What is the difference between GAAP vs IFRS balance sheets? GAAP and IFRS are the two main sets of accounting standards that are adhered to by organizations. Generally, accounting standards are established to ensure a company’s financial statement and information are accurate and can be compared easily to the data reported by other companies.

Nevertheless, when it comes to preparing a balance sheet, deciding which set of standards to follow would depend on whether the company operates in the US or internationally as there are significant differences between IFRS vs GAAP balance sheets.

The US GAAP is an acronym for Generally Accepted Accounting Principles which is a set of guidelines set by the Financial Accounting Standards Board (FASB). This set of accounting guidelines is adhered to by most US companies. IFRS, on the other hand, is an acronym for International Financial Reporting Standards which are dictated by the International Accounting Standards Board (IASB) and adhered to by many countries outside the US.

The US GAAP is based on rules whereas the IFRS is based on principles. In this article, we will be comparing GAAP vs IFRS balance sheets by their differences and similarities; but first, what do we understand about the balance sheet?

Related: IFRS recognition of revenue

Balance sheet explained

The balance sheet which is also known as a statement of financial position is a type of financial statement that gives a report of a company’s financial activities at a particular point in time during an accounting period. This financial statement shows a summary of the company’s assets, liabilities, and equity, at any accounting period. Both the GAAP and IFRS require entities and organizations to present a balance sheet as well as other financial statements like the income statement and the cash flow statement.

The balance sheet gives a summary of the financial standing of a company at a particular point in time. Hence, this financial statement comprises two columns; one column for the company’s assets and the other column for liabilities and equity. This brings us to the balance sheet equation expressed as:

Assets = Liabilities + Equity

The above accounting equation is known as the balance sheet equation because the total amount in all assets accounts of the balance sheet must be equal to the total amount in all liabilities and equity accounts of the balance sheet. Once, this happens, then the balance sheet is said to be in balance, but if this doesn’t happen, then it is not balanced. Business owners, accountants, investors, auditors, etc make use of the balance sheet to track a company’s earnings and spending.

A balance sheet, is definitely a required component in financial statements, under both the IFRS and GAAP because it shows a company’s assets and liabilities at a particular point in time. These accounting standards also require footnotes that offer supplementary information that clarifies and explains the data on the financial statements. For instance, the notes to the financial statements will explain the accounting methods used in presenting the data on the balance sheet or others. This is essential for understanding the figures presented on the balance sheet because accounting methods vary among companies.

The preparation of the IFRS vs GAAP balance sheet differs in several ways. That is, the way a balance sheet is formatted in the US is different from other countries. For instance, current assets are listed first under GAAP, whereas a balance sheet prepared under IFRS would begin with non-current assets. Also, US GAAP and IFRS dictate different approaches to ordering categories on the balance sheet. GAAP requires accounts to be listed in the order of liquidity whereas, under IFRS, the order is reversed (least liquid to most liquid).

