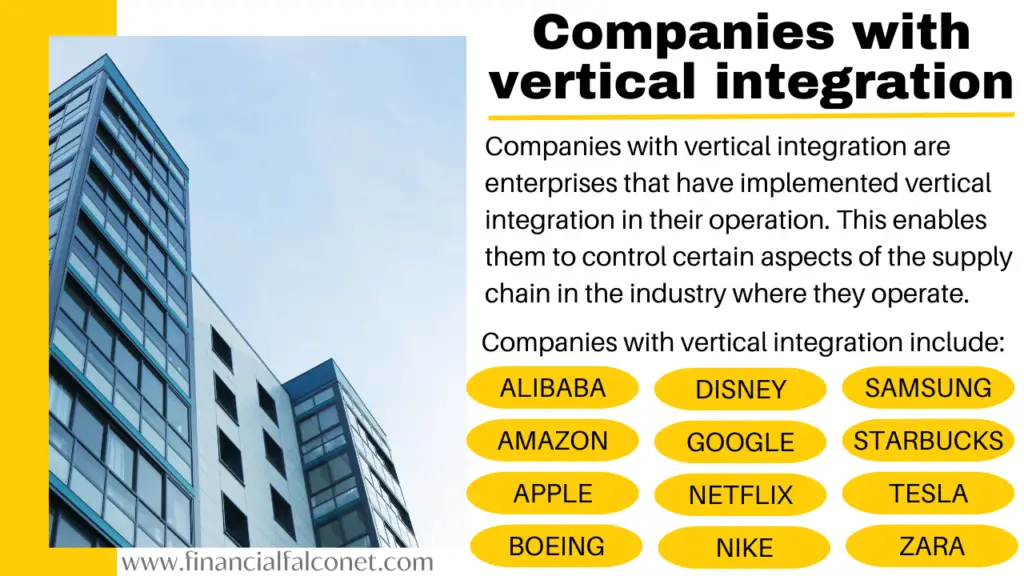

Vertical integration is a strategy used by companies or corporations in order to lessen the inconsistencies and inefficiencies along their supply chain. Examples of companies with vertical integration include Amazon, Tesla, Apple, etc. These companies have used both forward and backward vertical integration to improve their overall business efficiency. Here, we shall outline some examples of companies with vertical integration and also discuss the particular vertical integration strategies that these companies have adopted.

What is vertical integration?

Vertical integration entails strengthening a company’s efficiency and expanding its operation base through the acquisition of a related company, supplier, producer, vendor, or distributor. This means expanding into different aspects such as manufacturing, production, and supply chain steps. Companies with vertical integration can adopt a backward or forward vertical integration. Backward vertical integration entails expanding upstream in the supply chain while forward vertical integration entails expanding downstream in the supply chain.

For example, when a boutique decides to acquire a company that produces clothes as well as a fabric manufacturing company, the boutique has implemented a backward vertical integration. This is because the boutique operated at the end of the supply chain but has acquired businesses that operated at the beginning of the chain.

On the other hand, when a cereal producer acquires companies that distribute its products to retailers as well as some retail stores, the cereal company has implemented a forward vertical integration strategy; It is expanding its operations forward in the chain of supply.

See also: Horizontal Integration Examples of Companies

List of Companies with Vertical Integration

- Alibaba

- Amazon

- Apple

- Boeing

- Carnegie Steel Company

- Disney

- ExxonMobil

- McDonald

- Netflix

- Nike

- Samsung

- Tesla

- Volkswagen

- Zara

Alibaba’s vertical integration strategy

Alibaba is one of the companies with vertical integration that has leveraged this strategy to expand its e-commerce platform. The China-based company began in 1999 as a Business-to-Business (B2B) e-commerce site to link Chinese manufacturers with foreign companies abroad that needed their products. This company has four different online marketplaces that cater to a wide demography of consumers living in various countries and regions around the world.

