The price to earnings ratio formula is a metric that is useful in stock valuation and also business valuation of a company. It measures a company’s current share price relative to its earnings per share (EPS). It is the most widely used financial ratio for determining whether shares are “correctly” valued in relation to one another, however, it does not indicate whether the share is a bargain.

The price to earnings ratio is a type of market prospect ratio. The P/E of a listed company’s share is the result of the collective perception of the market as to how risky the company is and what its earnings growth prospects are in relation to that of other companies. A company with a low P/E ratio indicates that the market perceives it as higher risk or lower growth or both as compared to a company with a higher P/E ratio.

Generally, investors use the P/E ratio to compare their own perception of the risk and growth of a company against the market’s collective perception of the risk and growth as reflected in the current price to earnings ratio.

If a company does not grow and its current level of earnings remains constant, its p/e ratio can be interpreted as the number of years it will take to pay back the amount paid for each share.

What is price-to-earnings ratio (p/e ratio)?

The price-to-earnings (P/E ratio) is a company’s stock price divided by its earnings per share for a designated period like the past 12 months. It tells investors how much a company is worth and how much they will pay per share for $1 of earnings.

Earnings are important when valuing a company’s stock because investors want to know how profitable a company is and how profitable it will be in the future.

In addition to showing whether a company’s stock price is overvalued or undervalued, it helps investors determine the market value of a stock as compared to the company’s earnings. The price to earnings ratio can reveal how a stock’s valuation compares to its industry group or a benchmark like the S&P 500 index.

The PE ratio shows what the market is willing to pay today for a stock based on its past or future earnings. A higher P/E ratio shows that investors are willing to pay a higher share price today because of growth expectations in the future. The average price earnings for the S&P 500 have historically ranged from 13 to 15.

A high P/E could mean that a stock’s price is high relative to earnings and possibly overvalued while a low P/E might indicate that the current stock price is low relative to earnings. However, companies that grow faster than average such as technology companies typically have a higher price to earnings ratio.

The price to earnings ratio is sometimes referred to as the price multiple or the earnings multiple.

Price to earnings ratio formula

The price/earnings ratio formula simply divides the current stock price (P) by the earnings per share (EPS).

Price/earnings ratio (PER) = Stock price per share ÷ Earnings per share

or

Price/earnings ratio (PER)= Market capitalization ÷ Total net earnings

The current stock price can be found by plugging a stock’s ticker symbol into a broker’s or exchange’s website. This concrete value reflects what investors must currently pay for a stock. Earnings per share are found by taking earnings from the last twelve months divided by the weighted average shares outstanding.

Earnings per share is the portion of a company’s net income that would be earned per share if all the profits were paid out to its shareholders. It is used typically by analysts and traders to establish the financial strength of a company. EPS provides the “E” or earnings portion of the P/E valuation ratio.

Calculations

The P/E ratio calculation is one of the many valuation measures and financial analysis tools that can be used as a guide when making investment decisions. It shows the investor how much they are investing for every dollar of annual earnings and how long it would take to recoup the share price if earnings stayed constant.

Companies with negative earnings (losses) or no profit have an undefined price to earnings ratio, which is usually shown as “not applicable” or “N/A” although a negative P/E ratio may be shown sometimes. Let us look at two P/E calculation examples below:

Suppose a company reported its stock price as $48 and its earnings per share for the most recent year as $6. Its P/E ratio can be simply found by replacing these values in the price to earnings formula.

Price to earnings (P/E) ratio = Stock price per share ÷ Earnings per share

P/E = $48 ÷ $6

P/E = 8

The information above means the purchaser of the share is investing $8 for every dollar of annual earnings. This implies that if earnings stayed constant, it would take 8 years to recoup the share price.

The Wall Street Journal.3 reported that as of February 3, 2021, Walmart Inc. (WMT) stock price closed at $139.55 and its earnings per share for the fiscal year ending Jan. 31, 2021, was $4.75

Therefore, Walmart’s P/E ratio is $139.55 ÷ $4.75 = 29.38

The information above means the purchaser of the share is investing $29.38 for every dollar of annual earnings. This further implies that if earnings stayed constant, it would take 29.38 years to recoup the share price.