See also: GAAP for Revenue Recognition: Criteria and Examples

GAAP vs IFRS balance sheet differences

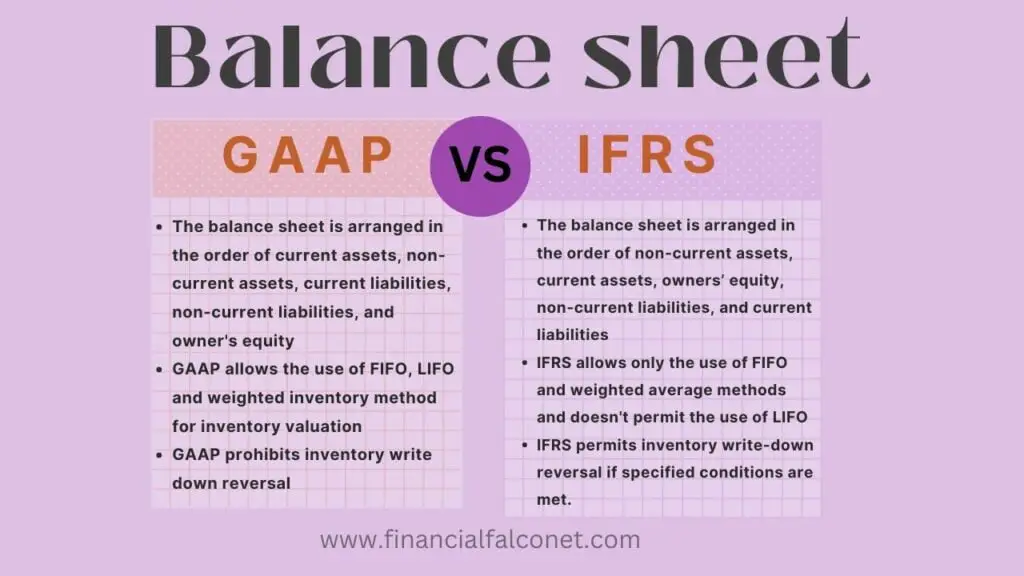

- One major difference between GAAP and IFRS balance sheets is that current assets are listed first under GAAP, whereas a balance sheet prepared under IFRS would begin with non-current assets.

- Under GAAP, inventory reversal is strictly prohibited whereas IFRS allows inventory reversal subject to specified conditions that are fulfilled.

- Another difference between IFRS and GAAP balance sheet is that GAAP requires the arrangement of accounts to be listed in the order of liquidity (most liquid to least liquid) whereas, under IFRS, the reverse is the case (least liquid to most liquid).

- One of the GAAP vs IFRS balance sheet differences is the use of Last in First out (LIFO) which is not permissible under IFRS but is permitted under GAAP.

- IFRS warrants no segregation of liabilities whereas, under GAAP, liabilities are segregated as current and non-current liabilities.

There are so many differences between the GAAP vs IFRS balance sheets. Here are some of them:

Valuation of fixed assets

Both GAAP and IFRS recognize fixed assets when purchased, but their valuation can differ over time. The US GAAP requires that fixed assets are measured at their initial cost; that is the value of the asset can decrease via depreciation or impairments, but cannot increase.

IFRS, on the other hand, allows companies to elect fair value treatment of fixed assets; this means that the reported value of the asset can increase or decrease as its fair value changes. Also, IFRS allows separate depreciation processes for separable components of PP&E whereas the US GAAP may allow that but does not require such cost segregations.

Revaluation of assets on the balance sheet (GAAP vs IFRS)

Due to market or technological factors, an asset may experience a reduction in value which in turn causes it to fall below its current value in a company’s account. This is known as a loss on impairment. Even though impairment is usually permanent, an asset’s value can increase after this loss has been recognized if the elements that caused it no longer exists.

However, the way GAAP and IFRS handle this ensuing rise in value differs. Under GAAP, it is not permitted to have an asset’s value written back up after it’s been impaired. However, under IFRS, it is permitted that certain assets can be reevaluated up to their original cost and adjusted for depreciation.

Comparing the recognition of Intangible assets on the balance sheet (GAAP vs IFRS)

When it comes to intangible assets, IFRS takes into consideration whether an asset will have a future economic benefit as a way of assessing its value. However, this is not the case for GAAP. Under GAAP, intangible assets are measured and recognized at the fair market value and nothing more.

Therefore, similar to fixed assets, intangible assets under US GAAP, must be reported at cost. Under IFRS, on the other hand, companies can elect fair value treatment; that is, the asset values can increase or decrease depending on changes in their fair value.

Difference between IFRS and GAAP balance sheet when using inventory valuation methods

Inventory valuation is a key difference when comparing the GAAP vs IFRS balance sheet. This is an accounting practice that is done by companies to find out the value of unsold inventory stock at the time that they are preparing their financial statements. A company’s inventory stock is an asset and in order to record it in the balance sheet, it needs to have a financial value. This recorded value of the inventory stock can help determine the company’s inventory turnover ratio, which in turn will help plan purchasing decisions.

