The cash ratio formula is one of the ratios used to measure the liquidity of a company. In finance, liquidity is the measurement of a business’s ability to settle its current liabilities. If a business has high liquidity, it means the business is able to settle its short-term bills as they become due. But a business that has low liquidity is going to have a more difficult time settling its short-term bills.

This article will discuss the cash ratio formula and interpretation with calculation examples. First, let’s understand what the cash ratio is and how it is used.

What is a cash ratio?

The cash ratio is a type of liquidity ratio that evaluates the company’s ability to settle its short-term debt with its cash and cash equivalents (such as easily marketable securities). The ratio focuses on calculating the company’s total cash or near-cash resources to its current liabilities.

Creditors use the result from calculating the cash ratio to decide how much money they would be willing to loan a company. These creditors are more likely to look at the cash ratio of a company than investors. This is because the ratio tells them whether a company can service its debt or not. Unlike the quick ratio and current ratio, the cash ratio doesn’t include accounts receivables and inventory. Therefore, if the ratio is greater than 1, creditors are assured that the company’s debt is serviceable.

Cash happens to be the best form of an asset used to settle liabilities compared to other assets like accounts receivables and inventory. It can take weeks or months for accounts receivables to be converted to cash and months to be able to sell inventory.

Therefore, the fact that the cash ratio equation doesn’t include accounts receivables and inventory in its calculation makes creditors feel more comfortable providing loans to companies that have better cash ratios.

Furthermore, despite the fact that creditors prefer a higher cash ratio, companies do not keep it too high. A cash liquidity ratio greater than 1 suggests higher cash assets that the company is not using for profitable activities.

These companies do not usually maintain high cash assets because cash lying idle in bank accounts does not produce good returns. So, they try to use the idle cash for projects, mergers, acquisitions, research, and development as well as acquiring new businesses to generate better returns. Therefore, a cash ratio in the range of 0.5-1 is considered a good cash liquidity ratio.

Hence, during a fundamental analysis of a company, investors do not frequently look at the cash ratio analysis despite the ratio being a stringent liquidity measure. This is because investors would prefer the company to utilize its idle cash to make more profit and income.

The investors benefit better if the company settles its debt in time and uses idle cash to reinvest in the business activities, thus, making better returns.

Cash ratio interpretation

What does the cash ratio analysis tell you? The cash ratio interpretation will tell you the measure of a company’s liquidity. In a situation where the company is forced to pay all current liabilities immediately, the cash ratio analysis will show if the company can pay all short-term debts and obligations immediately without selling or liquidating other assets.

The cash ratio calculation results in a numeral, greater or less than 1. If the cash ratio result is equal to 1, it is assumed as a cash ratio interpretation, of the company having the same amount of current liabilities as its cash and cash equivalents to pay off its debts.

The cash liquidity ratio is almost like an indicator of the value of a firm under the worst-case scenario such as the company being about to go out of business. Interpreting the cash ratio tells creditors and analysts the value of current assets that could quickly be turned into cash, as well as the percentage of the company’s current liabilities that these near-cash assets and cash could cover.

The U.S. Small Business Administration advises companies to monitor healthy levels of liquidity, collateral, and capacity, through the use of cash ratios and other liquidity ratios, especially when building relationships with lenders. As businesses pursue loans, lenders will analyze financial statements to gauge the health of the company.

Values of Cash Ratios and What the Mean

Less Than 1

If a company has a cash ratio that is less than 1, it means that the company has more current liabilities than cash and cash equivalents. This simply means that there is insufficient cash on hand to settle the short-term debt. This may not necessarily be bad if the company has conditions such as long credit terms with its suppliers, very little credit extended to its customers and efficiently-managed inventory, that skews its balance sheets. Generally, a cash ratio that is less than 0.5 is considered risky because the company has twice as many short-term liabilities compared to cash.

Equal to 1

If a company has a cash ratio result that is equal to 1, it means that the company has the same amount of current liabilities as its cash and cash equivalents to pay off its short-term debt.

Greater Than 1

A greater than 1 cash ratio meaning implies that the company has more cash and cash equivalents than current liabilities. This simply means that the company is capable of covering all its short-term debt and would still have cash remaining. A cash ratio that is above 1 is generally favored.

In as much as a higher cash ratio is generally better, it may also indicate that rather than investing in profitable projects or company growth, the company is making use of its cash inefficiently or is not maximizing the potential benefit of low-cost loans. Furthermore, a high cash ratio may also be an indication that the company is worried about future profitability and is, therefore, accumulating a protective capital cushion.

