The current ratio formula and calculation is an example of liquidity ratios used to determine a company’s ability to pay off current debt obligations without raising external capital. The current ratio, quick ratio, and operating cash flow ratio are all types of liquidity ratios.

This article will discuss the current ratio formula, interpretation, and calculation with examples. But first of all, let’s look at the definition and how it is used.

What is the current ratio?

The current ratio is a liquidity ratio that evaluates the ability of a company to pay its short-term or current liabilities with its short-term or current assets. The current ratio is also known as the working capital ratio. This ratio gives investors and analysts insight into how a business can maximize the current assets on its balance sheet to satisfy its current debt and other payables.

Therefore, the current ratio measures a company’s short-term liquidity with respect to its available assets. Current ratios measure the ability of a company to pay its short-term or current liabilities (debts and payables) with its short-term or current assets, such as cash, inventory, and receivables. The ratio is an indication of a firm’s liquidity.

The current ratio in finance compares the company’s current assets to its current liabilities, thus, evaluating whether a company has enough resources to meet its short-term obligations. This ratio is called a current ratio because all current assets and liabilities are included in the current ratio equation. This is different from other liquidity ratios like the quick ratio and cash ratio.

The quick ratio, unlike the current ratio formula, only considers assets that can be converted to cash in a short period of time. So, it excludes inventory and prepaid expense assets in the calculation. While cash ratio as the name implies measures the ability of the company to settle its short-term liabilities using only cash and cash equivalents. Therefore, a simple on how to find current ratio in accounting is to divide the company’s current assets by its current liabilities.

Furthermore, the current ratios that are acceptable will vary from industry to industry. So, the ratio derived from the current ratio calculation is considered acceptable if it is in line with the industry average current ratio or slightly higher.

Conversely, a current ratio may indicate a higher risk of distress or default, if it is lower than the industry average. For investors, a very high current ratio may not be a good sign. This is because a company having a very high current ratio compared to its peer group may mean that the management might not be using the company’s assets or its short-term financing facilities efficiently.

If the current liabilities of a company are more than its current assets, the current ratio will be less than 1. It is interpreted that a current ratio of less than 1 may mean that the company likely has problems meeting its short-term obligations.

Nevertheless, some kinds of businesses function with a current ratio of less than 1. For instance, a company’s current ratio can comfortably remain less than 1, if inventory turns into cash much faster than the accounts payable become due. The sale of inventory will generate substantially more cash than its value on the balance sheet if it is sold for more than the cost of acquiring it. More so, low current ratios are also understandable for businesses that can collect cash from customers long before they need to pay their suppliers.

Interpretation

Interpreting current ratio as good or bad would depend on the industry average current ratio. The current ratio interpretation of a ratio greater than 1 shows that the current assets of the company are greater than its liabilities. This can be seen as a desirable situation for investors and creditors. Furthermore, the current ratio analysis that gives a ratio that is equal to 1 shows that the current assets of the company equate to its current liabilities, indicating that the company has current assets that are just enough to settle short-term obligations.

However, interpreting a current ratio of less than 1 shows that the company’s current assets are less than its current liabilities. This could be a problem as it indicates that the company does not have enough current assets to settle its short-term obligations.

Therefore, in several cases, a current ratio greater than 1 means that the company has the financial resources to remain solvent in the short term, whereas a company with a current ratio less than 1 may not have the capital on hand to pay off its short-term obligations. However, the current ratio analysis is usually not a complete representation of a company’s short-term liquidity or longer-term solvency.

Therefore, it is only when the ratio is placed in the context of what has been historically normal for the company and its peer group that it can be a useful metric of a company’s short-term solvency. Current ratios can also offer more insight when calculated repeatedly over several periods. This is because calculating the current ratio at just one point in time could show that the company can’t pay off all of its current debts, but it doesn’t necessarily mean that the company won’t be able to settle the debts when the payments are due.

Theoretically, we interpret current ratios as the higher the current ratio, the more the ability of the company to pay its obligations because it has a larger amount of short-term asset value compared to the value of its short-term liabilities.

Nevertheless, a company with a very high current ratio, say 3.0 compared to its peer group may not necessarily mean that the company can cover its current liabilities three times. It could mean that the management may not be using the company’s current assets or its short-term financing facilities efficiently. It could be an indication that the company’s working capital is not properly managed and is not securing financing very well.