For instance, a shoe business owner that has 50 pairs of shoes left at the end of the year, will need to calculate the financial value of the shoes and record it in the balance sheet. How this business owner will calculate the financial value of the shoes left will depend on the accounting principles that he or she follows. GAAP and IFRS differ in how they handle inventory valuation. Companies make use of three methods to value inventory such as FIFO, LIFO, and weighted inventory.

FIFO means First In First Out which is an inventory valuation method that follows the natural flow of inventory, which assumes that the first items in inventory (i.e. the oldest) are the first sold. LIFO, on the other hand, which stands for Last In First Out, takes the opposite approach of FIFO.

Therefore, under LIFO, the last items to arrive in inventory (which is the newest) are assumed to be the ones that are sold first. As for weighted average, this method looks at the weighted average cost of items remaining in inventory at the time of an associated sale, which provides a figure that can then be used to value ending inventory as well as the related COGS (cost of goods sold).

Under GAAP, all of these approaches to inventory valuation are permitted; that is the use of FIFO, LIFO, and weighted inventory are allowed. However, this is not the case under IFRS. IFRS only allows for the FIFO and weighted average methods to be used and doesn’t permit the use of LIFO. This means that in the treatment of inventory, IFRS prohibits the use of Last In First Out (LIFO) inventory accounting methods whereas GAAP allows the use of LIFO. Therefore, both GAAP and IFRS allow the use of the first-in, first-out method (FIFO) and the weighted average-cost method.

The write-down difference between IFRS and GAAP balance sheet

GAAP requires companies to write down the market value of their fixed or inventory assets, and even when the asset’s market value increases over time, this write-down amount cannot be reversed. IFRS, on the other hand, allows the reversal of an asset’s value when its price increases.

Therefore, unlike IFRS, the GAAP mandate may lead to inaccuracies because it doesn’t reflect the positive changes in the market value of assets. In conclusion, GAAP does not permit inventory reversals, whereas IFRS permits them under certain conditions.

Classification of liabilities on IFRS balance sheet vs GAAP

Organizations are allowed to classify liabilities into two types for financial reporting purposes, which are current and non-current liabilities. These liabilities are classified depending on how much time an organization requires to settle the debt. The debts with a repayment period of 12 months or less are considered current liabilities whereas the debts with a repayment period that exceeds 12 months are considered long-term (non-current) liabilities.

Under GAAP, current liabilities are listed first before noncurrent liabilities. This is not the case for IFRS as it does not follow this order. Hence, under IFRS, long-term liabilities are listed before short-term liabilities. In addition, IFRS and US GAAP also differ with respect to the amount of liability that is recognized.

Generally, IFRS uses the expected value in its measurement of the amount of the liability recognized, whereas the amount of the liability recognized under US GAAP depends on the distribution of potential outcomes. This can lead to differences in the recognition, measurement, and even disclosure of contingent liabilities if an organization was reporting under US GAAP or IFRS.

Hence, reporting contingent liabilities differs under these two accounting standards. Contingent liabilities are liabilities that the likelihood and amount of the settlement are contingent upon a future and unresolved event. A typical example would be a liability associated with a company’s future cost of fixing a product under warranty or a liability associated with a pending lawsuit.

Therefore, when comparing US GAAP and IFRS balance sheets, the differences in the definition of the word ‘probable’ and the measurement techniques used can lead to differences in both the recognition and amount of contingent liabilities on the balance sheet. That is, the recognition and amount of contingent liabilities that are considered probable differ under GAAP and IFRS.

Under IFRS, contingent liabilities are referred to as ‘Provisions’. IFRS has a lower threshold for recognition as its definition of a probable contingent liability is > 50%, whereas US GAAP generally considers a contingent liability probable only when the likelihood is >75%.