What is a good cash ratio?

The fact is cash ratio will vary between industries. This is because some sectors depend more heavily on short-term debt for financing (debt financing). For instance, there are sectors that rely on quick inventory turnover.

Nevertheless, a good cash ratio would be considered to be a ratio equal to or greater than 1, which indicates that the company has enough cash and cash equivalents to entirely service all short-term debts. Therefore, a cash ratio that is above 1 is generally favored, whereas a cash ratio that is less than 0.5 is considered risky. This ratio is considered risky because the company has twice as many short-term liabilities compared to cash.

Cash ratio formula

Similar to the current ratio and quick ratio, the cash ratio formula is used to measure short-term liquidity. However, the cash ratio, generally, is a more conservative look at the ability of a company to cover its debt and obligations compared to other liquidity ratios. This is because the cash liquidity ratio sticks strictly to cash or cash-equivalent holdings. Therefore, other assets such as accounts receivable, inventory, etc are excluded from the cash ratio formula.

What is the formula for cash ratio?

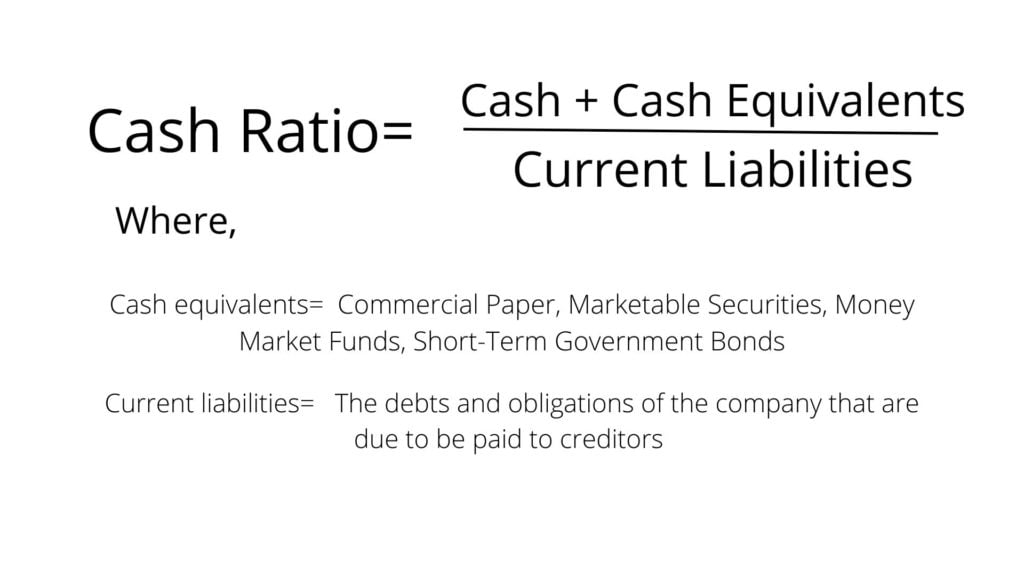

The cash ratio formula is expressed as:

Cash Ratio= Cash + Cash Equivalents / Current Liabilities

The cash ratio equation consists of cash & cash equivalents in the numerator and short-term liabilities in the denominator. The cash in the numerator of the cash ratio formula is quite straightforward, while the cash equivalents may include the following:

- Marketable securities

- Commercial paper

- Money market funds

- Short-term government bonds (e.g. Treasury bills)

Therefore, the formula for the cash ratio is to add the company’s cash and cash equivalents together and divide them by current liabilities. However, a variation of the cash ratio equation that may be slightly more accurate is to exclude accrued expenses from the current liabilities in the denominator of the equation. The reason is that these accrued expenses may not be necessary to pay for in the near term.

Calculations and Examples

You calculate the cash ratio by dividing the company’s cash and cash equivalents by its current liabilities. The cash equivalents include items like marketable securities, commercial paper, money market funds, and short-term government bonds depending on what is seen on the company’s financial statement.

The formula for cash ratio shows the ability of a company to cover its near-term debt burden by dividing a company’s most liquid cash and near-cash assets by the value of its short-term debt that is coming due within the coming year.

