The predetermined overhead rate formula can be used to balance expenses with production costs and sales. For businesses in manufacturing, establishing and monitoring an overhead rate can help keep expenses proportional to production volumes and sales. It can help manufacturers know when to review their spending more closely, in order to protect their business’s profit margins.

Knowing how to calculate the predetermined overhead rate (POHR) helps businesses to have a better understanding of the costs associated with producing a product or rendering a service. When a business knows how much overhead cost is associated with each product it makes, it can add the cost to the price to ensure it is making a profit.

In other words, using the POHR formula gives a clearer picture of the profitability of a business and allows businesses to make more informed decisions when pricing their products or services. In this article, we will discuss the formula for predetermined overhead rate and how to calculate it.

Related: Asset Turnover Ratio Formula and Calculations

What is predetermined overhead rate?

A predetermined overhead rate also known as the plant-wide overhead rate is an allocation rate that can be used by a manufacturer to determine the indirect manufacturing costs that are involved in the production of a product. That is, a certain amount of manufacturing overhead is applied to job orders or products which is used to estimate future manufacturing costs.

This estimate is made at the beginning of an accounting period wherein the manufacturing overhead, or ongoing expenses, for a work-in-progress inventory, is determined before the commencement of the projects for which the rate is needed. Therefore, in simple terms, the POHR formula can be said to be a metric for an estimated rate of the cost of manufacturing a product over a specific period of time. That is, a predetermined overhead rate includes the ratio of the estimated overhead costs for the year to the estimated level of activity for the year.

These overhead costs involve the manufacturing of a product such as facility utilities, facility maintenance, equipment, supplies, and labor costs. Whereas, the activity base used for the predetermined overhead rate calculation is usually machine hours, direct labor hours, or direct labor costs.

For example, assume a company expects its total manufacturing costs to amount to $400,000 in the coming period and the company expects the staff to work a total of 20,000 direct labor hours. In order to calculate the predetermined overhead rate for the coming period, the total manufacturing costs of $400,000 is divided by the estimated 20,000 direct labor hours. This will give a predetermined overhead rate of $20 per hour.

The company, having calculated its overhead costs as $20 per labor hour, now has a baseline cost-per-hour figure that it can use to appropriately charge its customers for labor and earn a profit. That is, the company is now aware that a 5-hour job, for instance, will have an estimated overhead cost of $100.

When is the predetermined manufacturing overhead rate computed?

In production, the predetermined overhead rate is computed to facilitate the determination of the standard cost for a product. It is computed at the start of the accounting period and this rate allows a company to be able to determine the cost for a product instead of having to wait, for several months, when all of the actual overhead costs are determined.

Take, for instance, a manufacturing company that produces gadgets; the production process of the gadgets would require raw material inputs and direct labor. These two factors would definitely make up part of the cost of producing each gadget. Nonetheless, ignoring overhead costs, like utilities, rent, and administrative expenses that indirectly contribute to the production process of these gadgets, would result in underestimating the cost of each gadget.

Hence, it is essential to use rates that determine how much of the overhead costs are applied to each unit of production output. This is why a predetermined overhead rate is computed to allocate the overhead costs to the production output in order to determine a cost for a product. The predetermined overhead rate is, therefore, usually used for contract bidding, product pricing, and allocation of resources within a company, based on each department’s utilization of resources.

