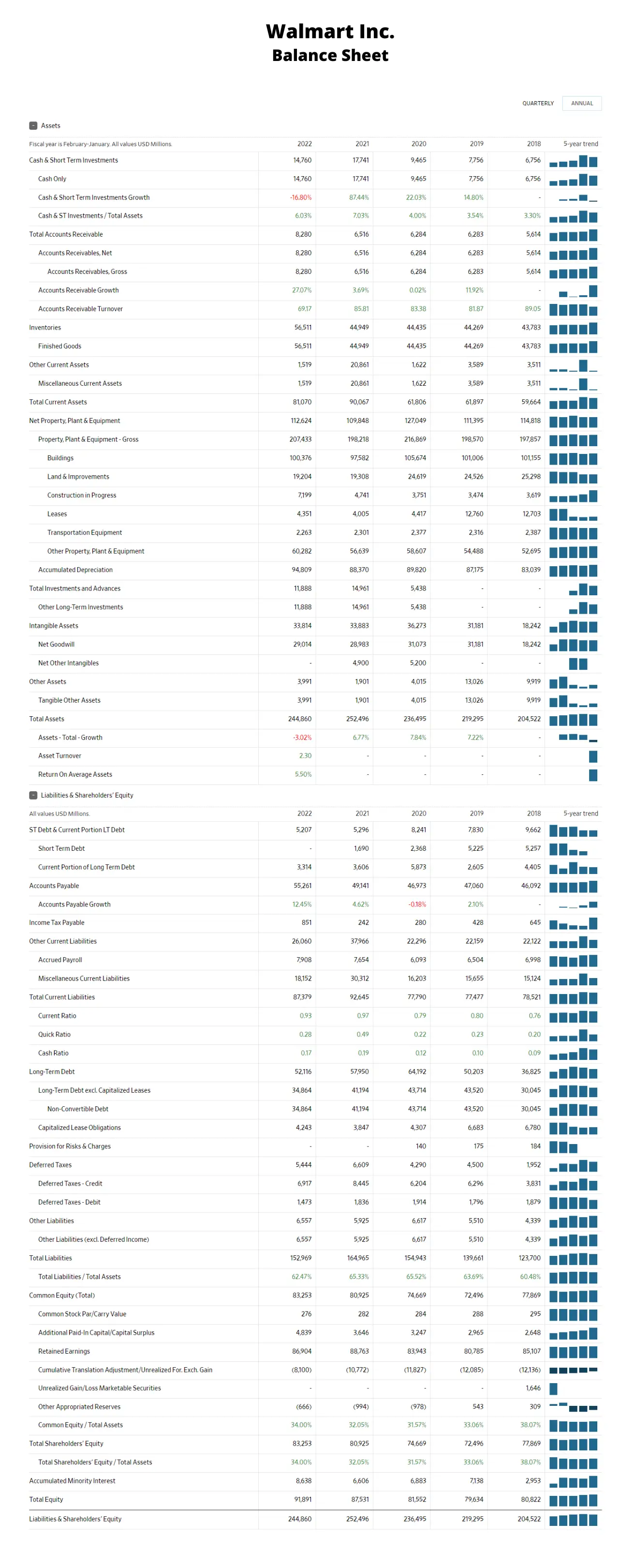

Balance Sheet Examples

Fedex Balance Sheet Example

Source: WSJ.com

Walmart Balance Sheet Example

Source: WSJ.com

What is a Fortress Balance Sheet?

A fortress balance sheet is a statement of financial position that can withstand shock (such as economic recession, pandemic, natural disaster, or severe regulations) because of its high liquidity, low debt, and liabilities. An example of a fortress balance sheet is that of JP Morgan.

A fortress balance sheet is also known as a well-supported balance sheet.

What is balance sheet substantiation?

Balance sheet substantiation is the method of validating the accounts of a balance sheet to make sure it is accurate and true; it is also called balance sheet reconciliation. This process verifies the information on a balance sheet to ensure it is correct. The balances of the various accounts are compared with data from other forms of documentation in order to detect any discrepancies.

