What is the difference between gross profit vs EBIT? A company’s gross profit is not the same thing as its EBIT, though they are related. Investors and managers carry out financial analysis on an entity to evaluate the financial health of the business. This is an important tool used when making investment or management decisions. The profitability of a business is one of the factors that are put into consideration when carrying out a financial analysis of a business.

A company’s profit is measured as what is left over from sales revenue after the deduction of expenses. Hence, both the gross profit and EBIT of a company measure the profitability of a business, though in different ways. That is, the company’s gross profit or EBIT can be used to calculate the profit margin of a business. The gross profit is used to calculate the gross profit margin of a company while EBIT is used to calculate a company’s operating profit margin.

A company’s gross profit vs EBIT differs in terms of the type of expenses deducted. Gross profit is the company’s revenue minus its costs of goods sold whereas EBIT is the company’s earnings minus its expenses without factoring in interest payments and income taxes. Hence, these financial metrics give an insight into the financial health of a company and provide a basis for financial management or decision-making. In this article, we will compare gross profit vs EBIT differences and similarities. But, first, let’s further discuss gross profit and EBIT.

Related: Net Income vs Net Profit Margin Differences and Similarities

What is gross profit?

Gross profit is the profit that a company makes after deducting the costs associated with producing and selling its products, or rendering its services. This coat associated with production and sale is known as the cost of goods sold or the cost of sales. Hence, the gross profit that appears on a company’s profit & loss statement is calculated by subtracting the company’s cost of goods sold (COGS) from its revenue (sales). The figures for the COGS and revenue (or sales) can be found on the company’s income statement. More so, gross profit is also referred to as sales profit or gross income.

Gross profit as an important financial metric measures a company’s profitability after deducting all the expenses related to the production and selling of its products or services. It shows the earnings of a company on the income statement in terms of the company’s operating profit before charging any indirect expenses. Hence, gross profit differs from EBIT because it measures a company’s profitability in terms of revenue and cost of goods sold, allowing businesses to make informed decisions.

This metric factors in variable costs, which are the expenses that depend upon production volumes, such as direct labor, direct materials, sales commissions, shipping charges, etc. Therefore, fixed costs, such as rent, insurance, administrative expenses, and amortization do not come under gross profit because it does not factor in all of the company’s expenses. Therefore, gross profit cannot be used all the time to determine the true profitability of a business.

See also: Net Income vs Net Revenue Differences and Similarities

What is EBIT?

EBIT means Earnings Before Interest and Taxes. This is a metric that calculates a business’s profitability based on its core operations, without factoring in financial leverage or taxes. Hence, EBIT can be calculated by subtracting all the company’s expenses excluding tax and interest from its revenue. The term ‘Earnings Before Interest and Taxes’ is self-explanatory; earnings refer to the operating profit, but the keyword ‘before,’ suggests the exclusion of interest and income tax expenses. Hence, a company’s EBIT is the profitability of the company based on its operating and non-operating incomes and expenses, excluding interest payments and income taxes.

EBIT is a fundamental measure of a company’s operating efficiency and is also referred to as operating profit, operating earnings, or profit before interest and taxes. However, operating income or operating profit is used for EBIT when a company does not have non-operating income and expenses. That is, EBIT and operating income can be different on the income statement in a situation whereby a company has non-operating income and expenses.

EBIT, by ignoring taxes and interest expense, focuses only on a company’s ability to generate earnings from operations, ignoring variables such as the company’s tax burden and capital structure. Hence, EBIT is a useful metric used to identify a company’s ability to generate enough earnings to be able to pay down debt, be profitable, and fund ongoing operations. It measures a company’s operating profitability in an accounting period after COGS and operating expenses are deducted.

Therefore, EBIT can be calculated in two ways; either by taking gross profit and then deducting operating expenses from it, or by adding net income, interest, and taxes. However, the U.S. Generally Accepted Accounting Principles (GAAP) doesn’t approve the use of EBIT on income statements. This means that EBIT is a non-GAAP metric and as such is not usually labeled specifically as EBIT in financial statements (though when a company does not have non-operating income and non-operating expenses, it may be reported as operating profits in a company’s income statement). Since EBIT is a non-GAAP metric, companies are not legally bound to put it on their income statements.

