The profit margin ratio formula at different levels guides the calculation which in turn helps in assessing a firm’s profitability. This is to show how well a company is managing its finances as well as its ability to convert profit made from sales into income. In this article, we see what a profit margin connotes, its types, formulas, calculation, and interpretation.

Related: Profitability Indicators: Types and Importance

What is a profit margin?

Profit margin refers to the ratio of profit remaining after the payment of all expenses has taken place. It is shown as a percentage that shows how well a company is managing its overall finances. The profit margin ratio compares different levels of profit to sales and tells how the company is handling its overall finances.

Oftentimes, investors, analysts, and creditors make use of this metric to determine a company’s ability to convert profit made from sales into net income. Creditors are interested in these figures in order to ensure that a company is capable of making enough money to pay off its loans. Investors on the other hand are interested in the figure to ensure that a company can generate enough profits to pay dividends to shareholders.

This means that external organizations are looking for proof that the organization is running its business efficiently. In situations where a company’s profit margin is low, it is an indication that there is a need for the company to cut back its expenses by instituting a stricter budget.

The profit margin is one of the most commonly used profitability ratios to gauge the degree to which a company or a business activity makes money or generates income. It represents the percentage of sales that a firm has turned or converted into profits.

In order to understand the formula used in calculating profit margin ratios, it is important to note that they are of different types based on the different levels of profit as they are reflected on a company’s income statement.

Aside from the profit margin, there are other key profitability ratios that are used by analysts and investors to determine a company’s financial health and well-being such as the return on assets, earnings per share, and return on equity.

Types of profit margin ratios

- Gross profit margins

- Operating profit margins

- Net profit margins

The above-mentioned are the three levels of calculating a firm’s profit margin. Gross profit is the most basic profit margin level while net profit is the most comprehensive. These financial ratios are simple and as well as extremely common in corporate finance. These three levels, although different in their exact method, all share corresponding profit margins that are obtained by dividing the profit figure by the company’s revenue and then multiplying the result by 100. The three types of profit margin ratios are explained below.

Gross profit margin

The gross profit margin, stated above, is the most basic way of calculating a firm’s profitability because it defines profit as any income that is left over after accounting for the cost of goods sold (COGS) or variable costs.

The cost of goods sold is any expense that has a direct relationship with the manufacturing or production of a product such as the wages paid for the labor required to make or assemble goods and the raw materials used throughout the process. This figure does not take into account taxes, debt, fixed costs, overhead costs, and one-time expenses.

Similarly, variable costs are costs that are incurred throughout the process and can fluctuate with production rates or output. Companies that do not participate in production or manufacturing make use of the cost of revenue or the cost necessary to make a sale rather than using the variable cost or cost of goods sold or cost of sales.

The gross profit margin simply compares a firm’s gross profit to the total revenue, reflecting the percentage of each revenue that is retained as profit after making payment for the cost of production.

Operating profit margin

Calculating a firm’s operating profit margin is slightly more complex than that of gross profit margin because it accounts for daily business expenses such as sales, administrative, operating, and overhead costs. It also includes the depreciation of a company’s assets, however, excludes non-operational expenses such as debts and taxes.

The profitability ratio divides a company’s operating profit by its revenue, giving a clear picture of the percentage of the amount that is left over after the business has paid its operating expenses.

Net profit margin

The net profit margin is said to be the most complex and comprehensive profitability ratio. It shows the total revenue that is left after accounting for all income streams and expenses including the cost of sales and operational expenses.

Unlike the previous two profit margin ratios, the net profit margin takes into account income that comes from investments, one-time payments, taxes, and debt. With this, the calculation gives an accurate account of a company’s overall ability to convert its income into a profit. This is because the famous net income reflects the total revenue that is left over after accounting for all expenses (without any exclusion) and additional income streams.

Related: Net Income vs EBIT Differences and Similarities

Profit margin ratio formula

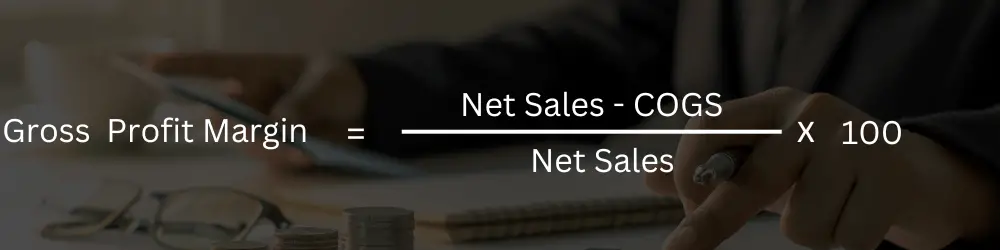

Gross profit margin formula

The gross profit margin ratio formula shows the relationship between a company’s gross profit and net sales or revenue. It is expressed mathematically as gross profit divided by net sales. Remember that the gross profit is calculated by subtracting the cost of goods sold from the net sales.

Gross profit margin ratio calculation

In order to calculate the gross profit margin, the following steps should be taken one after the other:

- Calculate the gross profit by subtracting direct materials, direct labor, and factory overhead from the net sales. In other words, subtract the cost of goods sold or the cost of sales from the revenue.

- Determine the net sales by subtracting the cost of sales allowance, returns, and sales discounts from the firm’s revenue.

- After calculating the gross profit and the net sales, one can now go ahead with the gross profit margin calculation using the formula (gross profit / net sales) x 100.