See also: ROE with Dupont Formula

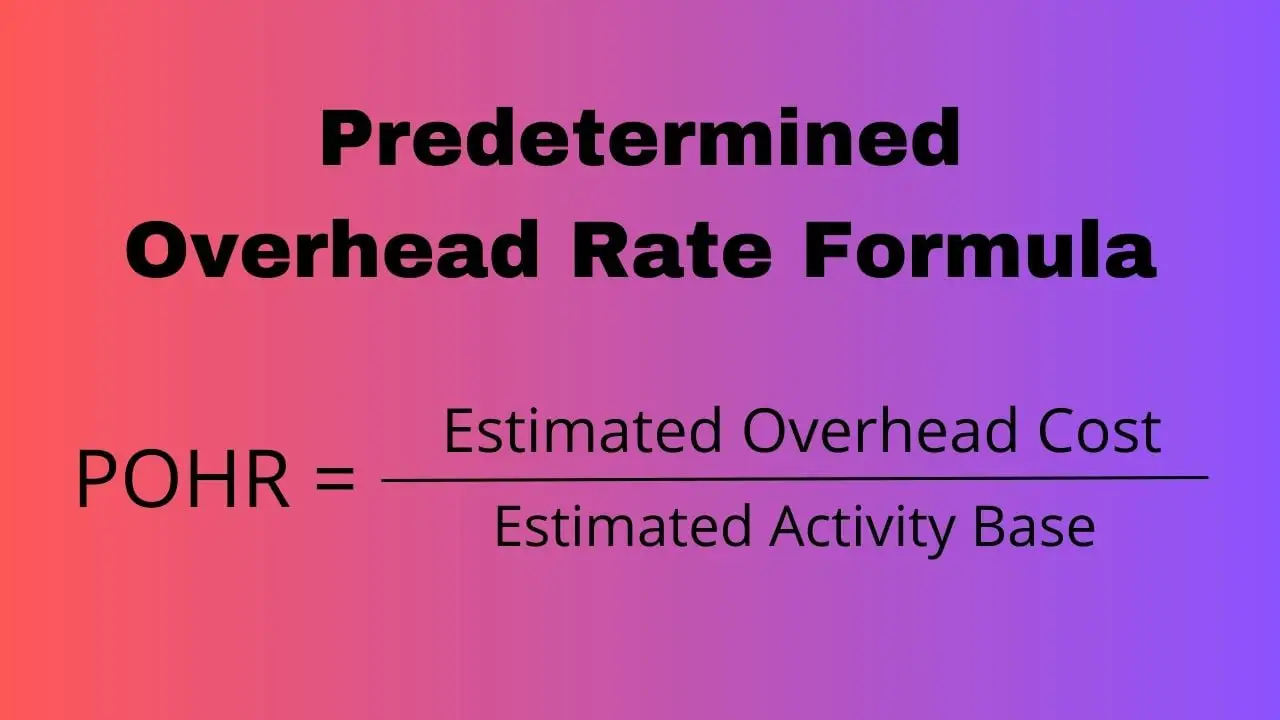

Predetermined overhead rate formula

The formula for a predetermined overhead rate is expressed as a ratio of the estimated amount of manufacturing overhead to be incurred in a period to the estimated activity base for the period.

That is, the predetermined overhead rate formula is expressed as:

Predetermined Overhead Rate = Estimated Overhead Cost / Estimated Activity Base

The predetermined overhead rate formula is mainly based on estimates. As a result, the overhead costs that will be incurred in the actual production process will differ from this estimate. The activity base (also known as the allocation base or activity driver) in the formula for predetermined overhead rate is often direct labor costs, direct labor hours, or machine hours. The activity base can differ depending on the nature of the costs involved. That is, a number of possible allocation bases such as direct labor hours, direct labor dollars, or machine hours can be used for the denominator of the predetermined overhead rate equation.

Check out: Importance of Budgeting

How to calculate the predetermined overhead rate

The predetermined overhead rate is calculated by dividing the estimated manufacturing overhead by the estimated activity base (direct labor hours, direct labor dollars, or machine hours). For instance, if the activity base is machine hours, you calculate predetermined overhead rate by dividing the overhead costs by the estimated number of machine hours. This is calculated at the start of the accounting period and applied to production to facilitate determining a standard cost for a product.