Example 1

The table below shows the financials of a skincare brand. Calculate the cash ratio of this skincare brand and explain what the cash ratio tells you.

| Balance sheet items | Amount |

| Cash & Cash Equivalents | $70 million |

| Accounts Receivable (A/R) | $35 million |

| Inventory | $30 million |

| Accounts Payable | $37 million |

| Short-Term Debt | $55 million |

Solution

From the financials listed, we are going to exclude the accounts receivable and inventory accounts from our calculation since we are calculating for cash ratio. This will leave us with cash & cash equivalent of $70 million.

Also, the skincare brand has short-term debt of $55 million and accounts payable that amount to $37 million, which are both near-term debts (i.e vendor financing) amounting to a total current liabilities of $92 million.

How to find cash ratio of the skincare brand using the cash ratio formula:

Cash Ratio= Cash + Cash Equivalents / Current Liabilities

Cash Ratio= $70 million / $92 million

Cash Ratio= 0.76

Cash ratio interpretation: The skincare brand has a cash ratio of 0.76 which is less than 1. This means that the cash and cash equivalents of the business are inadequate to cover its liabilities with near-term maturity dates. Nevertheless, seeing that the business has an inventory balance of $30 million and an accounts receivable balance of $35 million, it is likely that the business may not default on its debt obligations or payments to its vendors in a worst-case scenario.

How to calculate cash ratio: Example 2

What will be the cash ratio of Company XYZ if it has $300,000 of cash and $700,000 of cash equivalents on its balance sheet at the end of June, and has current liabilities of $900,000 on that date?

Solution

From the financials given, Company XYZ has a cash & cash equivalents of ($300,000 + $700,000).

The company has current liabilities of $900,000.

How to calculate cash ratio of Company XYZ using the cash ratio formula:

Cash Ratio= Cash + Cash Equivalents / Current Liabilities

Cash Ratio= ($300,000 + $700,000) / $900,000

Cash Ratio= 1.11

Cash ratio interpretation: Company XYZ has a cash ratio of 1. This means that the cash and cash equivalents of the company are exactly enough to pay off its short-term debt.

How to calculate cash ratio: Example 3

Calculate the cash ratio assuming a company with a current liabilities of $170,000 has the following balance sheet data:

| Assets | Amount |

| CURRENT ASSETS | |

| Cash on hand | $35,000 |

| Cash in bank | $25,000 |

| Marketable securities | $40,000 |

| Inventory | $60,000 |

| Accounts receivable | $85,000 |

| Prepaid insurance | $15,000 |

| TOTAL CURRENT ASSETS | $260,000 |

| NON-CURRENT ASSETS | |

| Fixed assets | $90,000 |

| Goodwill | $30,000 |

| TOTAL NON-CURRENT ASSETS | $120,000 |

Solution

From the balance sheet data given, the company has total current assets of $260,000. However, we are going to exclude the inventory accounts, accounts receivable, and prepaid insurance from our calculation since we are calculating for cash ratio. This will leave us with cash & cash equivalent of $100,000

i.e Cash on hand and Cash in bank ($35,000 + $25,000) + Marketable securities of $40,000= $100,000

The company has current liabilities of $170,000.

How to calculate cash ratio of the Company using the cash ratio formula:

Cash Ratio= Cash + Cash Equivalents / Current Liabilities

Cash Ratio= $100,000 / $170,000

Cash Ratio= 0.58

Cash ratio interpretation: The company has a cash ratio of 0.58 which is less than 1. This means that the cash and cash equivalents of the company are inadequate to cover its liabilities with near-term maturity dates. Nevertheless, seeing that the business has an inventory balance of $60,000 and an accounts receivable balance of $85,000, it is likely that in a worst-case scenario, the company may not default on its debt obligations or payments to its vendors.

A high or low cash ratio, which is better?

It is usually better to have a high cash ratio because this indicates that your company has more cash on hand, lower short-term liabilities, or both. It can be a signal to investors and creditors that the company has a greater ability to settle current debts as they come due.

Creditors feel more comfortable providing loans to companies that have higher cash ratios. However, even though creditors prefer a higher cash ratio, companies should not keep it too high. When a company’s cash ratio is considered to be too high, it may be that the company may be inefficient in managing cash and leveraging low credit terms. In such an instance, it would be preferable for the company to reduce its cash ratio.

Increasing the ratio

How can the cash ratio of a business increase? There are ways a business or company can increase its cash ratio. Since the cash ratio is calculated by dividing cash and cash equivalents by short-term liabilities, a business can improve its cash ratio by striving to have more cash on hand in case of demand for payments or short-term liquidation. They can have more cash on hand by doing the following:

- Turning over inventory quicker

- Holding less inventory

- Not prepaying expenses

As another option, the business or company can reduce its short-term liabilities. They can start paying expenses with cash if credit terms are no longer favorable. The company can also reduce payment obligations by evaluating spending and striving to reduce its overall expenses.