Alibaba has since employed both backward and forward vertical integration to expand its business scope into fields that cater to Business-to-Consumer (B2C) and Customer-to-Customer (C2C) transactions. This has been made possible through the company’s establishment or acquisition of various companies in its chain of supply that operates payment platforms, supermarkets, delivery logistics, cloud computing, and search engines.

Alibaba’s vertical integration began in 2003 when the company established Taobao as a C2C online marketplace for the Chinese. Thereafter, Alipay which is an online payment platform was launched in 2004. This platform partners with global financial institutions such as MasterCard and Visa to aid easy payments for people who use the various Alibaba group of companies, its affiliates, and other businesses. Thus helping both manufacturers and consumers in carrying out transactions worldwide.

In 2005, the Alibaba group formed a partnership with Yahoo! Inc and acquired China Yahoo!. China Yahoo! is a Chinese portal that focuses on essential internet services including search, news, and email. By April 2008, it established Taobao Mall; a B2C to complement the online marketplace.

In a bid to further expand its online presence and attract more customers to the Taobao marketplace and mall, eTao was launched in October 2010. eTao is a shopping search engine that connects shoppers to various products from all the major Chinese online shopping platforms.

Alibaba Cloud computing is another aspect of the company’s vertical integration strategy. This cloud computing service was established in September 2009 to be a data-centric cloud computing service platform that can serve for high-speed massive e-commerce data processing, e-commerce data mining, and data customization.

By combining these various vertical integrations into its business, the Alibaba group has been able to establish itself as the biggest e-commerce platform in China. It is also considered one of the biggest e-commerce platforms worldwide alongside others such as Amazon and eBay.

Amazon’s vertical integration

Another company that is vertically integrated is Amazon, this company began in 1994 but became operational on July 16, 1995. It began as a digital store where buyers and sellers could meet and carry out transactions on book sales and purchases. The company itself did not produce any books, or own a publishing house, or logistics; instead, it partnered with other companies in those fields. Over time, the company began to vertically integrate its business in a bid to avoid delays and other inefficiencies from the companies it had partnered with.

The vertical integration of Amazon began when the company ventured into book publishing through the Amazon Kindle platform which allowed established publishers and other independent publishers to directly place their books for sale on the platform. It further expanded its scope beyond books into other consumer goods and began warehousing in 1997 as the company aggregated the goods which it sold on its platform. Amazon’s warehouses were first used in-house, but over time, the company offered the warehousing service to other companies.

Due to its use of robotics, its warehousing cost is significantly lesser than its competitors. Hence, small enterprises have taken advantage of the minimized cost of warehousing as well as picking and packing services to patronize the brand.

This company has also developed a cloud computing ecosystem; the Amazon Web Services (AWS). The computing technology used by this service is commonly used by companies to glean useful insights into consumer behavior. Thus, smaller e-commerce businesses have also leveraged this service by using its larger database and storage space to create their own applications.

Additionally, being an e-commerce brand that depended on electronically routed transactions, the company launched debit cards, Amazon Rechargeable in Mexico in 2018. This was done to aid its customers in Mexico in successfully completing transactions on the site. Amazon Rechargeable was facilitated to bridge the gap created by the lack of debit cards and the extremely low availability of credit cards for most individuals in Mexico.

These Amazon debit cards can be recharged at local stores, used to make purchases both online and offline, and even for cash withdrawals at ATMs. Hence, this aspect of its vertical integration has bypassed the need to depend on traditional banks or financial institutions that issue debit cards.

Furthermore, Amazon has vertically integrated into logistics and product delivery too. It has been working to improve its logistics by deploying technologies such as drone delivery to reduce the cost of its operations. It has also been experimenting with in-house deliveries, especially after the pandemic.

Amazon has also delved into the production of clothing through its numerous clothing lines including Cable Stitch, Lark & Ro., Amazon Essentials, and Mae. They are also into the production of electronic items such as Alexa, Fire tablets, and Kindle e-readers. It has acquired grocery stores through its acquisition of Whole Foods Market in 2017.