Here is how to compute predetermined overhead rate:

- First, you have to figure out the different overhead costs that are involved and the total amount

- Then, you determine which costs are the same in nature and have a relationship with the different allocation bases, this could be labor hours or units

- Next, you determine the allocation base for the department in question

- Then, you divide the total overhead cost by the allocation base that was determined in Step 3

- The predetermined overhead rate calculated in step 4 can either be applied to other departments or products; or better still, new rates for other departments can be computed using the same steps

See also: Budgetary Challenges and Problems

Examples of predetermined overhead rate

In order to have a better understanding of how to calculate the predetermined overhead rate, let us look at some examples:

How to find predetermined overhead rate: Example 1

A firm, Jotscroll Media Company will be launching a new product soon and wants a predetermined overhead rate calculated for it. The company’s production department comes up with the details of how much the overheads will be and the total of the other costs that will be incurred. Hence, the pricing details presented are as follows:

| Item | Allocation Base | Amount |

|---|---|---|

| Direct labor | Based on labor hours | $200,000 |

| Direct materials | Based on material units | $250,000 |

| Variable overhead | Based on labor hours | $150,000 |

| Fixed overhead | Based on labor hours | $350,000 |

| Direct labor hours | 2000 |

Since we want to calculate the predetermined overhead rate, direct costs will be ignored. This means that to get the total manufacturing overhead cost, we must add the variable overhead and the fixed overhead. That is:

Total manufacturing overhead cost = $150,000 + $350,000 = $500,000

- Total Manufacturing Overhead = $500,000

- Labor hours amount to 2,000.

Therefore, using the POHR formula;

Predetermined Overhead Rate = Total Manufacturing Overhead Cost / Direct labor hours

The predetermined overhead rate is calculated as:

= $500,000 / 2,000 = 250 per direct labor hour

Therefore, this predetermined overhead rate of 250 is used in the pricing of the new product.

On the other hand, if we change the allocation base used for the calculation from labor hours to machine hours, the predetermined overhead rate would be based on machine hours. Supposing the pricing details are as follows:

| Item | Allocation Base | Amount |

|---|---|---|

| Direct labor | Based on labor hours | $200,000 |

| Direct materials | Based on material units | $250,000 |

| Variable overhead | Based on labor hours | $150,000 |

| Fixed overhead | Based on labor hours | $350,000 |

| Direct labor hours | 1,000 | |

| Direct machine hours | 4,500 |

The predetermined overhead rate calculation for this would be as follows:

Total manufacturing overhead cost = $150,000 + $350,000 = $500,000

- Total Manufacturing Overhead = $500,000

- Direct machine hours amount to 4,500

Therefore, using the predetermined overhead rate formula:

= Total Manufacturing Overhead Cost / Direct machine hours

The predetermined overhead rate is calculated as:

= $500,000 / 4,500 = 111.11 per direct machine hour

The example shown above is known as the single predetermined overhead rate or plant-wide overhead rate. Different businesses have different ways of costing; some would use the single rate, others the multiple rates, while the rest may make use of activity-based costing.

In larger companies, each department in which different production processes take place usually computes its own predetermined overhead rate. Despite the fact that it may become more complex, it is considered more accurate and helpful to have different predetermined overhead rates for each department, because the level of efficiency and precision increases.

How to determine predetermined overhead rate: Example 2

Suppose that ABC Ltd produces a product and uses labor hours to assign the manufacturing overhead cost. Let’s assume the manufacturing overhead was estimated to be $155,000, and the labor hours estimated to be involved were 1,200 hours. Here is how to calculate the predetermined overhead rate for this example:

Solution

For this example of predetermined overhead rate, labor hours will be our activity base. Therefore:

- Total Manufacturing Overhead = $155,000

- Direct labor hours amount to 1,200

Using the predetermined overhead rate formula:

= Total Manufacturing Overhead Cost / Direct labor hours

Calculating predetermined overhead rate:

