Examples of efficient market hypothesis are found in its three forms and have been the bane on which the securities market functions to a large extent.

The existence of the EMH has ensured that issuers of securities do not withhold relevant information that is supposed to be reflected in the security’s pricing.

It additionally ensures that all securities are rightly priced such that investors have no chance of consistently earning above the average market returns since there is no room for the undervaluation of securities.

Furthermore, securities investors get protected as securities do not get overvalued either, this way, the market prices of securities are seen to fully reflect their real value as all relevant information is incorporated into the pricing.

See also: Characteristics of a good market

What is efficient market hypothesis?

The efficient market hypothesis, popularly abbreviated as EMH, asserts that financial markets incorporate all available information into asset prices, making it impossible for investors to achieve above-average returns consistently.

The efficient market hypothesis is also referred to as the efficient market theory. Eugene Fama and Paul Samuelson have been credited with independently developing the efficient market hypothesis.

The hypothesis proffered reasons why investors cannot consistently beat the market due to the assumptions made in the three different forms of the efficient market hypothesis.

Some assumptions of the efficient market hypothesis include the random pricing of assets, incorporation of all relevant information in pricing, the rationality of investors, and equal access to information on assets.

The hypothesis applies to various financial security instruments that trade on the financial markets. These include bonds, stocks, stock options, and other kinds of options.

See also: Market Economy Examples

What are the three forms of the efficient market hypothesis?

The three forms of the efficient market hypothesis are the stong-form, semi-strong, and weak-form EMH

These EMH forms make assumptions that support the seemingly random pricing of securities and the impossibility of accurately predicting future changes in the prices of securities based on historical price movements.

The three forms of the efficient market hypothesis reiterate that investors cannot consistently outperform the market by gaining above-average returns.

See also: What is a free market economy? characteristics and effects

Examples of efficient market hypothesis

Examples of the efficient market hypothesis exist in its different forms by supporting the assumptions made in each EMH form. Overall, all the forms emphasize the inability of an investor to consistently earn a return that is higher than the market average,

Example 1

The strong-form EMH propounds that all information about a security both past and present is already incorporated in the market price of a security.

The above implies that no analysis can give an investor an edge in the market. For example, a company is considering a merger that has not yet been made public and its current share price is $30, it is assumed that the share price already reflects this private information.

This is due to the assumption that the current share price accurately reflects all past and current information, whether private or public.

Example 2

The semi-strong EMH assumes that the prices of securities quickly adjust to reflect any new public information, hence making technical and fundamental analysis of securities invalid.

For example, assuming a company made an earnings call on February 28, 2024, and reported an increase in the revenue it generated, it is expected that that new information will be reflected in its share price within the shortest possible time.

Hence if for instance, the share price was $4 on the day of the call, it could increase to $5 within a few hours after the call to reflect the growth in the company’s revenue.

Example 3

For the weak-form EMH, its assertion of the inclusion of all publicly available past information into the market price of securities supports the view that security prices follow the random theory; meaning that they change without following set patterns.

For example, the price of a security could be $2 today, change to $1 tomorrow, and become $5 next tomorrow. These changes can be attributed to the change in past information on the stock.

Real-life examples of efficient markets

Aside from the hypothetical examples of EMH that we earlier discussed, there are real-life examples of the EMH application. One such example is the elimination of the incorporation of irrelevant information into the price of a security.

In the past, a change in stock price has been observed to occur once a stock gets listed in the S&P 500 index. This has been known as the S&P phenomenon.

Although the price change could be attributed to the new information on the stock’s inclusion in the index as observed in a study by Rajnish et. al, the inclusion does not change any valuable information about the company such as its revenue.

Thus, the existence of an efficient market has considerably reduced this effect and contributed to its gradual diminishing over the years. The change can be attributed to the effect of the efficient market hypothesis.

This is because the hypothesis only supports changes in the prices of securities due to a change in available information about the security or its issuer and not merely adding to an index.

An additional real-life example of an efficient market is the effect observed after the Sarbanes-Oxley (SOX) Act was passed in 2002. Before the law was passed, several cases of fraud and other inappropriate actions by corporations and accounting firms were recorded.

The law upheld an efficient market by ensuring that companies operated in a straightforward manner by adhering to certain requirements such as filing quarterly financial reports, not engaging in criminal activities, and other requirements that boost transparency.

It further eliminated most of the volatility in share price as well as boosted investors’ confidence in the market price of securities since the companies that issue them had to ensure transparency in their activities and in disseminating information that needs to be reflected in the security’s price.

See also: LME vs CME: Coordinated Market Economy vs Liberal Market Economy

What is an example of a weak form efficient market hypothesis?

An example of a weak form efficient market may be seen in the random pricing of securities and how hard it is to accurately predict future security prices based on past information. These render the technical analysis of securities useless.

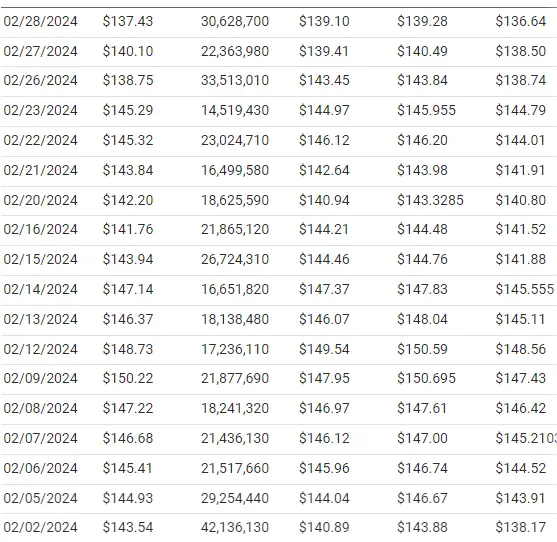

The price of Alphabet’s class C shares as of February 29, 2024, was $139.78 and as seen in the above image, the same share traded at $137.43 on February 28, 2024, and at $140.10 on February 27, 2024.

The differences in the share price support the impossibility of predicting future prices based on past prices; it also clearly shows the randomness in the stock’s pricing.

See also: Market Economy Examples

Conclusion

Examples of efficient market hypothesis exist in the real world outside the assumptions which the hypothesis emphasized. Its existence has been attributed to ensuring the smooth and transparent operations of companies and financial markets.

The EMH has also helped in ensuring that only relevant information gets quickly reflected in the prices of securities to ensure that the market price of a security at any given time will fully reflect all available and relevant information.

Blessing's experience lies in business, finance, literature, and marketing. She enjoys writing or editing in these fields, reflecting her experiences and expertise in all the content that she writes.