Over the years, Amazon has become a vertically integrated company that has successfully covered important aspects of its supply chain including the production of goods and services, online marketplace, physical stores, warehousing, logistics, and digital marketing. These have improved its business greatly, enhanced increasing consumer satisfaction, increased the company’s profitability, and aids it in gaining a competitive advantage over other e-commerce companies.

Apple’s vertical integration strategy

Apple is one of the companies with vertical integration. The company has successfully deployed vertical integration in its business model for over 35 years. Hence, establishing itself as an industry leader in the technology sector has further enabled it to use some distinct types of pricing strategies such as prestige and skimming pricing strategy. Apple’s vertical integration ranges from the development of software and hardware manufacturing to the provision of cloud services, and the operation of retail stores amongst others.

Apple’s acquisition of its power management circuits supplier, Dialog Semiconductor is an example of one of the ways Apple has implemented vertical integration. The acquisition of this company enabled Apple to produce its own chips which were used in extending the battery life of iPads and iPhones. It has also enabled the company to produce more efficient power management chips that are tailored to suit its diverse array of products including the Apple Watch and AirPods.

Although some of the components required for the manufacturing of iPhones and their assembling are still outsourced to firms in Europe, North America, and Asia; Apple has distinguished itself due to the unique products they offer, high demand, and the extensive patents they own.

Furthermore, as a company that has implemented vertical integration, Apple is better able to control the production of the various components that make up its products. This has led to a significant decrease in its overhead costs which has enabled the company to stay ahead of similar companies and set it apart in the competitive market.

By owning its operating system and cloud services, Apple ensures that the highest quality standards are met and that its products are better secured through the provision of cloud and password storage, sync, authentication, payment, messaging, and communications.

The company has also vertically integrated into the area of product distribution and retail through the establishment of physical stores across the globe. These physical stores have contributed about 40% of the revenue generated from the sales of products according to Statista.

The vertical integration of Apple has enabled it to fully participate in the designing and development of hardware and software, product distribution, services, and customer experience. These give the company more control in creating products that are in line with the company’s vision, meet its quality standards, ensures consumer satisfaction, and aid its profitability.

Boeing’s vertical integration

Another company with vertical integration is Boeing which is the number one exporter in the United States. The company has pursued vertical integration in areas that include specialty manufacturing, flight controls, engine components, auxiliary power units, engine components, and avionics. Its major aim in pursuing vertical integration is to avoid cost overruns and delays in its supply chain that had disturbed its production of the Boeing 787.

It also aims to have greater control of intellectual property, improve product quality, gain more competitive advantage in the aviation industry, and achieve a higher level of profitability by getting more involved in various aspects of the supply chain processes.

One of Boeing’s steps toward vertical integration is its joint venture with Adient aimed at developing and manufacturing seats for commercial aircraft. This joint venture was spurred by capacity constraints and delays in seat production from its suppliers. Its collaboration with Safran to make auxiliary power units is another vertical integration move.

These vertical integration strategies have been spurred by Boeing’s plan to develop internal capabilities and depth in essential areas in order to offer better products, expand services, and ensure higher life cycle value through vertical integration. It has also ventured into the production of actuators, makes a large portion of the 777X advanced wings, and the 737 Max nacelles. Boeing has also partnered with Embraer and COMAC for different projects.

Additional reasons why Boeing has adopted the vertical integration strategy are due to its focus on cost reduction and drive towards diversification in the bid to reduce its overall risks and increase its sources of revenue. Boeing has focused on expanding its market share by consistently improving its products, hence, it invests significantly in research and development of better designs and innovative aircraft models. Its continuous efforts to get contracts from governments and major airlines so as to increase its sales in the existing markets around the globe.

All the vertical integration efforts of Boeing are geared towards having a shorter development cycle and gaining better control of its parts manufacturing thereby leading to quicker and more efficient production of planes. It has also enabled them to offer customization options to its customers and focus on sustainability through reduced emissions and promoting fuel efficiency in its planes.