Listing order of assets on IFRS balance sheet vs GAAP

One of the key differences between GAAP vs IFRS balance sheet is the listing order of assets. Under US GAAP, assets are listed in decreasing order of liquidity; that is current assets before non-current assets. For IFRS, the reverse is the case, because IFRS reports assets in increasing order of liquidity; that is non-current assets before current assets. Therefore, a balance sheet prepared under GAAP will have its current assets displayed first whereas a balance sheet prepared under IFRS will report its assets beginning with non-current assets.

In balance sheet listing, IFRS does not prioritize liquid accounts, so the least liquid assets are listed first, followed by the most liquid ones. Hence, the arrangement of accounts on the balance sheet under IFRS would be non-current accounts shown first, then current assets, followed by owner equity, non-current liabilities, and then current liabilities.

GAAP, on the other hand, makes its listing based on liquidity, with the most liquid accounts displaying first. Therefore, the arrangement of accounts on the balance sheet under GAAP would be current assets shown first, followed by non-current assets, then current liabilities, non-current liabilities, and owner’s equity.

Quarterly/Interim reports for balance sheet (GAAP vs IFRS)

There is a difference between the quarterly/Interim reports for the balance sheet under GAAP vs IFRS. The US GAAP considers each quarterly report as an integral part of the fiscal year and requires a Management’s Discussion and Analysis section (MD&A) whereas IFRS considers each interim report as a standalone period, and even though an MD&A is allowed, it is not required.

Category of investment property

Under GAAP, all the company’s property is included in the general category of Property, Plant, and Equipment (PP&E). However, under IFRS, when a property is held for capital appreciation or rental income, it is separated from PP&E as Investment Property. This means that GAAP does not have an investment property category whereas, companies under IFRS are allowed to have an investment property category on the balance sheet. However, this category is permitted under IFRS for property used for rental income or capital appreciation.

Biological assets on IFRS balance sheet vs GAAP

Under US GAAP, production animals are included in PP&E whereas harvestable plants are included in inventory. Under IFRS, on the other hand, living animals and plants that can be harvested or transformed are considered biological assets and are measured at their fair value until they can be harvested.

Leases accounting on GAAP vs IFRS balance sheet (ASC 842 and IFRS 16)

The Lease Standards, which were effective in 2019, require that leases greater than 12 months are reported on balance sheets as Right of Use Assets under both the IFRS and US GAAP. However, the US GAAP distinguishes between Operating and Finance Leases (which are both recognized on the balance sheet), whereas IFRS does not.

Also, IFRS has a de minimus exception which allows lessees to exclude leases for low-value assets whereas GAAP has no such exception. The IFRS includes leases for some kind of intangible assets whereas the US GAAP categorically excludes leases of all intangible assets from the scope of the lease accounting standard.

Deferred Taxes on the balance sheet (IFRS vs GAAP)

Under IFRS guidelines, deferred taxes are classified on the balance sheet as noncurrent liabilities. However, under IFRS, footnotes are required for this, which is to contain information describing the temporary differences between amounts that can be recovered within one year from the balance sheet date and the amounts requiring more than one year. GAAP standards, on the other hand, allow deferred taxes to be listed as both current and noncurrent liabilities and do not have this footnote requirement.

Net pension asset on the balance sheet (IFRS vs GAAP)

Another difference between the GAAP vs IFRS balance sheets is the net pension asset. A net pension asset is the resources a company will use to pay employee benefits. Under GAAP, the amount of the net pension asset that a company lists as part of employee benefits is not limited on the balance sheet, whereas under IFRS, the amount of the net pension asset that a company lists as part of employee benefits is limited and full explanation of the limitations is to be provided in the footnotes.