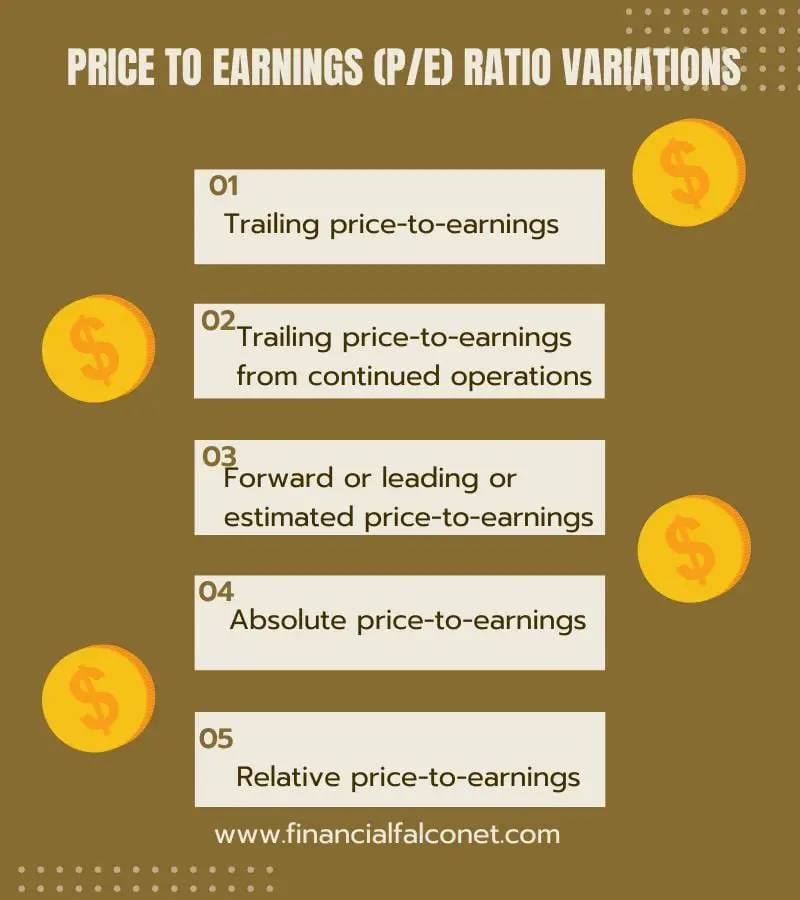

PE ratio variations

- Trailing price-to-earnings

- Trailing price-to-earnings from continued operations

- Forward or leading or estimated price-to-earnings

- Absolute price-to-earnings

- Relative price-to-earnings

Price-to-earnings in its basic form is the stock price divided by earnings per share. In practice, however, there are a number of different price and earnings variables that are used when constructing the p/e ratio.

The variables of stock price include the peak and low stock price data during the full fiscal year, the specific date the analyst report or newspaper article was written, the specific date the company released its earnings into the financial markets, the company’s fiscal year-end date, the peak stock price date during a specific month of the fiscal year, a three-year average price using the company’s fiscal year-end date, the stock price exactly four months after the fiscal year-end, an estimated stock price at some future date, etc.

The variables of earnings per share include using the U.S. Generally Accepted Accounting Principles (GAAP) to determine the bottom-line earnings for the firm’s fiscal year, GAAP bottom-line earnings for the firm’s most recent four quarters preceding the date of the analyst’s report which is often referred to as Trailing Twelve Months (TTM) earnings, operating earnings measure as reported by the firm in its GAAP income statements, estimated future earnings for either the remainder of the current fiscal year or for the firm’s following fiscal year, etc.

Variations on the standard trailing and forward P/E ratios are common. Generally, alternative P/E measures substitute different measures of earnings, such as rolling averages over longer periods of time (to attempt to “smooth” volatile or cyclical earnings, for example) or “corrected” earnings figures that exclude certain extraordinary events or one-off gains or losses.

For companies that are operating at loss or whose earnings are expected to change dramatically, a “primary” P/E can be used instead, based on the earnings projections made for the next years to which a discount calculation is applied.

These multiple variants when combined in different ways lead to variations in the price-to-earning ratio. Like other financial analysis tools, the price-earnings ratio is neither formally regulated nor is there a standard, agreed-upon construction. The P/E ratio is simply a tool created to help perform financial analysis—most notably, to help make investment decisions.

Below are some of the price-to-earnings ratio variants.

Trailing price-to-earnings

The trailing price-earnings rely on past performance by dividing the current share price by the total earnings per share (EPS) earnings over the past 12 months. It’s the most popular P/E metric because it is the most objective—assuming the company reported earnings accurately.