= $155,000 / 1,200 = 129 per direct labor hour

How to calculate the predetermined overhead rate: Example 3

Let’s look at another example of predetermined overhead rate; assume you are the head of ABC Inc and you are considering the launch of a new product, X. You have, however, asked the production head to develop the details of costing on existing product overhead costs so that you can apply the same to product X while making its pricing decisions. In this regard, the production department presented the following details:

| Item | Allocation Base | Amount |

|---|---|---|

| Direct labor | Based on labor hours | 235,000 |

| Direct materials | Based on the number of units | 350,000 |

| Variable overhead | Based on labor hours | 145,000 |

| Fixed overhead | Based on labor hours | 420,000 |

| Direct labor hours | 8,500 |

The production head would need to calculate a predetermined overhead rate, as that is the main cost allocated to the new product X. Hence, this is how it will be calculated:

Solution

In order to calculate the predetermined overhead rate, all the direct costs will be ignored; be it direct cost labor or direct material. Hence, the total manufacturing overhead cost will be the variable overhead and the fixed overhead. That is:

=145,000 + 420,000 = 565,000

Using the labor hours as allocation base units, the predetermined overhead rate includes:

- Total Manufacturing Overhead = 565,000

- Direct labor hours = 8,500

Using the predetermined overhead rate formula:

= Total Manufacturing Overhead Cost / Direct labor hours

= 565,000 / 8,500

= 66.47 per direct labor hour

Hence, you can apply this predetermined overhead rate of 66.47 to the pricing of the new product X.

Example 4

Two companies, ABC company, and XYZ company are competing to get a massive order that will make them much recognized in the market. This project is going to be lucrative for both companies but after going over the terms and conditions of the bidding, it is stated that the bid would be based on the overhead rate. This means that since the project would involve more overheads, the company with the lower overhead rate shall be awarded the auction winner.

In this regard, the following overhead details are reported by both companies:

| Items | ABC Company | XYZ Company |

|---|---|---|

| Factory Manager Salary | 120,000 | 115,000 |

| Factory Rent | 35,000 | 38,500 |

| Electricity Bill | 45,009 | 51,340 |

| Utilities of Factory | 155,670 | 145,678 |

| Quality Assurance Department | 345,600 | 351,750 |

| Labour Hours per Unit | 2 hrs | 1.5 hrs |

| Number of Units Produced | 2,000 | 2,500 |

Based on the above information, we must calculate the predetermined overhead rate for both companies to determine which company has more chance of winning the auction.

Solution

Calculating predetermined overhead rate for ABC Company:

First, we have to calculate the total manufacturing overhead cost for ABC Company, which is

=120,000 + 35,000 + 45,009 +155,670 + 345,600 = 701,279

Then, the direct labor hours = 2,000 (Number of Units Produced) x 2 hrs (Labour Hours per Unit) = 4,000

- Total Manufacturing Overhead = 701,279

- Direct labor hours = 4,000

Using the formula for predetermined overhead rate:

= Total Manufacturing Overhead Cost / Direct labor hours

= 701,279/ 4,000

= 175.32

That is, the predetermined overhead cost for ABC Company is 175.32 per direct labor hour

Calculating predetermined overhead rate for XYZ Company:

First, we have to calculate the total manufacturing overhead cost for XYZ Company, which is

=115,000 + 38,500 + 51,340 + 145,678 + 351,750 = 702,268

While, direct labor hours = 2,500 (Number of Units Produced) x 1.5 hrs (Labour Hours per Unit) = 3,750

- Total Manufacturing Overhead = 702,268

- Direct labor hours = 3,750

Using the predetermined overhead rate equation:

= Total Manufacturing Overhead Cost / Direct labor hours

= 702,268 / 3,750

= 187.27

That is, the predetermined overhead cost for XYZ Company is 187.27 per direct labor hour

Conclusion: ABC Company has a predetermined overhead rate of 175.32 per direct labor hour while that of XYZ Company is 187.27 per direct labor hour. Judging from the POHR calculated for both companies, ABC Company is likely to be the winner of the auction because it has a lesser overhead rate. Despite the fact that XYZ Company has fewer labor hours and more units produced, it has a higher predetermined overhead rate than ABC Company and therefore, stands a lesser chance of winning.