Table summarizing the differences between GAAP vs IFRS balance sheet

| Factors for comparison | GAAP | IFRS |

|---|---|---|

| Quarterly/Interim reports for balance sheet | The US GAAP considers each quarterly report as an integral part of the fiscal year and requires an MD&A section | IFRS considers each interim report as a standalone period, and even though an MD&A section is allowed, it is not required |

| Order of listing | GAAP requires accounts to be listed in the order of liquidity based on how quickly and easily they can be converted to cash (that is, accounts are listed from most liquid to least liquid | Under IFRS, the order of listing is in ascending order of liquidity (that is, accounts are listed from the least liquid to the most liquid). |

| Arrangement of accounts | The balance sheet is arranged in the order of current assets, non-current assets, current liabilities, non-current liabilities, and owner’s equity | The balance sheet is arranged in the order of non-current assets, current assets, owners’ equity, non-current liabilities, and current liabilities |

| Considering a contingent liability probable | When the likelihood is >75% | When the likelihood is >50% |

| Investment property category | Under GAAP, all properties are included in the general category of Property, Plant, and Equipment (PP&E) and do not have an investment property category | Under IFRS, the Investment property category is allowed on the balance sheet for property held for capital appreciation or rental income |

| Allowed inventory valuation methods | GAAP allows the use of FIFO, LIFO, and weighted inventory methods for inventory valuation | IFRS allows only FIFO and weighted average methods to be used for inventory valuation and doesn’t permit the use of LIFO |

| Valuation of Property, Plant, and Equipment (Tangible fixed assets) | For fixed asset valuation, GAAP does not allow the use of a revaluation model but allows the use of a cost model | For fixed asset valuation, IFRS allows either the cost model or the revaluation model |

| Inventory Reversal | GAAP prohibits inventory write-down reversal | IFRS permits inventory write-down reversal if specified conditions are met |

| Net pension asset | Under GAAP, the amount of the net pension asset that is listed as part of employee benefits is not limited | Under IFRS, the amount of the net pension asset that is listed as part of employee benefits is limited and a full explanation of the limitations is to be provided in the footnotes |

| Deferred Taxes | Under GAAP, deferred taxes are allowed to be listed as both current and noncurrent liabilities and does not have a footnote requirement | Under IFRS, deferred taxes are classified as noncurrent liabilities and footnotes are required |

Check out: IFRS vs GAAP Income Statement: Differences and Similarities

GAAP vs IFRS balance sheet with examples

In order to understand how the IFRS balance sheet differs from the GAAP balance sheet, let’s look at the following balance sheet examples.