Related: Liabilities vs Assets Differences and Similarities

Gross profit vs EBIT differences

- One of the major differences between gross profit vs earnings before interest and taxes (EBIT) is that gross profit is the profit calculated after all direct expenses have been deducted from the company’s revenue while EBIT is the profit calculated after all expenses have been deducted from the company’s revenue without factoring in financial leverage or taxes.

- EBIT measures the profitability of a business based on its core operations, while gross profit measures the profitability of a business based on its operating profit before any indirect expenses are charged.

- Another key difference between EBIT vs gross profit is that investors and analysts use EBIT to analyze and compare profitability among companies and industries while gross profit is used to determine how well a company generates profit from their direct labor and direct materials.

- Gross profit differs in calculation from EBIT in that, the gross profit is calculated by subtracting the company’s cost of goods sold (COGS) from its revenue while EBIT is calculated by deducting operating expenses from gross profit, or by adding net income, interest, and taxes.

- The formula for gross profit vs EBIT differs as well; gross profit is expressed as Revenue – Cost of goods sold while EBIT is expressed as Revenue − COGS − Operating Expenses or Net Income + Interest + Taxes.

- One of the gross profit and EBIT differences is that gross profit is one of the first subtotals in the income statement while EBIT (as operating income) is one of the last subtotals in the income statement.

- The gross profit formula factors in variable costs but doesn’t factor in fixed costs whereas the EBIT formula factors in all costs and expenses including variable costs, fixed costs, and overhead costs while excluding interest and income tax expenses.

Gross profit vs EBIT formula

There is a difference in the formulas used for calculating EBIT and gross profit. You need gross profit to calculate EBIT.

Gross profit formula

Gross profit can be calculated by subtracting an entity’s cost of goods sold (COGS) from its revenue (sales). Hence, the formula for gross profit is expressed as:

Gross profit = Revenue – Cost of goods sold

EBIT formula

Earnings before interest and taxes (EBIT) can be calculated by deducting COGS and operating expenses from revenue, or by adding net income, interest, and taxes. Hence, the formula for EBIT is expressed as:

EBIT = Revenue − COGS − Operating Expenses

Or

EBIT = Net Income + Interest + Taxes

EBIT vs Gross profit calculation

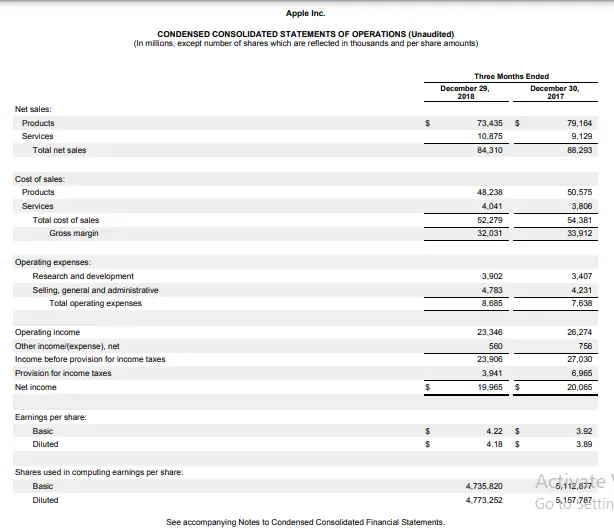

Let’s look at how the calculation for EBIT vs gross profit is done using the Apple income statement below:

From the income statement, Apple recorded a total net sales of $84,310 for FY 2018, COGS (cost of sales) of $52,279 and total operating expenses of $8,685. Here is the difference in the company’s gross profit vs EBIT calculation:

For gross profit calculation

Gross profit = Revenue – Cost of goods sold

Where,

Revenue = $84,310

Cost of goods sold = $52,279

That is, Gross profit = $84,310 – $52,279 = $32,031

Therefore, Apple’s gross profit was $32,031 which we can see on its income statement, reported as ‘Gross margin’.