Balance sheet substantiation can be carried out anytime, but most companies do it monthly, quarterly, or yearly. It can be carried out manually or by use of accounting software like Oracle, SAP accounting software (developed by SAP SE), etc.

Balance Sheet Runoff

Balance sheet runoff is a type of monetary policy used by central banks such as the Federal Reserve in a bid to control inflation. The Fed balance sheet runoff involves reducing the financial assets (such as notes and bonds) it has on its balance sheet. These assets, rather than being reinvested are sold off into the financial markets, which decreases the size of the balance sheet, and this leads to high-interest rates which in turn reduces the money in circulation. Balance sheet runoff is also called Quantitative tightening (QT).

Importance of a balance sheet

- It gives a picture of the net worth of a company, hence the balance is also known as a statement of net worth.

- It shows the amount of money available in various accounts of the company

- A balance sheet is important for investors as they look at the reports and use it in calculating many financial metrics that help them know the best companies to invest in.

- Business valuation metrics and Market prospect ratios can be calculated from the reports on the statement of financial position; this is important to investors before business acquisitions and mergers.

- Banks and other financial institutions make use of the balance sheet of a company before approving loans.

- Employees of public companies can also evaluate or analyze the company’s balance sheet to ensure their jobs are secured. From the balance sheet, they can know whether the company is financially stable and whether the company has good financial management principles.

Financial metrics that can be calculated from the balance sheet

- Debt-to-equity ratio

- Debt to capital ratio

- Working capital

- Return on Assets (ROA)

- Return on Equity (ROE)

- Acid test ratio (or the quick ratio)

- Current ratio

The debt-to-equity ratio (D/E ratio)

The debt-to-equity ratio shows how a business raises money to fund its activities; it is a ratio that shows the financial leverage of a company. A high Debt to equity ratio means a business relies on debt to finance its activities which is not healthy. Investors would prefer a business with a low D/E ratio because it means the business can run with minimal or no debt.

Debt to total capital ratio

This is another type of financial leverage ratio that indicates how a company finances its operations, whether through debt or through current revenues or shareholders. The debt to capital ratio can be calculated by dividing the interest-bearing debt by the total capital of the company.

Working capital

The working capital is the money that is available for a company to use for its day-to-day activity; it can be calculated by subtracting the short-term liabilities from the short-term assets. Working capital may include cash equivalents that are highly liquid that can easily be sold for cash. It is an indicator of the financial status of a business; a high working capital means that a business has excess cash to use for funding growth even when all liabilities are paid in full.

Return on Assets

The Return on Assets formula helps in the calculation of the efficiency of a business. A high return on assets (ROA) shows a business is utilizing its resources very well compared to another business with a lower ROA that does not perform well even when the assets are available. It means a business with a good ROA is making good use of the available assets compared with another that only wastes resources or underutilized the available assets.

Acid test ratio (quick ratio)

The quick ratio (also known as the Acid test ratio) is a type of liquidity ratio used to assess the ability of a company to meet its short-term liabilities using the most liquid assets. It is a ratio that compares how the short-term assets of a company can be used to pay for short-term liabilities. Lenders find the quick ratio to be very useful.

In essence, a financially healthy company can be identified from the balance sheet when there are more assets than liabilities; that is, the company’s net worth should be positive and not negative. Negative net worth means there are more liabilities than assets.

What are the limitations of the balance sheet?

One of the drawbacks of a balance sheet is that it doesn’t give a complete picture of the financial health of a company unless it is combined with other financial statements like the income statement and the cash flow statement. Another limitation is that it looks at the financial activities at a point time (it gives a summary of what has occurred) and does not tell you what has been occurring prior to a particular date; this makes it difficult to know the performance of the company unless you combine several balance sheets to analyze.

The balance sheet can be manipulated to make the company look profitable because it is allowed to account for the depreciation of assets, this makes it vulnerable to manipulation because the depreciation of an asset may not be well stated to deceive a lender to think an asset is still valuable to be used as collateral while in reality, such an asset may not be of value again. This is an important limitation of the balance sheet that any lender needs to take note of it.