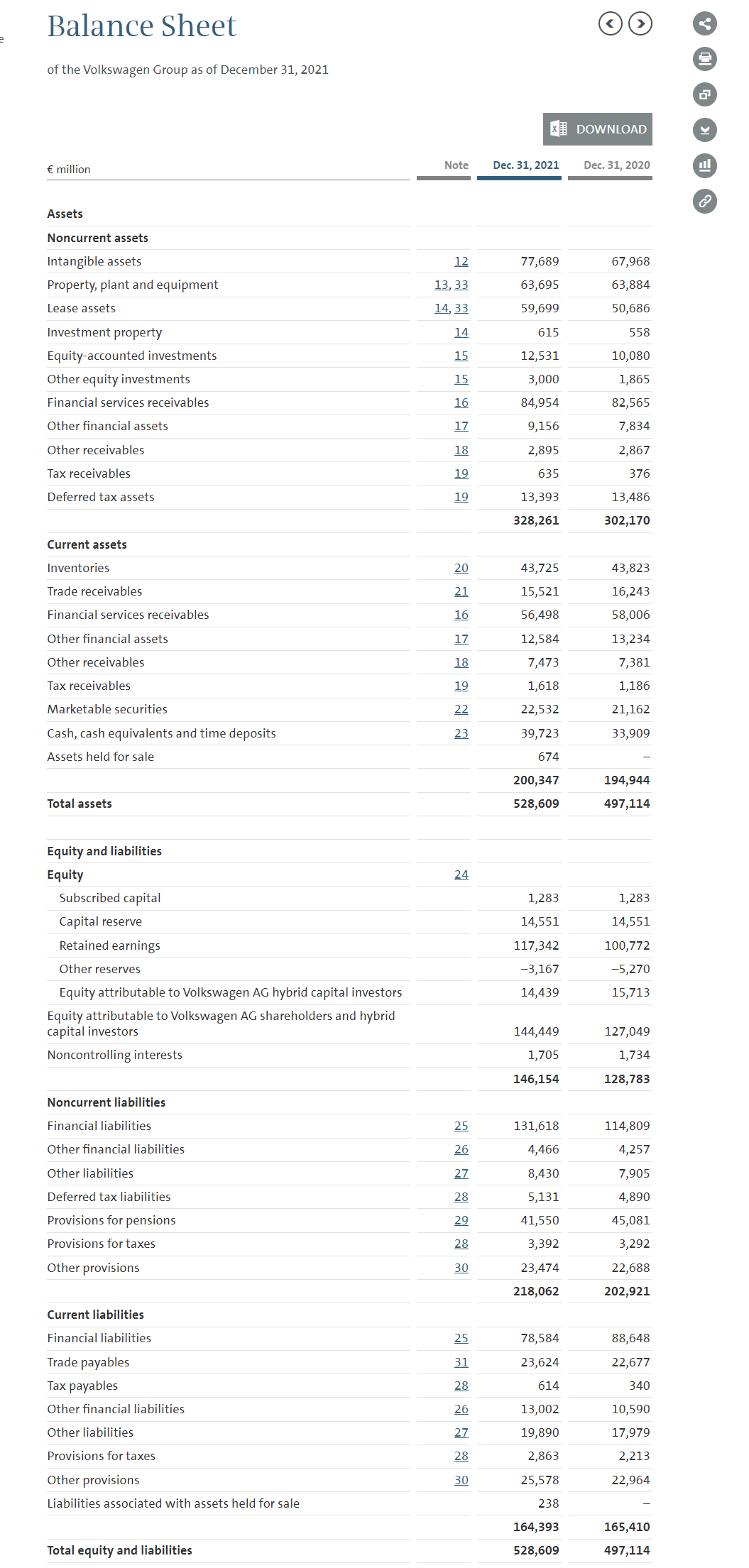

The first image below is the Volkswagen 2021 balance sheet which was prepared under IFRS:

From the IFRS balance sheet example above, we can see the listing order of accounts is done in ascending order of liquidity. That is non-current assets are first listed, followed by current assets, owners’ equity, non-current liabilities, and then current liabilities.