Current ratio formula

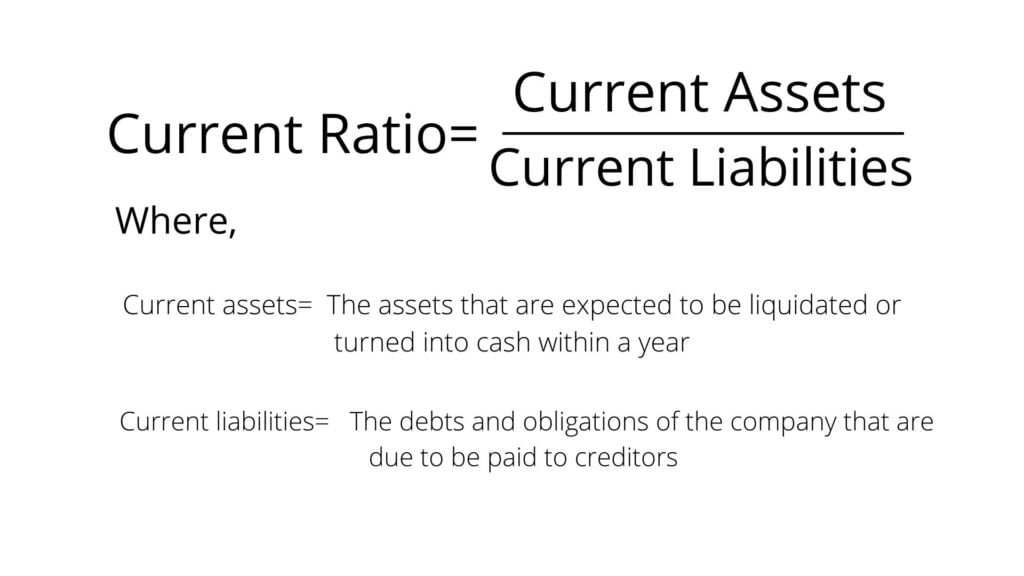

The formula for current ratio in accounting is expressed as:

Current ratio = Current Assets / Current Liabilities

The current assets and current liabilities are listed on the company’s balance sheet. These current assets include items such as accounts receivable, cash, inventory, and other current assets (OCA) that are expected to be liquidated or turned into cash within a year. The current liabilities, on the other hand, include wages, accounts payable, short-term debts, taxes payable, and the current portion of long-term debt.

Current ratio calculation

The current ratio calculation is done by comparing the current assets of the company to its current liabilities. How to find the current ratio is to divide the company’s current assets by the current liabilities of the company.

How do you calculate current ratio?

The calculation for current ratio is very straightforward. All it entails is simply dividing the company’s current assets by its current liabilities. The current assets of the company are on the balance sheet. They are those assets that can be converted into cash within one year such as cash, inventory, and accounts receivable.

Whereas, the current liabilities are obligations that the company is expected to settle within one year such as accounts payable, wages payable, and the current portion of any scheduled interest or principal payments.

Example 1: How to calculate current ratio from balance sheet

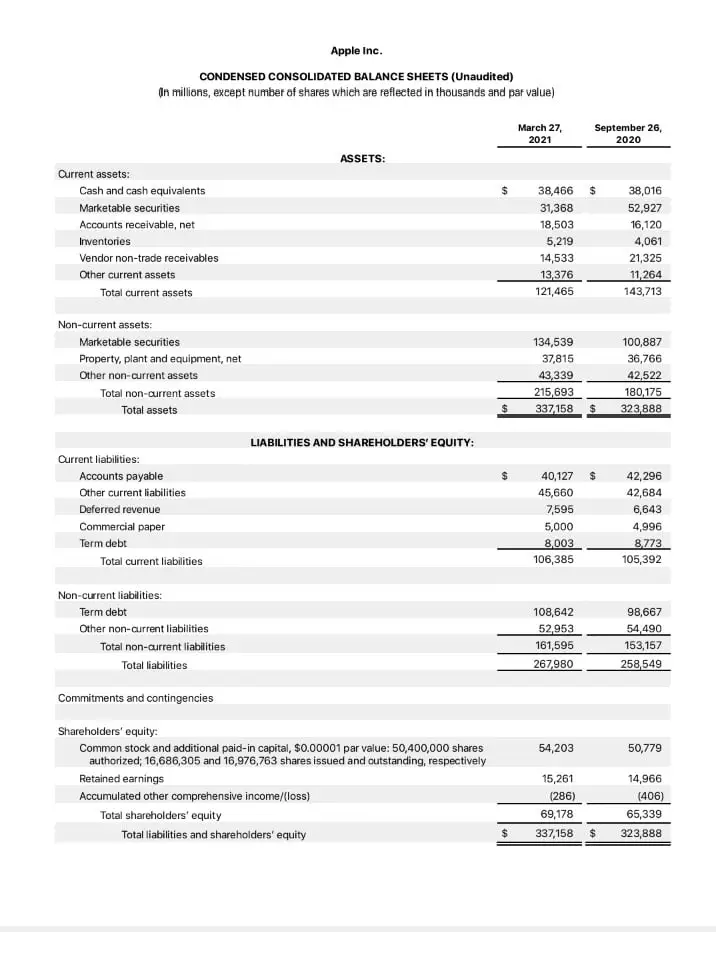

Here is an example of how to calculate current ratio from the balance sheet using the excerpt from the Apple balance sheet for the fiscal year of 2020 below:

From the excerpt of Apple, Inc. (AAPL) 2020 balance sheet, we can see that for the fiscal year (FY) ended September 26, 2020, Apple had total current assets of $143,713,000,000 and total current liabilities of $105,392,000,000.