Advantages

The cash ratio, generally, is a more conservative look at the ability of a company to cover its debt and obligations compared to other liquidity ratios when looking at a worst-case scenario. This ratio is almost like an indicator of the value of a firm under the worst-case scenario such as the company being about to go out of business. Interpreting the cash ratio tells creditors and analysts the value of current assets that could quickly be turned into cash, as well as the percentage of the company’s current liabilities that these near-cash assets and cash could cover.

Limitations of the cash ratio formula

In the fundamental analysis of a company, the cash ratio is barely used by analysts or in financial reporting. One of the drawbacks of the cash ratio is that it is not realistic for a company to maintain excessive levels of cash and near-cash assets to cover short-term debts and obligations. This is because such a situation is usually seen as poor utilization of assets.

It is poor asset utilization, for a company to hold large amounts of cash on its balance sheet because the money could be returned to shareholders or used in other ways to generate higher returns.

Another limitation of the cash ratio formula is that it is only more useful when looking at changes in the same company over time, or when the ratio is compared with industry averages and competitor averages. More so, it is a norm for certain industries to operate with lower cash reserves and higher current liabilities.

As earlier said, the ratio may be most useful when analyzed over time. The company’s cash ratio may be low at the moment but may have been directionally improving over the past year. Additionally, this ratio fails to incorporate seasonality or the timing of large future cash inflows. Therefore, this may understate a company during their offseason or overstate a company in a single good month.

Furthermore, one of the disadvantages of the cash ratio is that it may interpret a company with a cash ratio lower than 1 as being at risk of having financial difficulty. However, a low cash ratio may not necessarily mean that. It may be an indication of the company undergoing a specific strategy that warrants maintaining low cash reserves because funds are being used for expansion.

Another major disadvantage of the cash ratio is that it can be easily manipulated by management. In an attempt to show a high cash ratio, a company may keep a large amount of cash on hand as of the measurement date, probably more than is prudent.

Cash ratio vs quick ratio

The cash ratio, quick ratio, and current ratio are all kinds of ratios used to evaluate the liquidity of a company. However, the cash ratio only includes cash and cash equivalent in its calculation and doesn’t include inventory and accounts receivables unlike the current ratio and quick ratio respectively.

Despite the quick ratio and cash ratio being both liquidity ratios, they are calculated differently. The difference between the cash ratio vs quick ratio is that the cash ratio measures the company’s ability to service its current liabilities using only cash and cash equivalents, whereas the quick ratio measures the ability of the company to service its current liabilities using its most liquid assets.

The quick ratio focuses on paying off current liabilities by using the current assets that can be quickly converted to cash within 90 days while the cash ratio focuses on using only cash and cash equivalents to settle the short-term debt. The formula for cash ratio is expressed as (Cash Ratio= Cash + Cash Equivalents / Current Liabilities), while the quick ratio formula is expressed as (Quick ratio= Liquid assets / Current liabilities). However, depending on the company’s kind of current assets, the quick assets of the company include Cash + Cash equivalents + Marketable securities + Net accounts receivable or (Total current assets – Inventory – Prepaid expenses).

The common thing between the cash ratio vs quick ratio is that they both don’t include inventory in their calculation. More so, cash and cash equivalents are included when calculating the cash ratio and quick ratio.

Cash happens to be the most liquid asset used to settle debts compared to other assets like accounts receivables and inventory. It can take weeks or months for accounts receivables to be converted to cash and months to be able to sell inventory.

Therefore, the fact that the cash ratio equation doesn’t include accounts receivables and inventory in its calculation makes creditors feel more comfortable providing loans to companies that have high cash ratios.

Conclusively, one of the major concerns of the cash ratio formula in contrast to the quick ratio is that the ratio only measures cash balances at a specific point in time, which may vary quickly. This may vary because receivables are collected and suppliers are paid. As a result of this, the quick ratio happens to be a better measure of liquidity, which includes accounts receivable in the numerator of the ratio.

Last Updated on November 6, 2023 by Nansel Nanzip BongdapObotu has 2+years of professional experience in the business and finance sector. Her expertise lies in marketing, economics, finance, biology, and literature. She enjoys writing in these fields to educate and share her wealth of knowledge and experience.