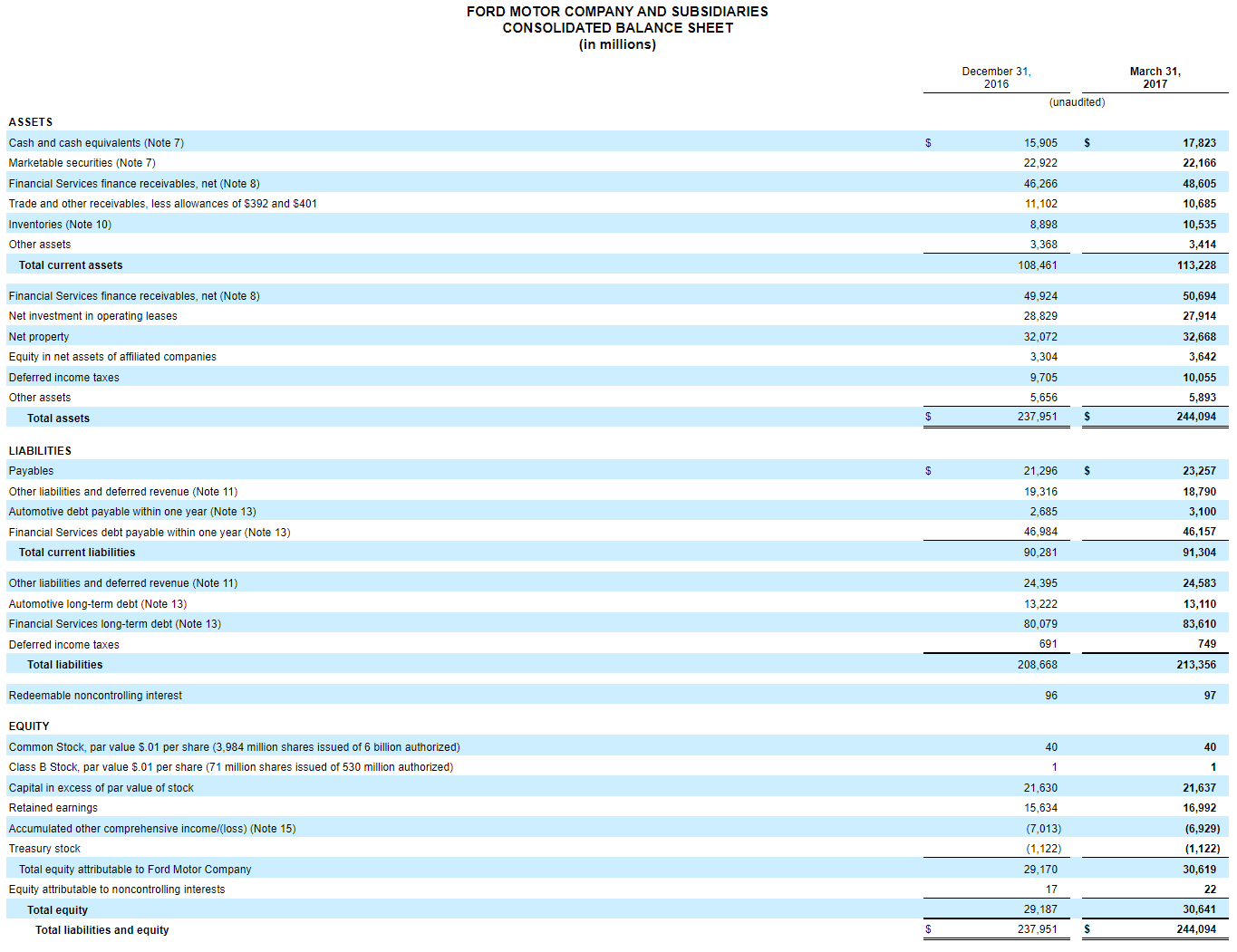

The second image below is Ford’s balance sheet which was prepared under GAAP:

From the GAAP balance sheet example above, we can see the listing order of accounts is done in descending order of liquidity. That is, the balance sheet accounts are arranged in the order of current assets, non-current assets, current liabilities, non-current liabilities, and then owner’s equity.

See also: Statement of Retained Earnings GAAP vs IFRS: Differences and Similarities

GAAP vs IFRS balance sheet similarities

- Both GAAP and IFRS require the presentation of balance sheets, statements of cash flows, and income statements.

- The two standards both offer the same guidelines when entities and companies deal with cash and cash equivalents on the balance sheet.

- One of the similarities between GAAP vs IFRS balance sheets is that they both allow the use of the first-in, first-out method (FIFO) and the weighted average-cost method for inventory valuation on the statement of financial position.

- Under both US GAAP and IFRS, it is required that leases greater than 12 months are reported on balance sheets as Right of Use Assets.

- Under both GAAP and IFRS, fixed assets on the balance sheet are depreciated over their expected useful lives.

Obotu has 2+years of professional experience in the business and finance sector. Her expertise lies in marketing, economics, finance, biology, and literature. She enjoys writing in these fields to educate and share her wealth of knowledge and experience.