Carnegie steel company’s vertical integration

The Carnegie steel company was one of the factories that emerged during the industrial revolution. It was formed in 1892 as a conglomeration of all the steel companies that Andrew Carnegie owned. It also comprised his coke works and bridge companies. Carnegie Steel was one of the companies with vertical integration during the industrial revolution. The company implemented the vertical integration strategy as means of having a high quantity supply of steel at a comparatively cheaper price; this was achieved by buying out most of its suppliers.

The production of steel required a large supply of coal, iron ore, and lime. Iron was the main component of steel, factory workers needed a large amount of coal to heat the furnaces used in the Bessemer process. Hence owning coal mines with on-site blast furnaces for coke production, and a significant number of natural gas wells were vital in the vertical integration strategy of Carnegie Steel. These hastened their steel production processes.

Furthermore, Carnegie Steel constantly incorporated the latest technological innovations in their manufacturing process through the creation of advanced machines and the adoption of processes that made steel production cheaper and faster such as the Bessemer process. The company further located its steel mills close to these coal mines to reduce transportation expenses and the time taken on logistics.

Additionally, the steel mills had easy access to both shipping and railroad networks, carnegie even purchased some of the railroads which enabled him to pay less when transporting his steel to other parts of the country. These vertical integration strategies enabled the company to become the dominant supplier of steel in the United States during its existence.

By using vertical integration in steel production, Carnegie Steel was able to take control of all the processes along its value chain including owning the sources of raw material (coal, iron ore, and lime), owning the steel mills, the transportation networks and directly selling to the end users. These ensured that the company could sell steel at a cheaper rate when compared to other steel producers thereby enabling them to become an industry leader. It should be noted that despite the lower price of their steel, the company was still very profitable because it controlled all the steps along its value chain.

Disney’s vertical integration

The Walt Disney Company which is commonly referred to as Disney is one of the companies with vertical integration. It was established in 1923 as the Disney Brothers Studios and was an industry leader in the production of animations with its widely popular character Mickey Mouse. Disney’s vertical integration has been quite diverse and varied, hence it is arguably one of the companies with the largest vertical integration. This can be traced back to its expansion into the production of live-action films, theme parks, and television in the 1950s.

Disney owns several divisions that cater to different aspects of its vertical integration strategy. The Walt Disney Studios cater to the creation and production of films and television content which are broadcasted via traditional television through the ABC broadcast network and through its several cable television networks including Disney Channel, FX, ESPN, National Geographic, and Freeform.

Before the proliferation of streaming services, the company vertically integrated by manufacturing its home videos through the Buena Vista Home Video. It further implemented forward vertical integration by acquiring several retail stores where the home videos as well as other Disney merchandise such as games, bags, and toys. These can be directly purchased by customers. Through these retail stores, Disney makes additional profit outside of its major enterprise of film and TV productions thereby enhancing its overall profitability.

With the advancement of subscription video-on-demand (SVoD), Disney has also vertically integrated by providing its consumers with several streaming channels which include Hotstart, Disney+, ESPN+, Star+, and Hulu. Through these channels, various Disney creations can be easily accessed directly by the consumer. By Disney’s effective utilization of vertical integration, the company has been able to grow beyond creating and producing its own animations.

Disney has expanded its animation productions with its acquisition of Pixar, delved into movie productions with the acquisition of Hollywood movie studios, and gone to television by acquiring media companies and television channels. All these have added to Disney’s already robust business and culminated with the creation of its different streaming platforms.

Furthermore, the company’s acquisition of other profitable entertainment companies such as 21st Century Fox, Star Wars, and Marvel Studios, have created additional intellectual property and merchandise bases that drive its streaming platforms, cinema releases, retail stores, theme parks, cruise lines, and resort hotels.

The vertical integration of ExxonMobil

Companies that are in the business of oil and gas are arguably one of the largest companies with vertical integration. The fossil fuel industry is a case in point of how vertical integration is deployed by companies to derive the most benefits. ExxonMobil, being one of the companies with vertical integration has a significant presence both downstream and upstream in the oil and gas industry due to its implementation of backward and forward vertical integration strategies. The company was formed through a merger between Exxon and Mobil in 1999.