Monthly earnings data for individual companies are not available, and in any case usually fluctuate seasonally, so the previous four quarterly earnings reports are used and earnings per share are updated quarterly. However, each company chooses its own financial year so the timing of updates varies from one to another. The trailing P-S ratio will change as the price of a company’s stock moves because earnings are only released each quarter, while stocks trade day in and day out.

Trailing price-to-earnings from continued operations

Trailing p/e from continued operations uses operating earnings, which exclude earnings from discontinued operations, extraordinary events or one-off gains or losses, and accounting changes.

Forward or estimated or leading price-to-earnings

The forward or leading or estimated p/e uses future earnings guidance rather than trailing figures. It uses estimated net earnings over the next 12 months instead of net income. Estimates are typically derived as the mean of those published by a select group of analysts. The selection criteria are rarely cited.

This forward-looking indicator is useful for comparing current earnings to future earnings and helps provide a clearer picture of what earnings will look like—without changes and other accounting adjustments.

Absolute price-to-earnings

The numerator of this ratio is usually the current stock price, and the denominator may be the trailing EPS (TTM), the estimated EPS for the next 12 months (forward p/e ratio), or a mix of the trailing EPS of the last two quarters and the forward p/e for the next two quarters.

Relative price-to-earnings

The relative P/E compares the current absolute P/E to a benchmark or a range of past P/Es over a relevant time period, such as the past 10 years. It shows what portion or percentage of the past P/Es the current p/e has reached. The relative price-earnings usually compares the current p/e value to the highest value of the range, but investors might also compare the current p/e to the bottom side of the range, measuring how close the current p/e is to the historic low.

The relative p/e will have a value below 100% if the current P/E is lower than the past value (whether the past high or low). If the relative p/e measure is 100% or more, this tells investors that the current p/e has reached or surpassed the past value.

Uses of Price/Earnings ratio (PER)

- Investors look at a company’s price/earnings ratio to determine whether to invest in it or not.

- PER shows how much growth investors expect from companies they invest in. A high ratio indicates that investors are paying much more per share than the company is earning. A low ratio indicates that growth has slowed.

- The price/earnings ratio can be used to gauge the market as a whole if different companies from the same industry are examined over the same period. This kind of comparison can help an investor determine if a given company is over or undervalued.

- PER is one of the most widely used metrics for investors and analysts to determine stock valuation.

- The price/earnings ratio can be used as a means of standardizing the value of $1 of earnings throughout the stock market. This can be done by taking the median of PER over a period of several years and formulating something of a standardized PER which could then be seen as a benchmark and used to indicate whether or not a stock is worth buying.

- It is used to compare a company against its own historical record or to compare aggregate markets against one another or over time.

The benefits

- A company’s price to earnings ratio is a useful indicator of how much confidence investors have in the business.

- The P/E ratio helps investors determine the market value of a stock as compared to the company’s earnings.

- The price to earnings ratio indicates the dollar amount an investor can expect to invest in a company in order to receive $1 of that company’s earnings.

- The P/E ratio standardizes stocks of different prices and earnings levels.

- With P/E similar companies within the same industry are grouped together for comparison, regardless of the varying stock prices.

- It is quick and easy to use when trying to value a company using earnings. For instance, when a high or a low P/E is found, we can quickly assess what kind of stock or company we are dealing with.

Disadvantages

- PE ratio can be affected either positively or negatively if the wrong information is provided during the p/e calculation.

- A company’s price-to-earnings ratio does not mean much until you compare it to the rest of the stocks in the same sector or other companies listed on the same index.

- Companies that are not profitable and consequently, have no earnings or negative earnings per share pose a challenge when it comes to calculating their p/e.

- Valuations and growth rates of companies may often vary wildly between sectors due to the different ways companies earn money and the differing timelines during which companies earn that money, therefore, comparisons may be challenging.

- Volatile market prices can throw off the p/e ratio in the short term.

- Earnings growth is not included in the p/e ratio.

What does having a high price/earnings ratio (PER) mean?

Generally, a high PER suggests that investors are expecting higher earnings growth in the future compared to companies with a lower PER. Companies with a high price/earnings ratio are often considered to be growth stocks. This indicates a positive future performance, and investors have higher expectations for future earnings growth and are willing to pay more for them.