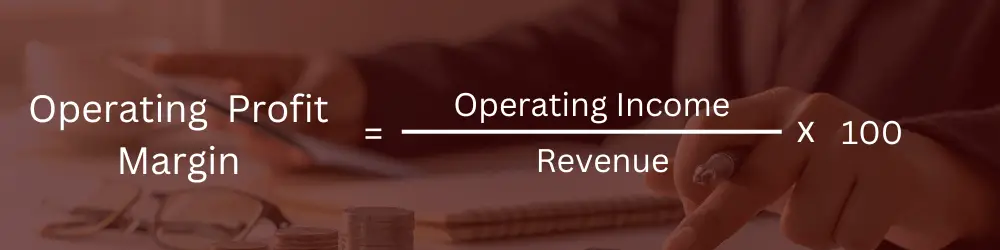

Operating profit margin formula

The operating profit margin formula shows the relationship between a firm’s operating profit and its revenue. It is expressed as operating income divided by revenue. Note that revenue is the same as net sales.

Operating profit margin ratio calculation

In calculating the operating profit margin:

- Calculate the cost of sales which is applicable regardless of industry. The elements involved in determining COGS can vary. It is calculated as cost of goods sold = beginning inventory + purchases – final inventory. Beginning inventory can also be called opening stock while final inventory can also be called closing stock. After this, determine the gross profit by subtracting the cost of goods sold from the net sales or revenue.

- Calculate the operating profit by subtracting operating expenses such as selling and administrative expenses from the gross profit.

- The operating profit can be determined at this point using the formula:

Operating profit margin = ((revenue + COGS – administrative and selling expenses) / revenue) x 100

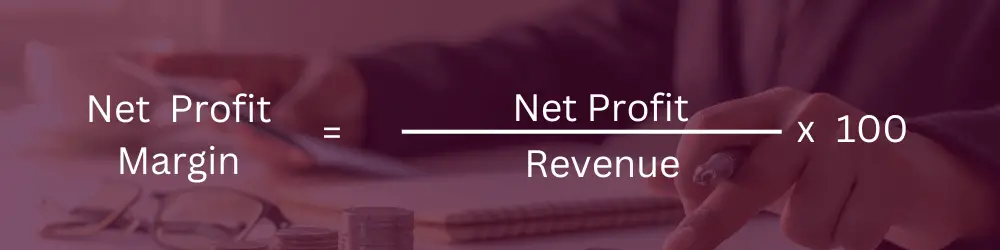

Net profit margin formula

The net profit margin ratio formula shows the relationship between a firm’s net profit and its net sales or revenue. It is expressed as net profit or net earnings divided by revenue. As earlier stated, the net profit margin is the most comprehensive metric that shows the actual profitability of a firm.

Net profit margin ratio calculation

The following steps are to be taken in order to determine a firm’s net profit margin:

- Calculate the net profit. This is done by subtracting all expenses such as depreciation, amortization, taxes, interest, etc, from the gross profit.

- At this point, the net profit margin can be determined using the formula:

Net profit margin = (net profit / revenue) x 100. Remember that net profit is the same as net income on the profit and loss statement.

Profit margin calculation example

Assuming based on the income statement of Emmy & Sons Co. for the fiscal year ended, 21st December 2020, the revenue recorded was $30.5 billion, the gross profit was $25.32 billion, the operating profit was $10 billion, and the net profit recorded for the year is $5.5 billion. Remember that these figures have been calculated on the company’s income statement and were extracted from there.

The three levels of Emmy & Sons Co’s profit margins will be as follows:

A) The gross profit margin will be calculated using the following formula:

Gross profit margin = (gross profit / net sales) x 100

Gross profit margin = ($25.32 billion / $30.50 billion) x 100 = 83.02%

B) The operating profit margin will be calculated using the following formula:

Operating profit margin = (Operating profit / Revenue) x 100

Operating profit margin = ($10.00 billion / $30.50 billion) x 100 = 32.79%

C) The net profit will be calculated using the formula:

Net profit margin = (Net profit / Revenue) x 100

Net profit margin = ($5.5 billion / $30.5 billion) x 100 = 18.03%

This example illustrates how important it is for a company to have strong gross and operating profit margins. Weakness at these levels is an indication that the company has lost money on basic operations, leaving little revenue for debt repayments and taxes. Therefore, healthy gross and operating profit margins in the example above enabled Emmy & Sons to maintain a decent profit while still meeting all of its other financial obligations.

Related: Gross Profit vs EBIT Differences and Similarities

Profit margin ratio interpretation

The profit margin ratio determines the percentage of a company’s sales that consists of income. It simply provides a measurement of the amount of profits that have been generated from a company’s sales. This metric is useful for determining how well an organization is managing its finances.

Companies seek higher profit margin ratios which indicate that their profits will exceed their expenses. They achieve these ratios by either lowering expenses or increasing revenues. Most times, generating more revenue would be a preferable solution although it is usually more difficult than reducing spending budgets (expenses). Most companies cut expenses in order to improve their profitability.

A lower profit margin on the other hand means that the company needs to cut back its expenses and employ a stricter budget. It also indicates that the company’s financial performance is low.

This figure can be used to compare the current and past performances of a company as well as to compare companies that are similar in size in the same industry.

Last Updated on November 4, 2023 by Nansel Nanzip Bongdap5+ years of professional experience in the business and finance sector with 1 year experience as a sales associate.

Writer, Editor, and economic activist.