For EBIT calculation

EBIT = Net Income + Interest + Taxes

Where,

Net income = $19,965

Interest = 0 (there is no interest expense on the income statement)

Taxes = $3,941 (Provision for income taxes)

That is, EBIT = $19,965 + $3,941 = $23,906

Therefore, Apple’s Earnings before interest and taxes was $23,906 which we can see on its income statement, reported as ‘Income before provision for income taxes‘.

Gross profit vs EBIT Interpretation

What does gross profit tell us?

Gross profit shows us a company’s efficiency in using its labor and supplies in producing goods or services. Since it is an absolute number, it is somewhat less useful as a comparison tool for investors than the gross profit margin, which is a percentage. However, we can have a better understanding of a company’s gross profit by closely examining its COGS.

Product businesses usually have higher COGS than service businesses, this means that product businesses would generally have lower gross profits. Service businesses, on the other hand, usually have higher operating expenses than product businesses, so higher gross profits are necessary for service businesses to be able to pay for fixed costs such as insurance or marketing.

If for instance, two similar companies have similar revenues but have different gross profits, the company with the higher gross profit indicates that the company likely has some significant competitive advantage over the other. Also, if a company’s revenue remains constant over time but its gross profit sharply declines, then it means that one or more of its direct costs has significantly increased. Sometimes, a company’s COGS remains constant but its gross profit drops due to the substantial decline in the price that a company is able to charge for its product or service.

What does EBIT tell us?

EBIT shows us a company’s profitability from operations. This metric doesn’t take into account the expenses associated with taxes and interest, thus, it ignores variables like capital structure and tax burden. Therefore, EBIT is particularly useful for investors who are comparing different companies with different tax obligations. For instance, a company that has recently received a tax break may appear to be more profitable than one that hasn’t; however, this may not necessarily be the case. Hence, measuring the company’s earnings before interest and taxes can help clarify the situation and give us a clearer picture of the company’s profitability.

Furthermore, EBIT can be very useful in terms of debt, especially when analyzing businesses in capital-intensive industries. Capital-intensive companies may have numerous fixed assets on their statement of financial position (usually financed by debt), which means that they have high-interest expenses. However, as these fixed assets are important for long-term growth, EBIT helps to show us a measure of the company’s profitability by stripping out debt and its associated expenses.

A table showing the differences between Gross profit and EBIT

| Factors for comparison | Gross profit | EBIT |

|---|---|---|

| Meaning | Gross profit is the amount of profit a company makes after deducting all the costs related to the production and distribution (COGS) of its goods or services | EBIT is the amount of profit a company makes after deducting all its costs and expenses without factoring in interest and income tax expenses |

| What is factored into the metric? | The gross profit formula factors in variable costs (which fluctuate compared to production output), but doesn’t factor in fixed costs | The EBIT formula factors in all costs and expenses such as variable costs, fixed costs, and overhead costs while excluding interest and income tax expenses |

| Measure of profitability | Gross profit measures the profitability of a business based on its operating profit before any indirect expenses are charged | EBIT measures the profitability of a business based on its core operations |

| How is it calculated? | Gross profit is calculated by deducting the cost of goods sold (COGS) from the company’s revenue | EBIT is calculated by taking gross profit and then deducting operating expenses from it, or by adding net income, interest, and taxes. |

| Formula | Gross Profit = Revenue – Cost of Goods Sold | EBIT = Revenue − COGS − Operating Expenses, or, EBIT = Net Income + Interest + Taxes |

| Presentation on the income statement | Gross profit can be found on a company’s income statement | EBIT is a non-GAAP metric and as such is not usually labeled specifically as EBIT on a company’s income statement. As a non-GAAP metric, companies are not legally bound to put EBIT on their income statements. |

| Type of profit margin | It is used to calculate the gross profit margin | It is used to calculate the operating profit margin |

| What does it tell us? | This metric is usually used to evaluate how efficiently a company is managing labor and supplies in production since gross profit considers variable costs | This metric is used to measure a company’s operating efficiency since it does not take into account indirect expenses such as taxes and interest due on debts. Hence, EBIT shows how much the company makes from its core operations |

| Relevance to investors | Gross profit is helpful to investors in determining how well a company is managing its production, spoilage due to manufacturing, labor costs, and raw material sourcing | EBIT is helpful to investors in comparing multiple companies with different tax situations |

| Subtotals in the income statement | Gross profit is one of the first subtotals in the income statement | EBIT (as operating income) is one of the last subtotals in the income statement. |