Read also: How to scale your business

Advantages of predetermined overhead rate formula

- One of the advantages of predetermined overhead rate is that it helps with closing the books

- Using the predetermined overhead rate formula and calculation can provide businesses with a percentage they can use to monitor relative expenses

- It can be used in setting pricing

- The POHR formula helps in monitoring the overhead rate

There are some advantages of predetermined overhead rate such as:

Closing the books

One of the advantages of predetermined overhead rate is that businesses can use it to help with closing their books more quickly. This is because using this rate allows them to avoid compiling actual overhead costs as part of their closing process. Nonetheless, it is still essential for businesses to reconcile the difference between the actual overhead and the estimated overhead at the end of their fiscal year.

Monitoring relative expenses

Using the predetermined overhead rate formula and calculation provides businesses with a percentage they can monitor on a quarterly, monthly, or even weekly basis. Businesses monitor relative expenses by having an idea of the amount of base and expense that is being proportionate to each other. This can help to keep costs in check and to know when to cut back on spending in order to stay on budget.

Monitoring overhead rate

One of the advantages of predetermined overhead rate is that it can help businesses monitor overhead rate. A business can calculate its actual costs periodically and then compare that to the predetermined overhead rate in order to monitor expenses throughout the year or see how on-target their original estimate was. This comparison can be used to monitor or predict expenses for the next project (or fiscal year).

Setting pricing

The price a business charges its customers is usually negotiated or decided based on the cost of manufacturing. Calculating predetermined overhead rates can help estimate those costs. This means that once a business understands the overhead costs per labor hour or product, it can then set accurate pricing that allows it to make a profit. Hence, one of the major advantages of predetermined overhead rate formula is that it is useful in price setting.

See also: Types of Profitability Ratios and Formulas

Limitations of the POHR formula

- The predetermined overhead rate is not realistic

- Sales and production decisions based on this rate could be faulty

- Variance recognition problems

In as much as using the predetermined overhead rate formula can be helpful for making decisions, there are several concerns and limitations with using this rate that should be taken into consideration, such as:

The predetermined overhead rate is not realistic

The most prominent concern of this rate is that it is not realistic being that it is based on estimates. Since the numerator and denominator of the POHR formula are comprised of estimates, there is a possibility that the result will not be close to the actual overhead rate. The fact is production has not taken place and is completely based on previous accounting records or forecasts.

The use of previous accounting records to derive the amount of manufacturing overhead may not always be the best, because prices increase all the time, and customer expectations and industry trends are constantly changing. As a result, there is a high probability that the actual overheads incurred could turn out to be way different than the estimate.

Sales and production decisions based on this rate could be faulty

If the predetermined overhead rate calculated is nowhere close to being accurate, the decisions based on this rate will definitely be inaccurate, too. That is, if the predetermined overhead rate turns out to be inaccurate and the sales and production decisions are made based on this rate, then the decisions will be faulty. This can result in unexpected expenses being incurred and abnormal losses. When there is a big difference between the actual and estimated overheads, unexpected expenses will definitely be incurred. Also, profits will be affected when sales and production decisions are based on an inaccurate overhead rate.

Variance recognition problems

Variance recognition problems are one of the concerns associated with the predetermined overhead rate formula. The difference between the actual and predetermined amounts of overhead costs could be charged to expenses in the current period. This may create a significant change in the reported amount of inventory assets and profit.

Last Updated on November 2, 2023 by Nansel Nanzip BongdapObotu has 2+years of professional experience in the business and finance sector. Her expertise lies in marketing, economics, finance, biology, and literature. She enjoys writing in these fields to educate and share her wealth of knowledge and experience.