There are many types of bills of exchange which will be further explained in this article.

What is bill of exchange?

A bill of exchange is an instrument of writing that contains an acknowledgment of an amount owed in consideration of goods received. In other words, it contains an unconditional order that the maker signs, directing a certain person to make a payment of a certain sum of money only to the order of a certain person or to the bearer of the instrument. A bill of exchange is a financial instrument in the money market.

A bill of exchange is defined as a written order that binds one party to pay a fixed amount of money to another party on demand or at some point in the future. It is used in international trade to enable importers and exporters to fulfill their transactions.

Importance and Significance

A bill of exchange is primarily used in international trade and it binds one party to pay a fixed amount of money to another party either on-demand or on a predetermined date. This instrument is similar to checks and promissory notes as either banks or individuals can draw them. They can generally be transferred by endorsements.

Bills of exchange are useful in international trade as they help buyers and sellers in dealing with risks that are associated with the fluctuations that take place in exchange rates as well as differences in legal jurisdictions.

One objective of the bill of exchange is to give the financier room to have a legal claim on both the buyer and seller. Another objective is to provide finance to the seller by transferring their debts to a bank. Also, a bill of exchange aims at granting credit for trade lawfully by making payments on prospective agreed dates.

Unlike a check, a bill of exchange is however a written document that outlines a debtor’s indebtedness to a creditor. The parties involved use it frequently in international trade to pay for goods and services. As earlier pointed out, a bill of exchange is not a contract in itself. However, the parties involved can use it to fulfill the terms of a contract. It can specify that payment is due on demand or at a future date that is being specified. For this document to be valid, the drawee has to accept it.

Discounting bills of exchange refers to the payment of the stated amount in the bill before the maturity date. The bank makes the payment after making a deduction of its charges from the bill.

Although a bill of exchange itself is not a contract, the parties involved can use it to specify the terms of transactions such as the credit terms and the rate of interest accrued.

There are three parties that are involved in a bill of exchange. These are the drawee (the party that pays the specified sum on the bill of exchange), the payee (the receiver of the sum of money), and the drawer ( the party that obliges the drawee to pay the payee). Usually, the drawer and the payee are the same entity unless the drawer transfers the bill of exchange to a payee that is a third party.

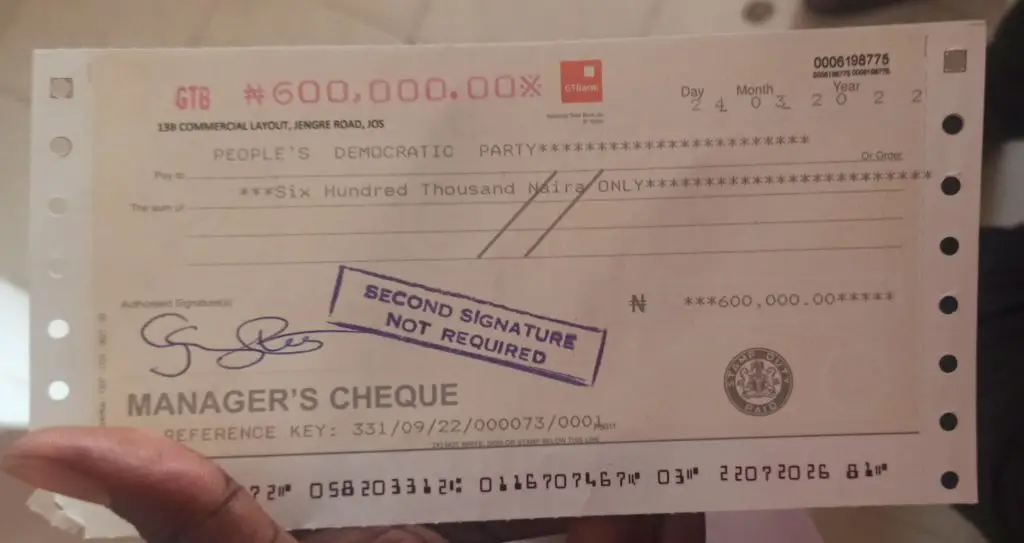

If a bank issues a bill of exchange, then we can refer to it as a bank draft. The issuing bank guarantees payment on the transaction. If individuals issue bills of exchange, we can refer to them as trade drafts. If the funds are to be paid either immediately or on-demand, then the bill of exchange is known as a sight draft.

In international trade, a sight draft gives an exporter room to hold title to the exported goods until the importer takes delivery and immediately pays for them. However, if the funds are to be paid for on a set future date, it is referred to as a time draft. A time draft gives the importer a short amount of time to make payment to the exporter for the goods after receiving them.

Generally, bills of exchange do not pay interests, making them in essence post-dated checks. If not paid by a certain date, they may accrue interest but in this case, the rate must be specified for payment. On the bill of exchange, there must be a clear detail of the amount of money, the date, and the parties involved.

Parties to a bill of exchange

- Drawer

- Drawee

- Payee

These are the three parties to a bill of exchange

Drawer

The drawer is the one who makes and signs the bill. A creditor who has an entitlement to receiving payment from the debtor can also draw an exchange bill.

Drawee

The drawee is the person upon whom the drawer draws the bill, he is the debtor who pays the money stated on the bill. We can refer to the drawee as the acceptor.

Payee

The payee is the person that receives the payment of the sum. This party may either be the drawer himself or a third party.

Features of a bill of exchange

Bills of exchange should possess the following features;

- It should be in written form.

- It has to contain a confirmed order to make a payment and not just the order.

- The order should have no condition.

- There should be a definite amount stated on the bill of exchange.