ExxonMobil is divided into the upstream, downstream, and chemical divisions. The company is globally recognized with its upstream divisions operating in Asia, North America, Europe, and South America. Its downstream units refine, market, and distribute various petroleum products while its upstream units explore, develop, and produce crude oil. ExxonMobil has a huge exploration division whose work is centered on finding and securing new sources of crude oil across the globe be it on land or at sea.

The upstream activity of development entails designing and building oil rigs and other major capital projects that will facilitate the extraction of oil and gas. Production comprises the operation and management of the oil and gas extraction. It further has a chemical division that is into the manufacturing of chemical products.

An example of how ExxonMobil deploys vertical integration in its business is by operating in all parts of the oil and gas industries thereby aiding the company to mitigate the hold-up problem. The hold-up problem is a situation where two parties such as a manufacturer and a supplier refrain from working together so that one party does not gain bargaining power over the other; even though working together may enable both parties to work more efficiently. With vertical integration, all the different players in the oil supply chain are able to work together to achieve the common goal of making more oil and gas available.

Vertical integration has further aided ExxonMobil in reducing its dependence on third parties which enables it to respond more effectively to changes in the business environment. This aids the company in maintaining tight control over the various steps in the value chain. Due to the fact that the company has vertically integrated into the distribution of refined petroleum products, it gets directly involved in the marketing and sales of gasoline, diesel, jet fuel, chemicals, and lubricants. This is done through its retail outlets comprising Esso, Mobil, and Exxon.

ExxonMobil also has a logistics system to provide cost-effective transportation; SeaRiver Maritime is an example of one of its subsidiaries that deals with oil shipment.

Being the world’s largest publicly traded international oil and gas company, and one that is highly vertically integrated, ExxonMobil is less dependent on fluctuations in crude oil supply. The company benefits from economies of scale and has more control over the prices of its refined petroleum products.

The company is also able to create value throughout the value chain by turning undiscovered resources into valuable commodities used globally from fuel for transportation to plastics for water bottles.

Google as an example of companies with vertical integration

Google, now known as Alphabet was founded in 1998 as a search engine company. However, due to its being one of the companies with vertical integration, it has since expanded into a diverse range of products and services. One way Google vertically integrated was through its acquisition of Motorola Mobility in 2012 which gave it access to Motorola’s patents and hardware expertise. This enabled Google to develop its own smartphones and tablets under the Nexus and later Pixel brands.

In the area of search, online advertising, and related services, Google has integrated vertically to a large extent. However, its vertical integration in this aspect is largely through the creation of diverse steps along the value chain rather than acquisitions. It has developed an operating system for both laptops and mobile phones which are ChromeOS and Android respectively. The company has a web browser, Chrome, that can be used in searches.

In addition to its search engine, Alphabet offers products and services such as Google Maps, Google Drive, YouTube, Google Ads, Google Cloud, Android operating system, and more. These diverse offerings have allowed Google to reach a broad consumer and business base and generate revenue from various sources.

For example, when an individual uses the Chrome web browser, they will have their network connection traveling through the company’s gigabit end-user fiber and transit to its data center over Google infrastructure. This data center is owned and operated by Google, with its servers using Google proprietary software to crawl and index the web as well as store the index and snippets. When the search query is satisfied, advertising is selected from the company’s search advertising system, and assembled along with search results.

The results then transit back to the source. All these happen in a few seconds and show how Google is able to provide adequate search results to its users due to its effective vertical integration of the web search processes.

With the speed at which Artificial intelligence is being developed and deployed, Google is also effectively leveraging the large amounts of data available to it through its search engine to not only curate and present relevant ads to its users but to also improve its AI.

It has further deployed this by facilitating numerous collaborations with other companies in the development of its own line of hardware products, including smartphones, smart speakers, and laptops. All these moves towards vertically integrating Google have aided the company in maintaining its flexibility while improving the services it offers users courtesy of the large amounts of data it is able to gather from users daily.