Solution

How to compute current ratio in balance sheet

Using the current ratio formula:

Current ratio = Current Assets / Current Liabilities

Calculating current ratio will be:

Current ratio = $143,713,000,000 / $105,392,000,000 = 1.36

Current ratio interpretation example: Apple Inc. (AAPL) having a current ratio of 1.36 indicates that the company has more than enough to cover its current liabilities if these liabilities were all theoretically due immediately and all its current assets could be converted into cash.

How to calculate current ratio example 2

Company X and Company Y are two leading competitors operating in the consumer electronics manufacturing sector. Calculate the current ratio of Company X and Company Y based on the figures given as appeared on their balance sheets for the fiscal year ending in 2020.

| Balance sheet items | Company X | Company Y |

| CURRENT ASSETS: | ||

| Cash and cash equivalents | $30,000 | $50,000 |

| Inventories | $60,000 | $10,000 |

| Accounts receivable | $15,000 | $45,000 |

| Total current assets | $105,000 | $105,000 |

| CURRENT LIABILITIES: | ||

| Accounts payable | $75,000 | $20,000 |

| Short-term notes payable | $40,000 | $80,000 |

| Wages payable | $15,000 | $30,000 |

| Total current liabilities | $130,000 | $130,000 |

Solution

How to calculate the current ratio

Using the current ratio equation:

Current ratio = Current Assets / Current Liabilities

Calculating current ratio for Company X will be:

Current ratio = $105,000 / $130,000 = 0.807

Calculating current ratio for Company Y will be:

Current ratio = $105,000 / $130,000 = 0.807

Current ratio interpretation example: In the current ratio calculation done for Company X and Company Y, it is seen that the two companies both have a current ratio value of 0.807 which is less than 1, indicating that these companies may not have enough current assets to settle their short-term obligations. However, even though these two companies seem similar, Company Y is likely in a more liquid and solvent position based on the following observations from the balance sheet:

- Company X has much more inventory than Company Y, which may be harder to turn into cash in the short term. It is possible that this inventory is overstocked or unwanted, which eventually may reduce its value on the balance sheet.

- Company Y has more cash than Company X. Cash is the most liquid asset, and Company X even have more accounts receivable, which could be collected more quickly than liquidating inventory.

- In regard to assets, even though the total value of current assets is the same for both companies, Company Y is in a more liquid, solvent position.

Also, for the liabilities, even though the current liabilities of Company X and Y sums up the same value, they are still very different because Company X has more accounts payable, whereas Company Y has a greater amount in short-term notes payable.

More investigation may be needed because there is a probability that the accounts payable will have to be paid before the entire balance of the notes-payable account. More so, Company X has fewer wages payable, which is the liability most likely to be paid in the short term.

However, an investor can look deeper into the details of a current ratio comparison of these companies by evaluating other liquidity ratios that are more narrowly focused than the current ratio, such as the quick ratio.

How to find current ratio example 3

What will be the current ratio analysis of a tech firm with the following details in its balance sheet:

| CURRENT ASSETS: | |

| Cash and cash equivalents | $37,000,000 |

| Inventories | $30,000,000 |

| Marketable securities | $20,000,000 |

| Total current assets | $87,000,000 |

| CURRENT LIABILITIES: | |

| Accounts payable | $15,000,000 |

| Short-term debt | $25,000,000 |

| Total current liabilities | $40,000,000 |

Solution

How to calculate the current ratio of tech firm

Using the formula for current ratio:

Current ratio = Current Assets / Current Liabilities

Calculating the current ratio for the firm will be:

Current ratio = $87,000,000 / $40,000,000 = 2.175

Current ratio interpretation example: It means that this tech firm has a current ratio of 2.1 indicating that it can easily settle $1 of its debts or accounts payable twice. This suggests financial well-being for the firm.

How to increase current ratio

- Reconfigure debt

- Reduce the company’s expenses

- Enhance asset management

Reconfigure debt

How to increase current ratio is to repay or restructure debt. Companies can explore ways they can re-amortize existing term loans and change the interest charges from lenders. This can effectively delay debt payments and drop off the current ratio. Companies can also negotiate for longer payment cycles whenever they can. This can enable the company to shift short-term debt into a long-term loan, thus, reducing its impact on liquidity.