See also: Statement of Retained Earnings GAAP vs IFRS: Differences and Similarities

Gross profit vs EBIT similarities

- Gross profit and EBIT are both important financial metrics that measure the profitability of a business.

- The company’s cost of goods sold is deducted when calculating both gross profit and EBIT.

- Taxes and interest are excluded when calculating gross profit and EBIT.

- Variable costs are the common costs that are factored into both metrics.

- A company’s gross profit and EBIT can both be positive or negative figures.

- A negative EBIT or gross profit is an indication of a company’s production cost exceeding its revenue meaning that the company was unprofitable during the reporting period.

- Another similarity between gross profit and EBIT is that a high figure of both indicates the effectiveness of a company at cost control and profit-making.

- Gross profit and EBIT both have their limitations.

Read also: Is Net Profit the Same as Net Income?

Limitations of EBIT and Gross profit

Gross profit and EBIT both have their limitations. One of the limitations of using gross profit is that it cannot be used all the time to determine the true profitability of a business. In as much as gross profit is useful in identifying an issue, if a company, for instance, discovers its gross profit is 25% lower than its competitor, the company must investigate all revenue streams and each component of the COGS to truly understand why its performance is lacking.

Another limitation of using the gross profit is that this metric can be a misnomer, especially when considering the profitability of service sector companies. For instance, a law office that has no cost of goods sold will have a gross profit that is equal to its revenue. Meanwhile, the rent expense of the company office is twice as high as the monthly revenue. This shows that gross profit may indicate a company is performing exceptionally well, when that may not actually be the case. Hence, when analyzing gross profit, one should be mindful of the below-the-line costs (costs below gross profit on the income statement).

Just as the gross profit has its limitations, EBIT has its as well. Note that depreciation is included in the EBIT calculation which can lead to varying results when comparing companies in different industries. If an analyst is comparing a company with a significant amount of fixed assets to a company that has few fixed assets, the depreciation expense would affect the company with the fixed assets because the expense reduces net income or profit.

Also, companies that have a large amount of debt will likely have a high amount of interest expense. Hence, one of the limitations of using the EBIT is that it removes the interest expense and therefore inflates a company’s earnings potential, particularly if the company has substantial debt. This is a concern because not including debt in the analysis can be a problem if the company increases its debt due to a lack of cash flow or poor sales performance. In addition, calculating EBIT can be difficult, especially for those who might be unfamiliar with it.

See also: Net Profit Margin Examples and Interpretation

Is EBIT the same as gross profit?

In conclusion, EBIT is not gross profit. EBIT is calculated by deducting operating expenses from gross profit, or by adding net income, interest, and taxes while gross profit is calculated by subtracting a company’s cost of goods sold (COGS) from its revenue. Therefore, EBIT measures the profitability of a business based on its core operations, while gross profit measures the profitability of a business based on its operating profit before any indirect expenses are charged.

In addition, another key difference between EBIT and gross profit is that EBIT factors in all costs and expenses such as variable costs, fixed costs, and overhead costs while excluding interest and income tax expenses; gross profit, on the other hand, factors in variable costs, but doesn’t factor in fixed costs. However, even though EBIT is not the same thing as gross profit, they are correlated. EBIT can be calculated by subtracting operating expenses from gross profit.

Last Updated on November 4, 2023 by Nansel Nanzip BongdapObotu has 2+years of professional experience in the business and finance sector. Her expertise lies in marketing, economics, finance, biology, and literature. She enjoys writing in these fields to educate and share her wealth of knowledge and experience.