In a nutshell, due to its utilization of vertical integration, Google has been able to build its own server computers, design some of its components, develop its own operating systems, build and operate its data centers, and own the fiber-optic cabling through which its data travels. The company has also coded and delivered an array of applications, sells and delivers ads over different media, operates its own checkout and payments service, and writes much of its internal operating software.

McDonald’s vertical integration

McDonald’s is one of the companies that has used vertical integration in its business. This renowned fast-food chain began as a restaurant in 1940 and has adopted vertical integration since the early 1990s. Typically, restaurants are the final part of the food processing industry where consumers can buy meals.

These restaurants are usually dependent on third-party suppliers for the various ingredients used in cooking the foods they sell. In the case of Mcdonald’s, its use of vertical integration has enabled it to form beneficial partnerships and even acquire some aspects along its value chain.

By owning more steps in its supply chain, McDonald’s has more control over its product quality and cost. It grows the potatoes that are used to make french fries, owns livestock farms, processes its meat used in making beef patties, and transports its own materials.

In addition, the company also owns most of the land on which its outlets are built. This eliminates the additional expenses of leasing or renting property. By owning parts of its supply chain through vertical integration, the company is able to function more efficiently without undue stress or unpredictable changes in prices of various food ingredients which may negatively affect its profitability.

Since McDonald’s has taken control of the component and distribution element in its value chain, it has been able to achieve an overall lower cost for its restaurants; this is among the top reasons why it offers one of the cheapest fast food in the world. Vertical integration is therefore beneficial to the fast-food chain aiding it to reduce waste, and inefficiencies arising from the supply chain, increase its profitability, and better serve its customers.

Netflix as an example of a company with vertical integration

Netflix began in 1997 as a DVD rental company with customers paying to rent movies from the company. Netflix changed its business model in 1999 such that its customers could have access to rent unlimited movies provided they paid between $7.99-$19.95 as a monthly subscription fee.

The number of DVDs a customer could rent per time depended on the particular subscription plan the customer was on. By 2008, they digitalized their business to become an Over-the-Top (OTT) service provider; they have maintained this model albeit with some changes here and there as they have grown to become one of the companies with vertical integration.

Companies that provide OTT services are internet-delivered television content distributors, they are also referred to as subscription video-on-demand (SVoD) or video streaming services. Netflix enabled individuals to stream licensed movies from their site for a fee. It began expanding to Canada in 2010 and has since expanded to several countries in the world except China, Crimea, North Korea, and Syria.

By 2012 Netflix vertically integrated by producing or co-producing their own exclusive content known as Netflix originals. Through the production of its own movies, the company no longer depends 100% on movie producers or studios to broker deals that will enable them to stream such movies on its platform. Instead, they have mitigated the time required to gain approval by making their own movies and streaming them without delay.

In addition, they have integrated vertically by owning their own studios too. This means Netflix has completely departed from its initial business model of aggregating licensed content to creating its own content and content production.

Netflix’s vertical integration beyond providing streaming services into movie production and even owning studios means that they have better control of both the production and distribution steps in the entertainment business. It also means they have considerably reduced expenditure while increasing revenue. Hence, vertical integration has been beneficial to Netflix as it has differentiated it from other video streaming service providers.

Nike vertical integration

Nike Inc. is an American multinational corporation that began in 1964 as Blue Ribbon Sports (BRS). It was a distributor for the Japanese shoe maker Onitsuka Tiger. By 1971, stopped distributing shoes for Onitsuka Tiger, instead, it prepared to launch its own line of footwear, which was rebranded as Nike.

When the company began, it was completely vertically integrated, having full control of its footwear manufacturing, distribution, and sales in the United States. Having full control over the production and distribution of its footwear aided the company in developing and creating distinct designs and evading failures, disappointments, and uncertainties that were generally associated with depending on suppliers.

Over the years, as the company has expanded beyond footwear into the production of accessories, apparel, equipment, and services, it has focused more on forward vertical integration. With its expansion, Nike is no longer directly involved in sourcing its raw materials, instead, they outsourced to foreign suppliers who could source and manufacture based on their specifications. This was done in order to reduce overhead costs and achieve more profitability through the availability of cheaper labor and readily available raw materials in the countries where their suppliers reside.