The downside to this is that growth stocks are often higher in volatility, and this puts a lot of pressure on companies to do more to justify their higher valuation. For this reason, investing in growth stocks will more likely be seen as a risky investment. Additionally, stocks with high PER ratios can also be considered overvalued.

For example, a technology company may have a high PER ratio, but this may reflect a trend within the sector rather than one merely within the individual company. An individual company’s high PER ratio, for example, would not mean much when the entire sector has high PER ratios.

What does having a low price to earnings ratio mean?

A low price to earnings ratio can indicate either that a company may currently be undervalued or that the company is doing exceptionally well relative to its past trends. When a company has no earnings or is posting losses, in both cases, the P/E will be expressed as not applicable (N/A). Although it is possible to calculate a negative P/E, it is not the common convention.

Furthermore, many investors will say that it is better to buy shares in companies with a lower P/E because this means you are paying less for every dollar of earnings that you receive. In that sense, a lower P/E is like a lower price tag, making it attractive to investors looking for a bargain.

Additionally, companies with a low P/E are often considered to be value stocks. This means they are undervalued because their stock prices trade lower relative to their fundamentals. This mispricing will be a great bargain and will prompt investors to buy the stock before the market corrects it. And when it does, investors make a profit as a result of a higher stock price.

Examples of low P/E stocks can be found in mature industries that pay a steady rate of dividends.

What is a good price-to-earnings ratio?

Before you make a decision on what a good price-earnings ratio is, you have to first ask yourself some vital questions:

- How is the company’s growth?

- What is the company’s PER compared to its peers?

- What is the company’s stock history?

The question of what is a good or bad price-to-earnings ratio depends on the industry in which the company is operating and the reasons behind a company’s PE ratio. Some industries will have higher average price/earnings ratios, while others will have lower ratios. In January 2021, publicly traded broadcasting companies had an average trailing P/E ratio of only about 12, compared to more than 60 for software companies.

In order to understand if the P/E ratio of a particular company is good or bad, you can compare it to the average price to earnings of the competitors within its industry. That way, you will have a more objective idea of which company’s P/E ratio is good and worth investing in.

Below are some factors to consider when checking a company’s price-earnings ratio:

How is the company’s growth?

A business that is growing faster than average such as a technology company typically has a higher price-to-earnings ratio whereas one whose business model is fundamentally in decline will have a low PER ratio. However, there are exceptions where mature companies that pay a steady rate of dividends have a low PER.

What is the company’s PER compared to its peers?

Usually, competitors in an industry have similar businesses and earnings models. That means PER ratios in the industry should be around the same, and differences to the positive likely reflect a business’ quality or growth potential. For instance, if the average PER in a particular sector is 15, and company A has a PER of 10 while company B has a PER of 19. It means that Stock B has a higher ratio than both its competitor and the sector. This might mean that investors will expect higher earnings growth in the future relative to the market.

What is the company’s stock history?

Looking at a stock’s PER ratio history is one of the best ways to avoid buying stocks with perpetually low PER ratios. If a value stock’s PER ratio is unfavorable and has been for years, then what’s the specific catalyst that will make it trade at higher prices in the future? If a growth stock is trading at its highest-ever PER, on the other hand, you can expect multiple expansions by the company over the coming years to maintain or even grow its price-earnings ratio.

Conclusion

As stated earlier, to determine whether a stock is overvalued or undervalued, it should be compared to other stocks in its sector or industry group. Sectors are made up of industry groups, and industry groups are made up of stocks with similar businesses such as banking or financial services.

In most cases, an industry group will benefit during a particular phase of the business cycle. Therefore, many professional investors will concentrate on an industry group when their turn in the cycle is up. Remember that the P/E is a measure of expected earnings. As economies mature, inflation tends to rise. As a result, the Federal Reserve increases interest rates to slow the economy and tame inflation to prevent a rapid rise in prices. Certain industries do well in this environment.

Conversely, toward the end of an economic recession, interest rates will typically be low, and banks tend to earn less revenue. However, consumer cyclical stocks usually have higher earnings because consumers may be more willing to purchase on credit when rates are low.

There are numerous examples of scenarios where the P/E of stocks in a particular industry is expected to rise. It is left to the investor’s discretion to decide which company to invest in.

Last Updated on November 6, 2023 by Nansel Nanzip BongdapBlessing's experience lies in business, finance, literature, and marketing. She enjoys writing or editing in these fields, reflecting her experiences and expertise in all the content that she writes.