- It should contain a fixed date for the amount to be paid.

- Both the drawer and the drawee must sign the bill.

- The amount stated on the bill is meant to be paid on-demand or on the expiry of a fixed time.

- The amount of money stated on the bill is paid to the beneficiary, a specific person, or against a definite order.

Types of bills of exchange

- Demand bill

- Term/usance bill

- Trade bill

- Accommodation bill

- Inland bill

- Foreign bill

- Documentary bill

- Usance bill

- Clean bill

- Supply bill

- Fictitious bill

- Hundis bill

The above-mentioned are the different types of bills of exchange.

Demand bill of exchange

A demand bill does not have a fixed date of payment, it is payable at the time when the holder presents it. In other words, it is payable on demand. In this type of bill, days of grace are not allowed. In essence, it has to be cleared whenever the holder presents it. A demand bill can also be referred to as a sight bill.

Term/usance bill of exchange

A term bill is drawn for a specific period of time. It has either a fixed future date or determinable future time. It implies that the payment has to take place within a given time period and the due date.

Trade bill of exchange

A trade bill is specifically related only to trade. It is a bill that is drawn and accepted due to the purchase and sale of goods on credit. The creditor draws the bill and the debtor accepts it. These bills are common when it comes to international trade.

Accommodation bill of exchange

An accommodation bill is a bill that is sponsored, drawn, and accepted without any condition attached. In other words, it is accepted without the sale and purchase of goods. This bill is aimed at providing financial assistance to one or both parties. It does not exist as a result of any trading activity.

Inland bill of exchange

This is a bill that is payable in the same country and not in any other foreign country. In other words, both the drawer and the acceptor are in one country.

Foreign bill of exchange

A foreign bill is drawn in one country and then accepted and payable in another country. In other words, the drawer and the drawee do not live in the same country. Foreign bills are subdivided into export bills and import bills.

Documentary bill of exchange

Relevant documents that confirm how genuine the transaction between the buyer and seller is, support this type of bill. In other words, the bill is usually accompanied by supporting documents that will facilitate the trade between the parties involved. Documentary bills take two forms, that is, documents against acceptance bills and documents against payment bills.

Clean bill of exchange

A clean bill is a type of bill that does not have any proof of a document. Because of this, the interest is higher compared to other bills.

Supply bill of exchange

This is a bill that a supplier or contractor from the government department draws to supply certain goods. In order to obtain cash for any payments that are pending from any financial institution for satisfying the financial requirements, these bills are used.

Fictitious bill of exchange

A fictitious bill is a bill where either the name of the drawer or the drawee or both are imaginary. Although these bills are enforceable by law, they are not good bills. However, if a genuine party accepts the bill, it becomes a good bill as long as he is capable of showing that the first endorsement of the bill and the drawer’s signature are the same handwriting. Also, it is necessary for the acceptor to be liable for the bill’s payment.

Hundis bill of exchange

These bills are indigenous in nature and are used for agricultural financing and inland trade. They are common in India.

Uses of bills of exchange

- Legal evidence

- Specific amount and date

- Discount facility

- Negotiable

- Drawee enjoys a full credit period

- Change in relationship

- Easy remittance

Bills of exchange are significant as they have several advantages when we compare them to other methods of payment for the credit sale of goods. These advantages are explained below.

Legal evidence

As earlier pointed out, a bill of exchange is a legal document. It is therefore legal evidence of debt. With this, the drawer has the power to sue the drawee for the recovery of the amount of the bill.

Specific amount and date

It is both parties that sign a bill of exchange. Because of this, both parties have knowledge with regard to the amount of the bill as well as its due date.

Discounting facility

It is possible for the bill to be discounted if the drawer or holder is in need of funds before the due date. This is another advantage. One can sell the bill to the bank to receive the total amount in advance.

Negotiable

When a bill is negotiable, it means that it is transferrable. A bill that is payable to the bearer can be transferred from one person to another for debt settlement.

Drawee enjoys a full credit period

The drawee can pay the amount stated on the bill on the due date. This means that there is no compulsion to make payment prior to the due date. Because of this, the drawee enjoys a full credit period.

The drawee is bound to pay the amount of the bill on the due date. They cannot be compelled to make the payment earlier. Therefore, the drawee enjoys the full credit period.

Change in relationship

Before a bill of exchange, the seller is a creditor and the buyer is a debtor. The bill of exchange converts this relationship into “drawer” and “drawee”.

Easy remittance

A bill of exchange is a negotiable instrument, just like a postdated cheque. Therefore, it can easily be remitted from one place to another, just like a cheque.

Differences between bill of exchange and promissory note

The table below summarizes the differences between bill of exchange and promissory notes.

| Basis for comparison | Bill of exchange | Promissory note |

| Meaning | A written instrument containing an order from the creditor to the debtor to pay a stated amount of money to a person mentioned therein. | A written instrument containing an unconditional undertaking signed by the maker to pay a specified sum of money. |

| Number of parties | There are three parties involved, that is the drawer, the acceptor, and the payee. | Only two parties are involved, the maker and the payee. |

| Liability | The drawer’s liability is secondary and conditional. | The maker’s liability is primary and absolute. |

| Acceptance | Requires the drawee to accept it. | Requires no acceptance by the drawee. |

| Notice of dishonor | The notice must be given to everyone liable to pay in case of dishonor. | Notice of dishonor is not necessary. |

| Stamps | Except for bills payable on demand, stamping is necessary. | Stamping is necessary without any exceptions. |

5+ years of professional experience in the business and finance sector with 1 year experience as a sales associate.

Writer, Editor, and economic activist.