Currently, Nike focuses more on its designs and marketing, and hence, the brand has implemented forward integration by having its own retail stores scattered all over the globe. This ensures Nike offers a better customer experience to its consumers and also affords them a chance to gain a better understanding of consumer expectations and how best o meet them.

Related: Nike’s Supply Chain Issues and Management

Samsung and its vertical integration

The Samsung Group is a South Korea-based conglomerate that was started in 1938 as a grocery trading company. It has since diversified to include several subsidiaries in the electronics, advertising, construction, insurance, defense, entertainment, textile, and heavy industries thereby becoming one of the largest businesses in Korea. The company produces nearly one-fifth of South Korea’s total exports.

The Samsung group has implemented both forward and backward vertical integration as part of its business strategy. Samsung has since established itself as an industry leader in the consumer electronics industry through the vertical integration of this division of the company. It is the world’s top manufacturer of TVs and the top supplier of display panels and semiconductors.

In the 1960s when Samsung entered the electronics industry, it fostered a Samsung-Sanyo partnership paving the way for the production of its first black and white TVs. By the late 1970s, the company established Samsung Electronics America, within this period, Samsung produced refrigerators, microwaves, color TVs, air conditioners, electric desk calculators, and other consumer products.

Vertical integration has aided Samsung’s television manufacturing business, enabling it to become a world leader in chip and semiconductor production. It is also actively involved in the manufacture of various components, such as LCD and AMOLED displays, smart TVs, OLED displays, and antennas. These enhance the quality of the television the company produces.

The company further ventured into the telecommunications hardware industry in 1980 when it purchased Anguk Jeonja Tongsin. At first, it built telephone switchboards, gradually expanding into the production of telephone and fax systems, which eventually shifted to mobile phone manufacturing.

When it comes to mobile phone manufacturing, Samsung has distinguished itself as one of the few manufacturers that designs and manufactures several individual parts of its phones. The company creates the 3 main components of the Solid State Drive (SSD) which comprise the NAND flash memory, controller, and firmware. This means Samsung does not use off-the-shelf firmware like other mobile phone manufacturers. Instead, it designs its own unique performance profile and executes more robust reliability and bug testing which ensures the superior quality of its firmware.

Samsung’s manufacturing of the pre-installed SSD has also positioned it as a supplier to several mobile phone companies. The company’s presence in different parts of the world including the united kingdom, Tokyo, and the United States is another vertical integration strategy that has further aided the availability of its electronic products to diverse consumers. It also controls a large aspect of its product distribution and contributes to the customer experience through its retail stores where customers can make a direct purchase.

Tesla’s vertical integration strategy

Tesla is one of the companies with vertical integration. The company’s insistence on vertically integrating its business was a drawback in the initial phase; as it made the company struggle to reach its estimated production volume and become profitable.

Before Tesla got on the scene, automotive companies generally relied on various supplies for the various parts and components that made up the vehicles they produce. They essentially functioned more or less as assembling companies. Tesla broke the status quo by insisting on vertical integration and in the long run, this has proved beneficial.

One of the steps Tesla has vertically integrated is the production of batteries. The company partnered with Panasonic to build its first gigafactory to ensure it has a steady supply of batteries as needed. To further ensure this steady supply, the company has signed a contract with a nickel mining company, Goro, which is located in New Caledonia. Nickel is an important component in the production of batteries.

Tesla also develops its own software which has enabled them to have propriety self-driving software for its cars. This software is constantly improved by the company due to the data they collect from their beta testers.

Tesla has integrated vertically by being an active participant in the sales and distribution of its vehicles. Consumers can make a direct purchase of the car from the company’s stores or its website.

They have also created a chain of Superchargers where car owners can recharge their cars. Tesla also plans to vertically integrate the mining and refining of lithium in its strategy. Lithium is an important component in the manufacturing of car parts, thus, if the company owns the mining and refining process, it will further reduce the cost of sourcing lithium and increase its availability.