Cooking the books (Creative accounting)

Another limitation of the balance sheet is concealed in what is known as creative accounting. This practice involves following the standard accounting rules and regulations but exploiting gaps in the stated accounting rules. These gaps may not have been known and some companies exploit them; therefore creative accounting deviates from the objectives that the rules and regulations aim to achieve (which are to protect investors, ensure transparency, and make sure companies pay the right amount of taxes).

Creative accounting is also known as “Cooking the books“, innovative accounting, or aggressive accounting.

Example

One example of cooking the books is a primary company making use of its offshore subsidiary in order to avoid tax. The offshore subsidiary would charge the primary company for a certain service or license; this license or service charge would be so high that it will greatly reduce the profits or nearly wipe out the profit of the parent company. Because the profit is now low or completely wiped out as a result of the charges; the parent company will now pay little or no tax on the non-existent profit. A real-life example of this occurred in the Netherlands.

Balance sheet vs Income statement Differences

The income statement gives a report of the revenue sources and expenses of a business over a period of time whereas the balance sheet only shows the report at a particular point in time. An income statement shows the profitability of a firm and therefore, it is also called a profit and loss statement (P&L).

An income statement is very important because it shows the profit generated by a business; it also shows the revenues, profits and losses, as well as the expenses of a company over a period of time.

Balance sheet vs Cash flow statement Differences

Just like the income statement, the cash flow statement also gives the report of a business over a period of time but it differs from the income statement in the sense that the cash flow gives a report of the cash inflow and outflow of a business whereas the balance sheet gives the financial position of a business at a point in time.

Lenders such as banks use the statement of cash flow to assess how a business can pay back a loan. If a business generates revenue from several sources and the expenses are low, it shows it is financially healthy and can pay off its debts. A company may generate high revenue from a single source, this can be risky when an unforeseen circumstance causes the revenue to dwindle, and this may cause the business to default on its debts.

Differences between Statement of Retained Earnings vs Balance Sheet

The statement of retained earnings shows the changes occurring in the equity of a business, that is, it reports the payments of dividends, the sale of stocks, the repurchase of stocks (treasury stocks), and any profit or loss incurred. The statement of retained earnings gives these changes occurring in equity over a period of time and not at a point in time as the balance sheet. While the statement of retained earnings is more detailed about what is transpiring in the equity, the balance sheet gives a summary of what has transpired in a company to the assets, liabilities, and equity.

Trial Balance vs Balance Sheet Differences

A trial balance is a record that shows all the balances in the accounts of the general ledger at a certain point in time. The trial balance is only used within the company, unlike the balance sheet which can be distributed to investors, auditors, regulators, etc. Whereas a balance sheet is a financial statement, a trial balance is not. The trial balance accounts are grouped into debits and credits.

A trial balance is useful for making a balance sheet and income statement when accounting software is not available or not being used.

What is off-balance sheet financing?

Some liabilities and assets are purposely kept away by companies from appearing on the balance sheet, such liabilities are known as off-balance sheet items. The reason for this is that such companies want to lower their debt-to-equity and leverage ratios so as to enable them to borrow easily and prevent a breach of covenants. It is legal if the accounting laws are followed but becomes illegal if the purpose is to hide some assets or liabilities in order to deceive regulators and investors.

Conclusion

A balance sheet is a vital record that every business needs to know how to create as well as make use of it in order to achieve its financial management goals. It is a summary of the general ledger accounts. From the balance sheet accounts, some financial ratios can be calculated and used for assessing the financial status of a firm; hence it is also called the statement of financial position.

Last Updated on November 4, 2023 by Nansel Nanzip BongdapNansel is a serial entrepreneur and financial expert with 7+ years as a business analyst. He has a liking for marketing which he regards as an important part of business success.

He lives in Plateau State, Nigeria with his wife, Joyce, and daughter, Anael.