Reduce the company’s expenses

One of the ways to increase the current ratio is to reduce expenses. The budget of the company should be reviewed carefully to see where some line items can be reduced. Also, considering limiting personal draws on the business can help in achieving a better current ratio. If possible, the business can finance or delay capital purchases that need a significant outlay of cash. This is because when the business spends operating funds on major expenses, the current ratio will draw below 1.

Enhance asset management

Enhancing asset management in the company can help increase the current ratio of the company. For instance,

with a sweep account, the cash on hand of the company can earn interest while remaining available for operating expenses. These accounts sweep excess cash into an interest-bearing account and then return this excess cash to the operating account when it’s time to pay bills.

The company can also consider selling unused capital assets that don’t produce a return. This cash infusion would increase the short-term assets column, which, in turn, increases the current ratio of the company. There are some liabilities that do not bring funds into the business that can be converted to cash.

Furthermore, if outstanding accounts payable have reduced the liquidity of the company, the company can consider amplifying efforts to collect on these debts. After purchase, the company can issue invoices as quickly as possible, establishing clear payment terms at the outset such as late fees and interest on past-due balances. Companies can conduct a close review of the business’ accounts payable process and look for inefficiencies that delay payments and prevent prompt collections.

Limitations of the current ratio formula

The current ratio formula has its limitations. It is only useful when comparing two companies in the same industry because inter-industrial business operations differ substantially. Hence, comparing the current ratios of companies across different industries may not lead to productive insight. Therefore, the current ratio is not as helpful as the quick ratio in determining liquidity.

Another disadvantage of using the current ratio formula is its lack of specificity. This is because the ratio includes all the assets that may not be easily liquidated such as inventory and prepaid expenses. Moreso, the current ratio can be manipulated by management. For instance, an equal increase in current assets and liabilities will reduce the current ratio while an equal decrease in current assets and liabilities will increase the ratio.

Compared with the quick ratio

The current ratio and quick ratio are both types of liquidity ratios. However, there is a significant difference between the current vs quick ratio. When comparing the quick ratio vs current ratio, the quick ratio is more conservative than the current ratio formula.

The quick ratio evaluates the liquidity of a company and in the calculation, the inventory and other current assets that are more difficult to turn into cash are excluded. The ratio only considers the most liquid assets on the balance sheet of the company. The current ratio formula, on the other hand, considers all current assets including the inventory and prepaid expense assets. Theoretically, the current ratio formula is not as helpful as the quick ratio formula in determining liquidity.

FAQs

What does the current ratio inform you about a company?

The current ratio meaning in finance informs us whether a company has enough resources to meet its short-term obligations. This ratio is called a current ratio because all current assets and liabilities are included in the current ratio equation.

What is a good current ratio?

A bad or good current ratio usually depends on the industry average current ratio. The current ratio interpretation of a ratio greater than 1 shows that the current assets of the company are greater than its liabilities. This can be seen as a good situation for investors and creditors. Furthermore, the current ratio analysis that gives a ratio that is equal to 1 shows that the current assets of the company equate to its current liabilities, indicating that the company has current assets that are just enough to settle short-term obligations.

What is a good current ratio for a company?

What is considered a good current ratio for a company will depend on the company’s industry and historical performance. Generally, current ratios of 1 or greater would indicate ample liquidity.

Is a high current ratio good?

Theoretically, the higher the current ratio, the more the ability of the company to pay its obligations because it has a larger amount of short-term asset value compared to the value of its short-term liabilities.

Nevertheless, a company with a very high current ratio, say 3.0 compared to its peer group may not necessarily mean that the company can cover its current liabilities three times. It could mean that the management may not be using the company’s current assets or its short-term financing facilities efficiently. It could be an indication that the company’s working capital is not properly managed and is not securing financing very well.

How is the current ratio calculated?

The calculation for the current ratio is very straightforward. The current ratio is calculated by simply dividing the company’s current assets by its current liabilities. The current assets are on the balance sheet and are those assets that can be converted into cash within one year such as cash, inventory, and accounts receivable. Whereas, the current liabilities are obligations that the company is expected to settle within one year such as accounts payable, wages payable, and the current portion of any scheduled interest or principal payments.

Is a higher current ratio better?

A higher current ratio is a desirable and better situation for lenders. This is because the higher the current ratio, the more the ability of the company to pay its obligations because it has a larger amount of short-term asset value compared to the value of its short-term liabilities. However, for investors, a very high current ratio may not be a good sign. This is because a company having a very high current ratio compared to its peer group may mean that the management might not be using the company’s assets or its short-term financing facilities efficiently.

Is the current ratio a percentage?

The current ratio is a liquidity ratio used to determine a company’s ability to pay off current debt obligations without raising external capital.

Obotu has 2+years of professional experience in the business and finance sector. Her expertise lies in marketing, economics, finance, biology, and literature. She enjoys writing in these fields to educate and share her wealth of knowledge and experience.