Based on Tesla’s vertical integration, it produces its batteries, self-driving software, and electric powertrain amongst other aspects of the supply chain that it is still trying to expand into. These factors give Tesla a competitive advantage over its competitors. It has been able to scale its business rapidly by employing both backward and forward vertical integration while other automotive companies still grapple with the challenges of suppliers.

Volkswagen’s vertical integration

Volkswagen is another company with vertical integration, the company began in 1937 and has implemented both forward and backward vertical integration in its operations.

One such move is its signing of a memorandum for cobalt and nickel supplies through a three-way joint venture between the company, Huayou Cobalt and Tsingshan Group for the extraction of these raw materials from Indonesia.

It also signed another memorandum for refining sulfates from nickel and cobalt that are needed for battery cathode production. These two memorandums are geared towards Volkswagen’s attempt at producing electric cars.

Furthermore, by employing this multiple-sourcing strategy, Volkswagen aims to safeguard its future supply of nickel and cobalt to avoid any potential problems that may arise when newer and more advanced technologies are created mining of these materials. Volkswagen has also entered into other partnerships with companies that are into the production of key car components like steering, engines, transmissions, axle, and suspension production. It has partnerships with ArwinMeritor, which assembles the complete interior of the Golf.

By using vertical integration in its business model, Volkswagen can exercise control over the quality, cost, and timeliness of the components used in its vehicles. Its expansion into the distribution of its cars through owning retail stores is another vertical integration move that is highly beneficial.

Through its numerous dealerships worldwide, the company can have direct contact with customers and maintain control over the sales process. This allows the company to better understand customer preferences, respond to market demands, and enhance customer satisfaction.

Zara’s vertical integration

Zara is a Spanish multi-national retail clothing chain that began as a clothing store in 1975. At that time, the store sold low-priced lookalike products of popular, higher-end clothing brands. Currently, it sells beauty products, clothing, shoes, accessories, and perfumes and also specializes in fast fashion.

Zara has thrived in the clothing business by effectively utilizing vertical integration to keep its supply chain running smoothly. It has acquired several businesses at different stages of the chain which enables it to maintain better control of the value chain, hence, being able to react quickly to shifting consumer demands.

Through vertical integration, Zara controls a large chunk of the process from design to production, display, sales, and shipping. Thus, the company is able to lower its cost of production, reduce risk, mitigate delays associated with having suppliers, provide greater transparency to customers, and lower the cost of distribution. Furthermore, the company can better control the various processes which ensure the greater quality of its products.

While other clothing companies that are not vertically integrated are highly dependent on suppliers, designers, and manufacturers, Zara’s vertical integration enables it to rely minimally on outsourcing while allowing it to gather valuable data at every stage of the supply chain. The accumulated data is very useful as it can be analyzed to identify inefficiencies, pinpoint areas of success, and create accurate forecasting for future productions.

See also: Telstra’s Vertical Integration Strategy and Examples

List of additional companies with vertical integration

- AT&T

- Birdseye

- Coca-Cola

- CVS-Aetna

- EssilorLuxottica

- Ferrero

- Ford Motor Company

- H&M

- Hermes

- Honda

- Ikea

- Mercedes

- Microsoft

- Nestle

- Prada

- Shell

- Starbucks

- Sycamore Partners

- Toyota

- Walmart

See also: Chain of Command in Business Management

Conclusion

The companies with vertical integration include Amazon, Nike, Tesla, Samsung, and Netflix amongst the others that we have discussed here. Each of these companies has employed vertical integration in their business strategies which have enabled them to stand out in their various industries. Some of the benefits of implementing a vertical integration strategy are better control over the supply chain, increased product quality, optimization of delivery time, and the improvement of customer satisfaction.

Related:

Last Updated on November 2, 2023 by Nansel Nanzip BongdapBlessing's experience lies in business, finance, literature, and marketing. She enjoys writing or editing in these fields, reflecting her experiences and expertise in all the content that she writes.